Hospitals are joining with one another to form larger systems and partnering with physician groups in an effort to handle the demands of population health. This trend often has a direct impact on the role of facility managers and of those who work closely with them.

|

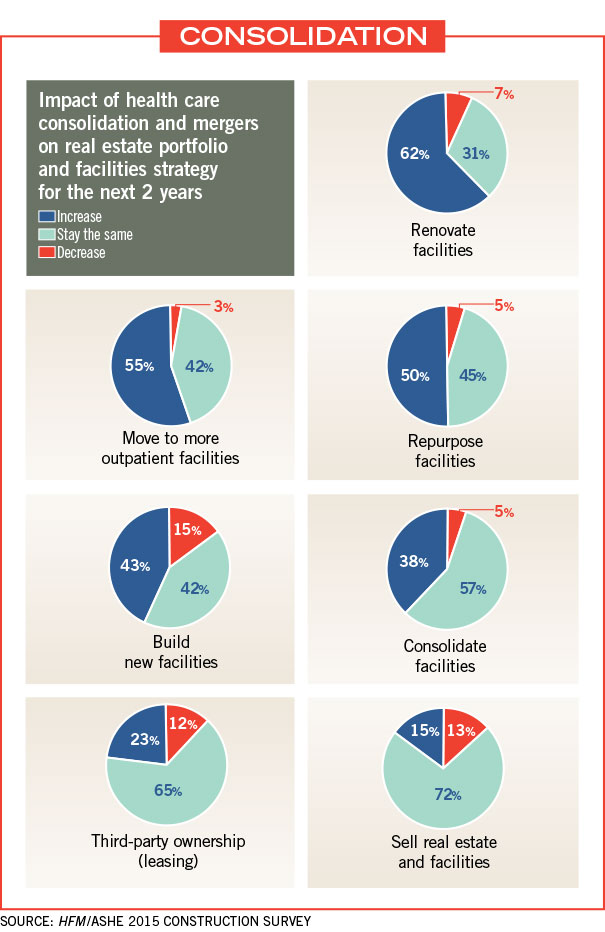

The 2015 Hospital Construction Survey highlights the impact of health care consolidation and mergers on real estate portfolios. Sixty-two percent of respondents said they have seen an increase in renovation as a result of a consolidation or merger, while 55 percent are seeing an increase in outpatient facilities and 50 percent in repurposing facilities.

Also, in our upcoming Salary Survey, we found that as health systems consolidate, facility-related decisions being made from the corporate office has become more common.

The trend also creates a scenario in which newly formed unions must dictate who will play what role and where to place which services. In an article on technology and facility planning, Morris A. Stein, FAIA, FACHA, says, “Mapping and analyzing locations among merging partners is an effective tool for technology integration. Consider the opportunity to place an outpatient radiology center, for instance, based on data-driven design information versus real estate availability.”

The trend also plays into the operations of third parties. In a recent interview, health care planner Don McKahan, AIA, FACHA, principal of McKahan Planning Group, notes that partnerships between hospitals and physician groups to form accountable care organizations (ACO) may even result in “more mergers among architects, engineers and construction firms who are attempting to integrate their services and attract these ACO clients.”

Although the incidence of failed mergers has grown, according to Juniper Advisory, an independent investment bank based in Chicago, it has done nothing to slow the growing interest in consolidation.