About the HFM/ASHE 2015 Construction Survey |

Health Facilities Management (HFM,) and the American Society for Healthcare Engineering of the American Hospital Association surveyed a random sample of 3,414 hospital and health system executives to learn about trends in hospital construction. The response rate was 16 percent. HFM thanks the sponsor of this survey: Forbo Flooring Systems.

|

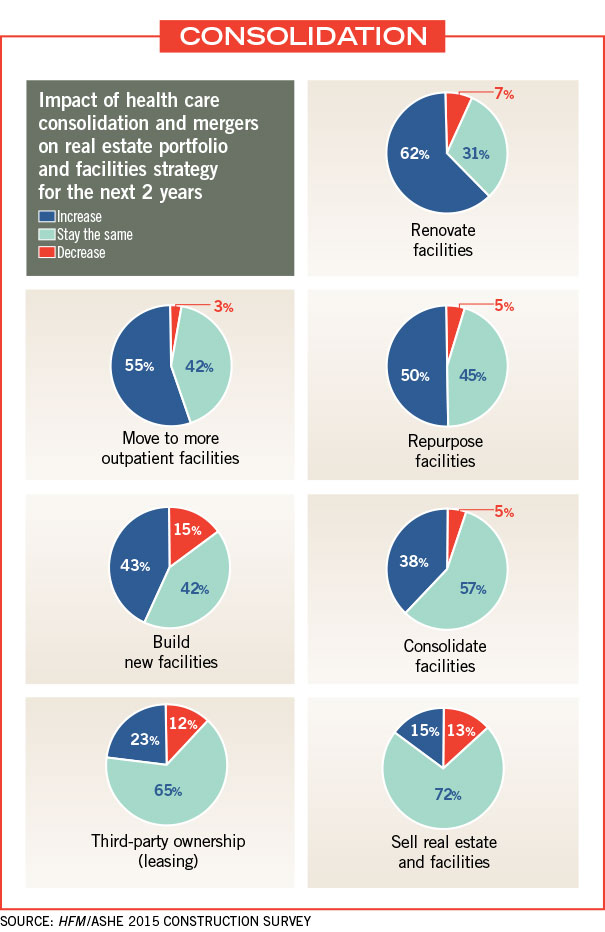

With hospitals and health systems beginning to sharpen their focus on population health, helping patients to avoid hospitalization and moving care delivery to the most appropriate and lowest-cost setting, there is another important related issue that is getting considerably less attention: What is to become of existing hospital buildings and how will these facilities need to change to accommodate care delivery system needs?

The question becomes particularly acute because many health care systems have been cautious about building new, more-efficient hospitals — a hangover effect from the Great Recession — and, instead, have focused on higher priorities such as aligning their service lines through mergers and acquisitions.

While queries about how to assimilate such fixed assets and how to optimize building spaces and real estate portfolios may take a number of years to answer, results from the Health Facilities Management/American Society for Healthcare Engineering 2015 Hospital Construction Survey clearly indicate that many hospitals and health systems are or soon will be repurposing existing space as they continue to move other services off campus and into their communities.

A higher purpose

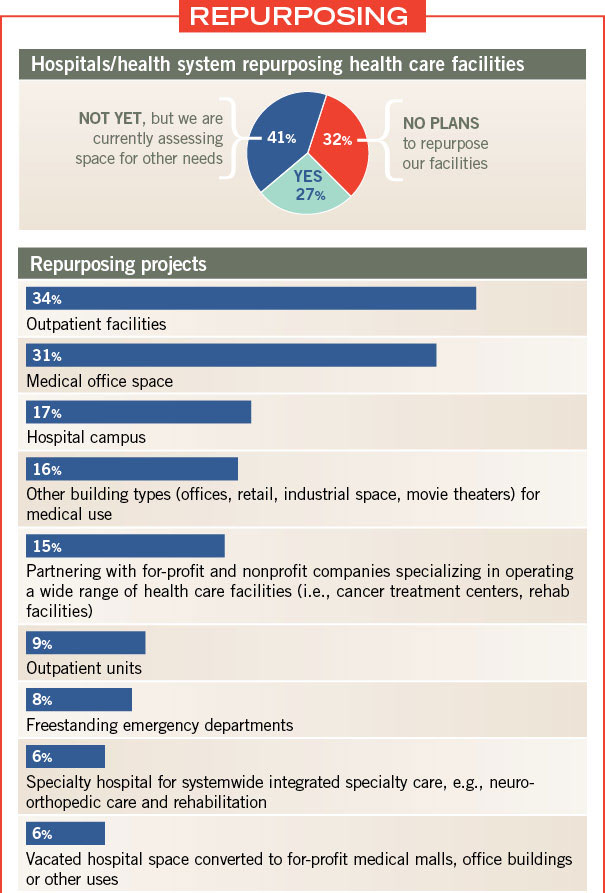

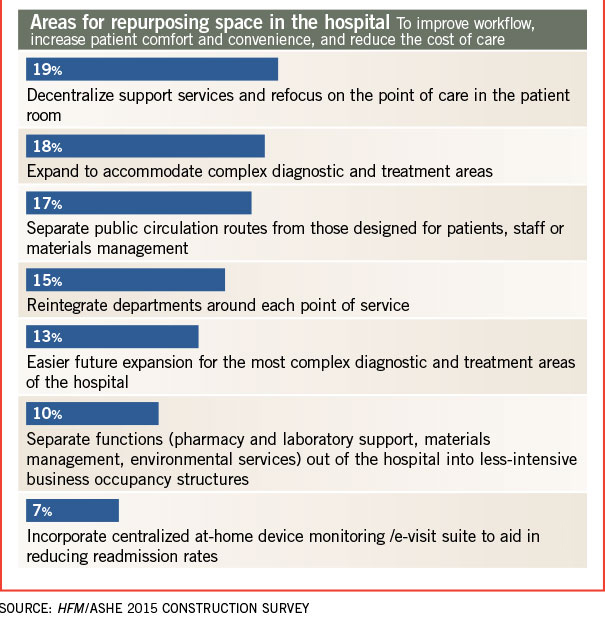

More than half of hospitals and health systems are repurposing space or considering the idea as they transition to value-based payment models and take the reins of population health management in their communities, according to the survey.

Nearly 67 percent of survey respondents said they are either repurposing health care facilities or currently assessing space for other needs (27 percent and 41 percent, respectively). Top current repurposing projects were outpatient facilities at 34 percent, and medical office space at 31 percent.

Facility repurposing increased slightly for 41 percent of respondents in this year’s survey, and increased greatly for 10 percent of those surveyed.

Construction experts say that the survey results reflect what they are seeing in the field.

“With a focus on population health management, there is a tremendous move to the ambulatory side,” says Joe Sprague, FAIA, FACHA, principal and senior vice president at HKS in Dallas. “In years past, we hadn’t paid as much attention to it in construction, but it is happening now.”

Repurposing existing space in hospital construction is happening along with thinking through the best uses of facilities in the new realm of overall population health, says Patrick Duke, managing director for health care services at CBRE in Richmond, Va. “There’s the mantra of serving the population and keeping people out of the hospital,” Duke says. “How do we do this in the most efficient manner and make our real estate an asset rather than a burden?”

The online survey of more than 3,414 hospital and health system executives was conducted in October and November. Perception Solutions prepared the study, which had a return rate of 16 percent, or 496 completed surveys.

Respondents included general medical and surgical hospitals (63 percent), health systems (12 percent) and academic medical centers (7 percent). Some 21 percent of respondents had 500 or more hospital beds.

Following the plan

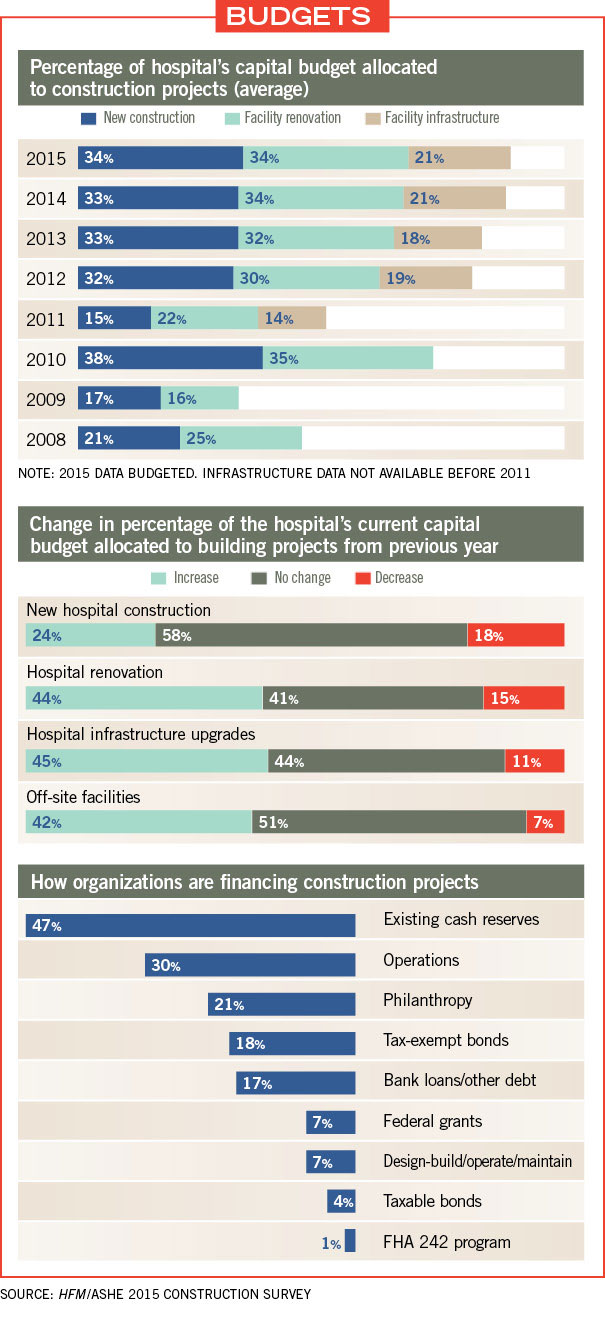

Deliberate and careful planning to meet new reimbursement models and revenue challenges is happening at facilities across the country, the survey found. A quarter of respondents said that their facility master plan was updated in the past six months, compared with 19 percent of respondents in last year’s survey. Meanwhile, 28 percent said their facility master plan was updated more than two years ago, down from 34 percent a year ago.

“That’s in line with what we are seeing,” says Duke. “The majority of people have updated master plans. It’s around the changing business model and shifting payment structures that require hospitals to repurpose their facilities.”

Budgeting and implementation of most facility infrastructure projects based on master plans rose slightly to 28 percent from 26 percent in last year’s survey.

“I think people have finally said, ‘We need to have a good plan and have a good idea of how to use our space,’ ” Duke says.

Hospital construction is starting to pick up, he adds. “More projects will start to come off the shelf,” Duke predicts. “You cannot keep deferring and deferring. You have to eventually face the music.”

While budgeting for new construction has remained relatively flat, with 33 percent of respondents allocating their capital budgets to new construction over the past couple of years, facility renovation and infrastructure projects are both seeing increases of 2 percent. Moreover, 44 percent of respondents expected capital budgets allocated to hospital renovations to increase in 2015, while 45 percent expected an increase for hospital infrastructure upgrades and 42 percent expected an increase for off-site facilities. This compares favorably against the respective 15 percent, 11 percent and 7 percent of respondents who are expecting decreases in these areas.

Still, a full 55 percent of respondents said that facility infrastructure projects were being done on an “as-needed basis.” Duke says this is a bit discouraging. “With health care organizations becoming much larger through mergers and acquisitions, I would hope they would plan for proper investments that can reduce energy consumption and contribute to the bottom line,” he explains.

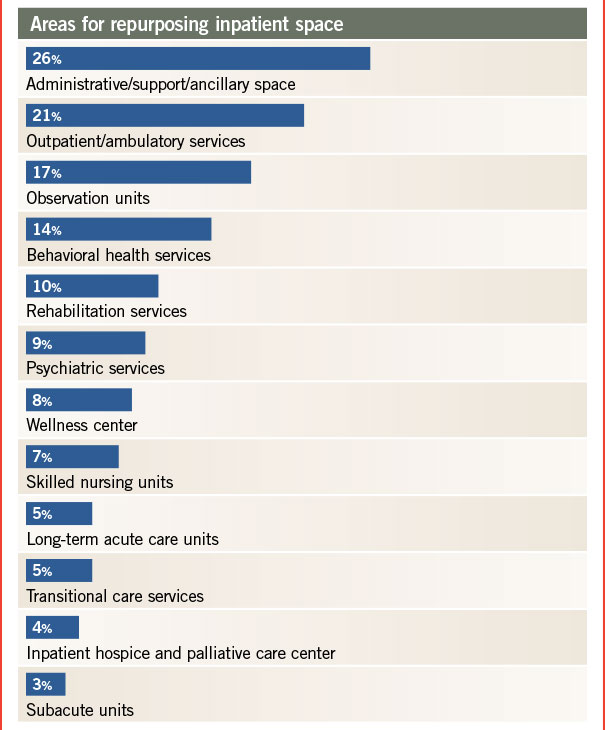

Top inpatient functions that are being repurposed included administrative/support/ancillary space (26 percent), outpatient/ambulatory services (21 percent) and observation units (17 percent).

Some of the respondents’ verbatim comments reflect this activity:

• “We’re having discussions about relocating nonessential services out of [hospital] occupancy space.”

• “As our inpatient census continues to fall because more is being accomplished in the outpatient setting, we are pushing forward with plans to create more private patient rooms from existing semiprivate rooms.”

• “We’re beginning discussions to master plan those spaces soon to be vacated and are continuously looking for space for new offices in response to our business growth strategy.”

• “There’s more talk about how to reuse existing space over building new.”

• “We’re looking at using vacant office space for nonclinical programs and re-evaluating flow through our main building.”

Repurposing inpatient space can be a challenge, says Randy Keiser, vice president and national health care director at Turner Construction in Brentwood, Tenn. In four hospitals with which Turner Construction currently works, about 80 percent of inpatient rooms are in use. But the intensive care unit (ICU) is always full because hospitals are becoming care centers for the highest-acuity patients. Some hospitals are attempting to convert lower-acuity beds, such as medical-surgical beds, into higher-acuity space, he says.

“I’ve noticed that when hospitals have extra space, they try to use it for other purposes,” Keiser says. “But it is a challenge to convert a unit into an ICU or critical care unit because of the technology and space constraints.”

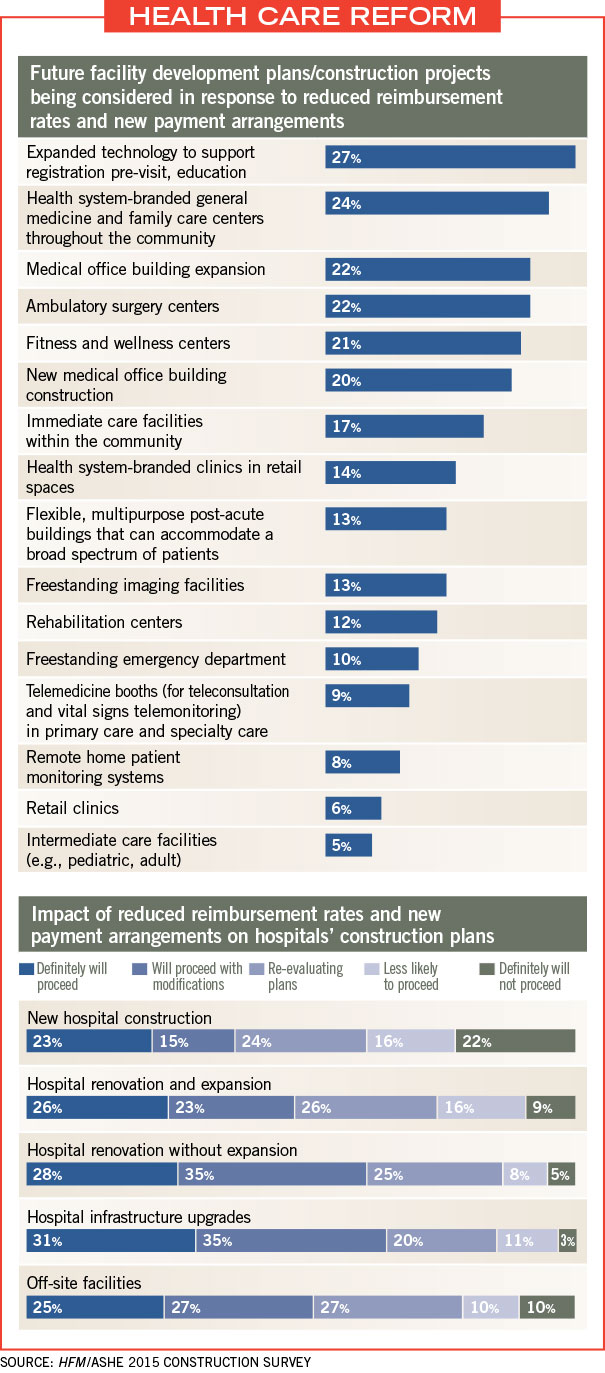

Outpatient and community-based facility initiatives most often considered due to new payment models included expanded technology to support registration pre-visit and education (27 percent), branded general medicine and family care centers in the community (24 percent), ambulatory surgery centers (22 percent) and medical office building expansion (22 percent).

Keiser cautioned against drawing major conclusions nationwide because so much changes from region to region. He said that states that have accepted federal funding to expand their Medicaid programs and start insurance exchanges are seeing more activity on the delivery system side.

“We have 52 offices and some are just overwhelmed with health care work, and others are the slowest they’ve been in 15 years,” Keiser says. “When you peel the onion back more, a lot has to do with Affordable Care Act acceptance. But, in general, everyone has taken a measured look at how they invest their dollars.”

Among the investments, medical office building expansion is happening at a brisk pace because it is a lower-cost facility construction project, says Sprague.

“Medical office buildings are among the most economical to build,” Sprague says. “Physicians are becoming more aligned with hospitals and hospitals are locating them at points of access. Medical office is “B” occupancy, meaning it is about half the cost of “I” occupancy — a hospital. When you have a limited number of dollars and are looking to expand capability, medical office is go-to.”

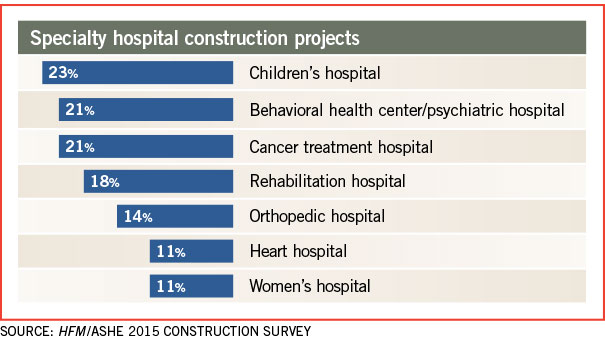

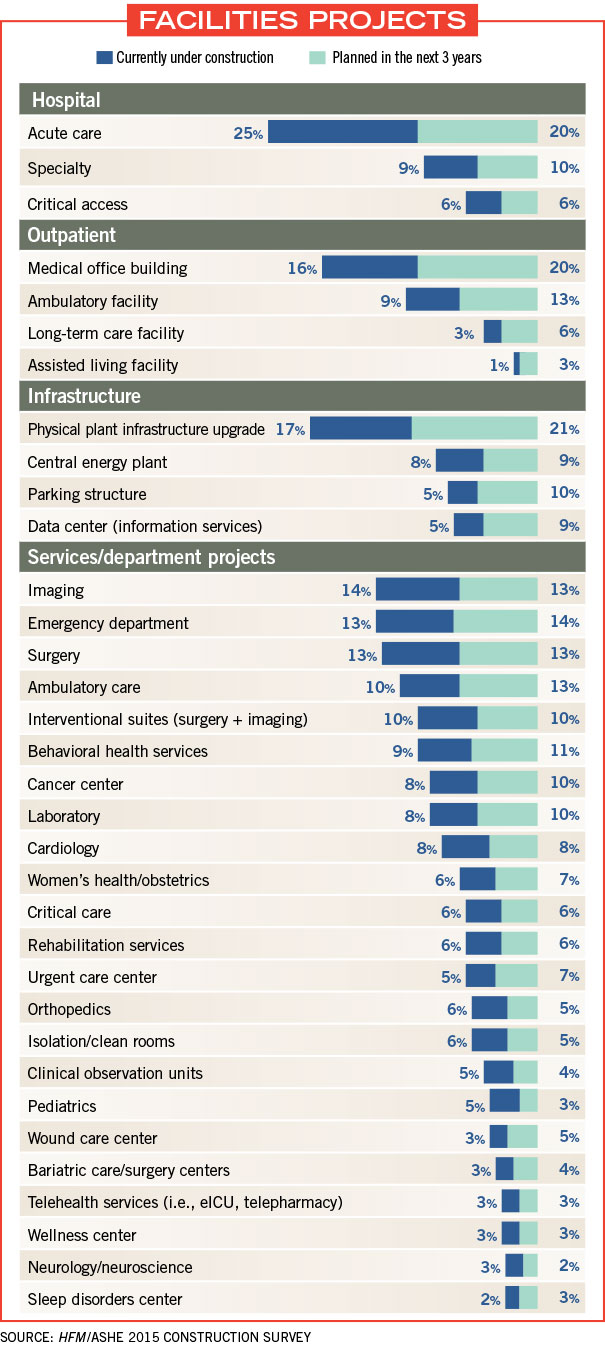

Cancer centers also provide value for the dollar, he adds. Some 18 percent of survey respondents said they have a cancer center currently under construction or planned in the next three years. “Chemotherapy is mostly done on an outpatient basis,” Sprague says. “Cancer care is still right at the top of the list for mortality but, certainly, more people are looking at surviving now.”

In open-ended comments in the survey, facility projects under construction or planned in the next three years included call centers, freestanding emergency departments, hospice, wellness centers, mental and behavioral health facilities, cancer centers, outpatient surgery and imaging.

Nearly a quarter of survey respondents said that they have an ambulatory care center currently under construction or planned in the next three years. And 27 percent said that imaging facilities are under construction or planned for the next three years.

Keiser of Turner Construction is seeing more construction out in the community as well. The company currently has 15 freestanding medical center projects of between 30,000 and 40,000 square feet in three states — Tennessee, Kentucky and Indiana. The facilities will offer imaging, urgent and primary care, and some specialty care.

“There is a considerable focus on the outpatient side and growing doctors’ practices,” Keiser says.

Nearly a quarter of respondents said that health system-branded general medicine and family care centers throughout the community are under consideration in response to recent trends in reimbursement and efficiencies.

Technology’s role

As far as changes to inpatient care, technology is playing a bigger role in facility upgrades, according to the survey.

Ted Hood, senior vice president and chief operating officer at GBA in Franklin, Tenn., says he was not surprised to see more technology at the bedside and point of care reflected in the survey. Nearly 20 percent of respondents said they are decentralizing support services and refocusing point of care in the patient room, and increasing the number of services at the bedside.

“Refocusing care in the patient room is about Lean initiatives and taking the approach to delivery of care to improve outcomes and efficiencies with the resources they have,” Hood says.

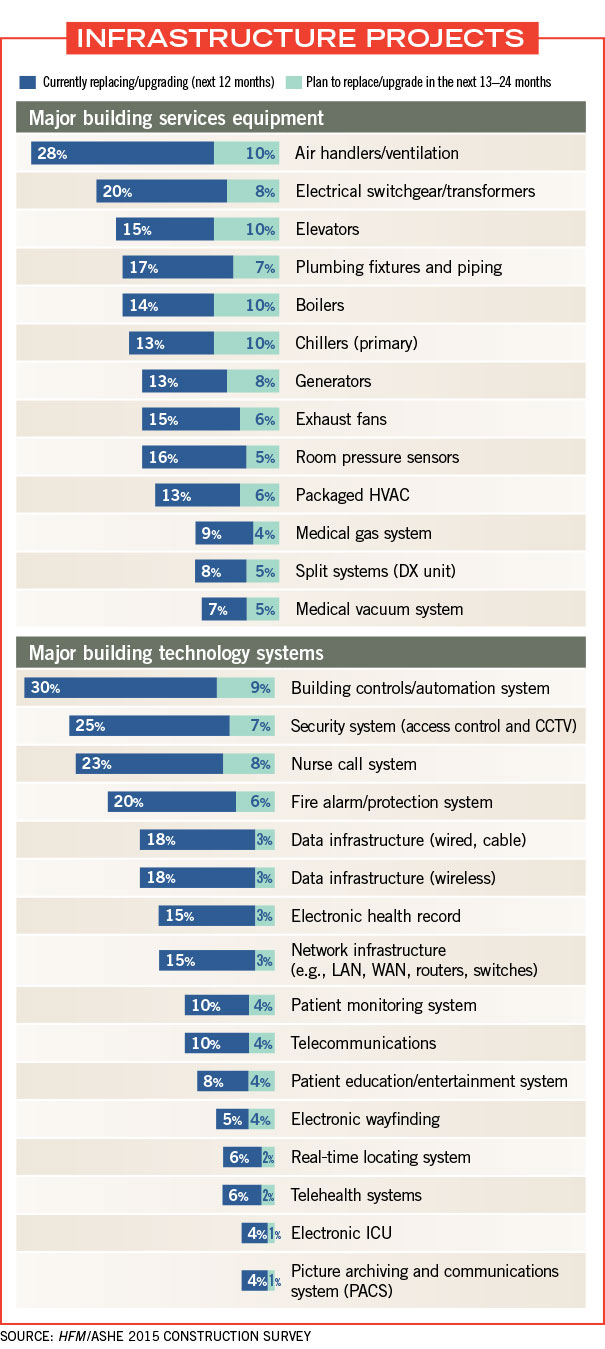

Some 30 percent of respondents said building controls/automation systems currently are being upgraded or replaced in the next 12 months, while 25 percent said they were upgrading or replacing security systems.

Building controls can improve efficiencies and reduce staffing needs to save money, Sprague points out.

Twenty-three percent of survey respondents said they were currently replacing or upgrading nurse call systems and 8 percent said they will replace or upgrade nurse call centers within the next two years.

“Nurse call systems are very cost-effective ways to use nursing staff efficiently,” Sprague says.

Patient education systems and patient monitoring systems were also notable trends with 8 percent and 10 percent of respondents, respectively, seeking to upgrade in the next year.

Telehealth is another area gaining traction for inpatient and outpatient care. While telehealth systems were low on the list for upgrades (just 5 percent of respondents said they would upgrade/replace in the next 12 months), about 2 percent said they would add telehealth within the next 24 months.

“Telehealth is another tool to execute a population health strategy,” says Duke. “Population health requires a lot of data and analytics. Then, at the same time, you’ve got to do it in a cost-effective manner.”

Hood says growth outside hospitals, in outpatient and retail clinics, is driving the trend in part. “It’s a natural progression to being able to have direct access to specialists and do remote consultations for rural patients,” he adds.

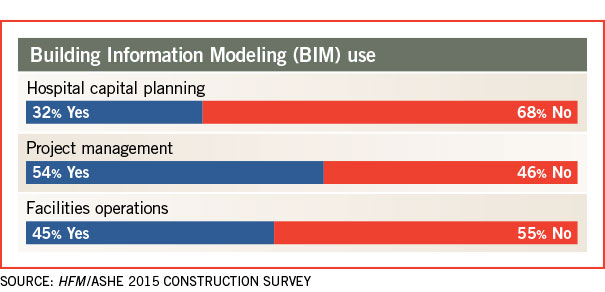

Building information modeling (BIM) is allowing facilities to conduct not only capital planning and project management, but, increasingly, facilities operations. Forty-five percent of respondents said they use BIM in facilities operations, up from about 33 percent in last year’s survey. BIM for project management jumped from 46 percent in last year’s survey to 54 percent this year.

BIM for facility management is a growing trend because of its availability to facility managers once projects are complete, says Keiser. Nearly all projects over $10 million use BIM, he adds.

“It allows maintenance guys to have a model there to do operations,” he continues, such as ordering new carpets as needed and repairing equipment. “I think you will see that continue as you see construction using BIM.”

Top building service equipment upgrades for inpatient facilities being currently replaced or upgraded in the next 12 months include air handlers/ventilation (28 percent), electrical switchgear/transformers (20 percent) and plumbing fixtures/piping (17 percent), according to the data.

Hood of GBA said that one trend not covered in the construction survey is integration and interoperability of technology systems at hospitals. “There is a growth in interoperability, and that allows health systems to get quantifiable data to help patients,” Hood says. “There are a lot of data being collected, and the next step is making it useful for patient care.”

At the forefront

As the economic ramifications of the Affordable Care Act and market forces continue to work their way through health care delivery, these considerations likely will remain at the forefront of the minds of health care facilities planners, designers and builders.

Rebecca Vesely is a freelance health care writer based in San Francisco. Suzanna Hoppszallern is a senior editor of data and research for HFM’s sister publication, Hospitals & Health Networks.

Economic issues put strain on health care construction project schedules and budgets

Far fewer hospitals completed construction projects on or under budget and/or on or ahead of schedule than were reported in last year’s Hospital Construction Survey by Health Facilities Management and the American Society for Healthcare Engineering.

In fact, more hospital construction projects were behind schedule or over budget or both than in any year since 2006, when the survey first began asking the question.

Just 46 percent of respondents’ completed projects were on or under budget and/or on or ahead of schedule — a big decline from 64 percent in last year’s survey and 68 percent the year before that.

Meanwhile, projects behind schedule jumped from 15 percent in last year’s survey to 22 percent in this year’s survey, and projects over budget jumped from 10 to 15 percent over the same period. A full 17 percent of projects in this year’s survey were over budget and behind schedule, up from 12 percent in last year’s survey.

Construction experts had some theories about why more hospital construction projects are not hitting budget or timeline goals.

First is the issue of obtaining required labor and raw materials. With the national economy in recovery — growing by 5 percent in the third quarter of 2014, the best quarterly growth since 2003 — and unemployment at around 6 percent, construction crews and materials are in high demand.

“In 2008, when the recession hit, lots of construction guys retired or switched to other jobs,” says Randy Keiser, vice president and national health care director at Turner Construction in Brentwood, Tenn. “Now, with construction rebounding, people aren’t going back into the field. The labor shortages are causing a lot of overruns.”

Joe Sprague, FAIA, FACHA, principal and senior vice president at HKS in Dallas, agrees. “In 2009, it was a great time to be in construction if you could afford it because labor and materials were down. Now it’s booming.”

Shifting project plans amid uncertainty about the Affordable Care Act and reimbursement models are another factor, some say.

“I think it has to do with the shifting market,” says Patrick Duke, managing director for health care services at CBRE in Richmond, Va. “There are a lot of people doing very difficult work, like renovation instead of new construction. A changing scope midstream could be contributing to the problem.”

Thirdly, the life of a project can be quite long, and any changes can add to the cost or time frame, some say.

“I think these findings are in alignment with challenges of organizations today,” says Ted Hood, senior vice president and chief operating officer at GBA in Franklin, Tenn. “What we’ve experienced is more along the lines of trying to find ways to do more with less and sometimes the schedule doesn’t allow that.”

What are the implications for being over budget and/or behind schedule? A loss of market share, for one, if a competitor opens a similar nearby facility sooner. Or an over-budget project could mean that another important project doesn’t receive funding, says Duke.

“There are pretty big implications in a highly competitive marketplace that has taken on more retail tendencies,” he adds.