A careful frugality has taken long-term root in the aftermath of the recession and credit clampdown that jolted the industry out of its decade-long buildup two years ago.

No true building bust has followed the boom, thanks to all the work that already was in progress. Access to capital is improving. But organizations are loathe to resume old spending habits in the face of broad uncertainty about the changing nature of health care, not just the halting economic recovery.

| Click the image below for full construction survey, including charts (PDF). |

|

A slight uptick in construction is likely in 2011, based on results of an annual survey by Health Facilities Management (HFM) and the American Society for Healthcare Engineering (ASHE) as well as interviews with industry insiders. However, the volume of new construction remains down from 2008's high-water mark, many projects still are being deferred and spending plans are being subjected to tough scrutiny.

"There's a lot of ambiguity out there," says George A. "Skip" Smith, CHFM, SASHE, 2011 ASHE president and interim vice president of supply chain/clinical engineering and facilities management at Catholic Health Initiatives, Hilliard, Ohio. "Everybody's trying to figure it out, but nobody knows what the elephant looks like right now."

Faced with a foggier future than usual, hospitals' sense of confidence about what to build seems to be missing, according to Dan Cates, director of business development for health care at St. Louis-based McCarthy Building Companies.

Wariness was evident on several fronts as the year began:

Dip in new construction. The estimated $24.9 billion of new hospitals and clinics under construction in the fourth quarter of 2010 reflects a 10 percent decline from $27.8 billion a year earlier, notes Reed Construction Data/RSMeans Business Solutions. The planning pipeline has more on the boards than a year ago — $27.7 billion, up from $26 billion — because of projects put on hold, but was down 24 percent from $36.3 billion in 2008.

Renovations the rule. Renovation or expansion accounted for 73 percent of construction projects at hospitals that responded to the HFM/ASHE survey in October and November. That reflected a move to address needs while avoiding the high cost and debt of new construction. Roughly two-thirds of current renovation projects are for less than $3 million, according to Reed Construction Data/RSMeans Business Solutions.

Focus on infrastructure. Infrastructure is getting more attention than in the past. A third of the 598 hospitals surveyed were in the process of replacing or upgrading their air handlers or ventilation systems, 26 percent were doing the same to building services systems to meet IT infrastructure needs in conjunction with the shift to electronic health records, and one in five was upgrading a data center or planning to — a higher percentage than a year ago.

| Click the image below for bonus web exclusive survey charts (PDF). |

|

While those numbers aren't dramatic, Smith and others say there's clearly a shift in priorities under way from the megaprojects that characterized the boom to more emphasis on IT and other infrastructure.

"People are saying they don't want to spend on big projects, but they do need to keep the plants running — the automation systems, air handlers, ventilation, those sorts of things," says Dana Swenson, senior vice president of facilities and chief facilities officer at UMass Memorial Health Care in Worcester, Mass.

Hesitancy because of health care legislation. Hospital organizations are still assessing the combined impact of what's coming: bundled payments, lower reimbursement, incentive-based pay and more patients. Passage of the Affordable Care Act last year reduced some of the uncertainty. But with a surge of patients expected when coverage expands in 2014 and 32 million more people can seek health care, there is an increased need to find cost savings in hospital construction and elsewhere — and an ongoing debate how best to achieve it.

Mark Kenneday, CHFM, SASHE, vice chancellor for campus operations at the University of Arkansas for Medical Sciences in Little Rock, Ark., has been to retreats on health care legislation with other hospital leaders, but concludes it's impossible for anyone to say exactly what it will be like. "When they do, the facilities people have to sit down and figure out how we develop habitats and structures to provide services in. Right now, that's definitely a gray area."

By no means is the hospital building industry in a tailspin. About 63 projects valued at more than $100 million apiece were under construction as of late 2010, according to RS Means. Another $20.8 billion of new megaprojects alone is in the planning process, albeit with no assurance when they will go from drawing board to shovel. The continuing momentum reflects a stable industry determined to keep pace with technology and meet the demands of baby boomers as their medical needs increase.

Yet there are fears of a delayed impact from the recession — a pause or slowdown as soon as this year once some big projects are finished. About one in four survey respondents believed 2011 will be worse than 2010 in terms of their previously planned building projects, and 29 percent said projects were on hold or delayed.

"2011's going to be a very important year," says Robert Levine, consultant and retired senior vice president for health care at New York-based Turner Construction Co., who thinks the economic downturn will be felt this year. "Health care's always the last to feel the recession and the last to come out of it. We overbuilt coming into the recession and now we're feeling the consequences."

Many forging ahead

Still, 36 percent of survey respondents had construction work under way on a hospital or specialty hospital and another 31 percent had work planned within the next three years. Other current building projects most commonly involve physical plant infrastructure upgrades, medical office buildings, ambulatory specialty treatment centers and central energy plant work.

Three of the specialty hospitals seeing the most construction activity — cancer treatment (21 percent), heart (18 percent) and orthopedics (12 percent) — reflect preparations for boomers and their ailments, says Howard Allums, vice president and general manager for the national health care group at Turner. More children's hospitals (20 percent) also are being built, mostly replacement facilities, as organizations try to bring them up to a new level of technology, he says.

Many of the additions or modernization projects are for emergency departments, imaging, surgery areas or cancer centers. "Hospitals are focusing on the dollars," explains Allums. "These are all revenue-producing departments, so there's a huge focus on them."

Not so common are such design features as three-story glass atriums and waterfalls in the lobby. "We're going to see less and less of that, because it's all about values and clinical outcomes," says York Chan, CHFM, administrator of facilities for Advocate Health Care in Oak Brook, Ill.

The improvement in financial markets helped spur more activity as 2011 approached. Construction management firm Skanska has seen an increase in work requests since about Nov. 1, reflecting pent-up demand for projects, says Andrew Quirk, senior vice president for Skanska's National Healthcare Center of Excellence in Nashville, Tenn.

Hot spots for renovation projects under construction are Texas, California, New York, Massachusetts and Illinois, according to RSMeans. For new construction of hospitals and clinics, the busiest states are California, Texas, Illinois, Indiana, Virginia and Georgia.

California dwarfs all other states with $9.67 billion in new construction projects in planning plus $3.14 billion in renovation projects. The state's seismic requirements have resulted in high demand for upgrade renovations to existing facilities as well as new construction for replacement hospitals.

Financing outlook brightened

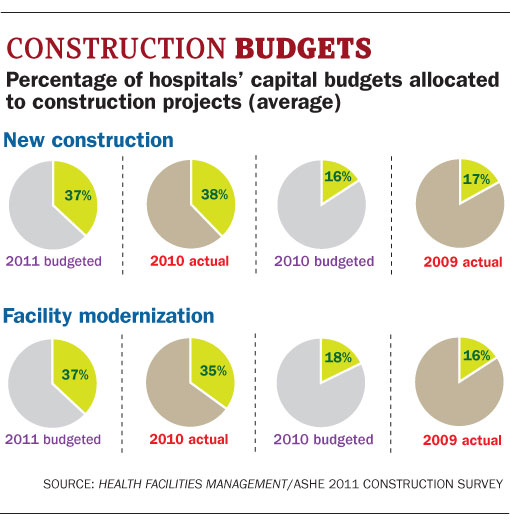

After holding back during the recession, organizations with the strongest finances and credit are spending on building projects again. Hospitals surveyed allocated roughly twice as much for construction in 2011 — 37 percent of their capital budgets — as they did a year earlier.

Fewer (40 percent) are dipping into cash reserves to finance projects than in 2009, a time of weaker balance sheets.

Decisions by PeaceHealth, a Catholic-sponsored system headquartered in Bellevue, Wash., to thrice delay and then move ahead with a renovation of its hospital in Eugene, Ore., typify how projects have been in flux through the downturn. The $80 million upgrade of its Sacred Heart Medical Center, University District campus, which entails razing three buildings and replacing them with a new medical complex, had been pushed back after the swoon of financial markets depleted its reserves. The system was to have obtained final board authorization in January to proceed with the project this year.

The economy slowed the project along with many like it, but hospitals can't afford to wait for a full recovery, notes Jill Hoggard Green, R.N., chief operating officer for PeaceHealth's Oregon region. "Clearly, capital is more scarce, but we're more optimistic about the future," she says. "You have to keep investing in both the technology and the facilities to meet the needs of people."

Cheaper material costs are one continuing dividend of the downturn, lopping millions off the price of big projects. Construction prices for hospitals and outpatient clinics, which had seen increases ranging from 4 to 13 percent annually in the previous five years, fell 1.3 percent in 2010 (through November). They are forecast to rise only 2 percent in 2011, according to Reed Construction Data. But Tim Duggan, the firm's product manager for market intelligence, says costs already are resuming their historical course, so "bargains aren't going to last a whole lot longer."

Greener materials

Hospitals increasingly are embracing the idea that going greener is cost-effective over the long run. More than two-thirds (68 percent) of those surveyed said they were using environmentally friendly materials in most or all construction and renovation projects, and 60 percent were evaluating the cost and benefit of green construction methods for most or all projects. Both percentages were up sharply from a year earlier.

One reason for the upswing, Chan suggests, is the realization in hospital executive suites that lowering energy costs brings a big boost to the bottom line. Another, according to Allums, is that organizations have discovered that donations and endowments often go to those that focus on being green.

Acceptance has grown with time, too, as both hospitals and providers of green products and materials gain a better understanding of how to assimilate green into projects. "I just get a general sense across the country that everybody associated with this has some level of acceptance for it," says Smith.

Among other survey results:

- The major building services equipment currently being replaced or upgraded the most were air handlers/ventilation, electrical switchgear/transformers and plumbing fixtures. Most respondents said it was old equipment that needed to be replaced. Major building services systems being replaced or upgraded most typically were building controls/automation systems, fire alarm/protection systems and security systems. Again, most cited aging equipment.

- Uncertainty since the financial meltdown is evident in master facilities plans. Only 39 percent of respondents had updated their plans within the past year, the fewest in the past five years. Just 30 percent undertake infrastructure projects as part of a master facility plan, with 58 percent doing replacements as needed due to malfunctions or aging equipment. Systems that don't replace their components on a scheduled basis are mortgaging their futures, says Kip Edwards, system vice president for design and construction at Phoenix-based Banner Health. "They're setting themselves up for some nasty surprises," he says. "Things are going to break - they're going to face bigger costs in an uncomfortable way."

- Use of building information modeling software was down significantly from a year earlier in both hospital capital planning (31 percent of respondents) and project management (36 percent). Since it remains widely viewed as a good cost-cutting method, the suspected reason for the one-year dip is the focus on renovations and smaller, less complex projects.

- About half of surveyed hospitals slashed the amount allocated to facility infrastructure projects this year by one-fourth or more, earmarking an average 27 percent to infrastructure in their 2011 capital budgets. That conflicts with other data and anecdotal evidence indicating a heightened focus on infrastructure. Allums suggests it may be because the best-financed systems are up-to-date on infrastructure after installing new control systems during the building boom of the past decade.

Renovate or replace?

Reimbursements are set to decline under the health care legislation. Will that lead hospitals to renovate or expand instead of building replacement facilities? Possibly.

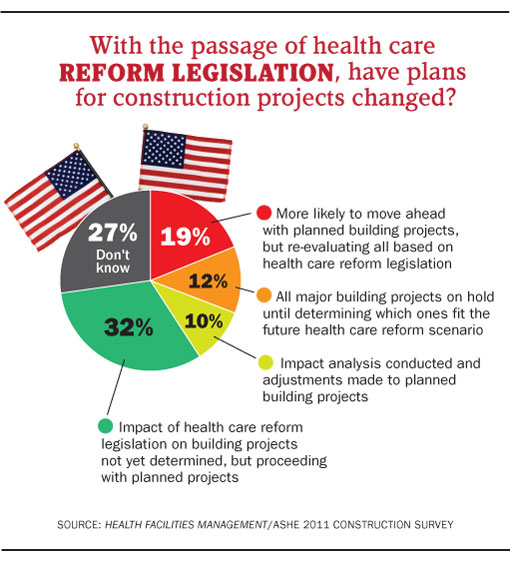

About half of those responding said they weren't considering replacements anyway; the bulk of the remainder said they were still evaluating. Overall, 32 percent said they were unsure about the law's impact but were proceeding with planned building projects, while 27 percent said they simply didn't know yet if the law would alter their plans.

One consequence that may slow building plans comes from the push to establish accountable care organizations (ACOs) — entities consisting of hospitals and physician groups that will accept bundled payments based on integrated care and discourage unnecessary services.

The issue of bundled payments looms large in construction decisions, according to Don McKahan, a health facility planner, architect and principal of McKahan Planning Group located in San Diego. "Everybody's talking about what being an ACO means for their bricks and mortar," he says. "That causes you to do more thinking before you buy more ground or initiate a new building campaign."

Many think a fiscally conservative approach to building makes sense because of the coming influx of millions more patients and other changes that will make outpatient services and smaller, outlying facilities a logical alternative.

Many think a fiscally conservative approach to building makes sense because of the coming influx of millions more patients and other changes that will make outpatient services and smaller, outlying facilities a logical alternative.

"Less money, more people, medical homes, rewards to reduce inpatient volumes, tighter capital markets, payments for specialties and upgrades will dramatically change the construction of new hospitals," says Bradley Pollitt, vice president of facilities for Shands HealthCare in Gainesville, Fla.

The legislation also is expected to spur industry consolidation as single hospitals seek to join large systems to have access to capital in a tighter financial era. This, too, could lessen demand for new health care facilities.

Cause for optimism

Those concerns notwithstanding, pent-up demand should keep hospital construction busy for the foreseeable future.

The dynamics that caused the building boom before 2008 still exist — an aging population, fast-advancing technology, older facilities and a push for best practices — notes Don Twining, vice president of business development for American Health Facilities Development, a program management and facility planning firm under Quorum Health Resources.

Signs of improvement as 2011 dawned also were cause for optimism for builders. "The health care marketplace will continue to grow," says Allums. "It's not where we would like it to be. But there is a lot of positive activity in the marketplace."

Dave Carpenter is a Chicago-based freelance writer who frequently covers health care industry topics. Suzanna Hoppszallern is senior editor of data and research for Health Facilities Management's sister publication, Hospitals & Health Networks.

| Sidebar - Wireless technologies - Smarten patient room designs |

|

The economic downturn hasn't halted the movement toward making patient rooms seem more like hotel rooms to hospital patients and their visitors. The most popular features being incorporated into room design for comfort show hospitals appealing to what satisfies patients and families, within cost reason. Based on results of the Health Facilities Management/American Society for Healthcare Engineering survey, they are wireless technologies for patients, individual room temperature control, larger room size, patient entertainment and educational systems and in-room family areas — each being incorporated in about a third or more of new rooms. Some softer features, such as views of nature, increased exposure to natural light and auditory environment controls to mitigate noise, have fallen out of favor for more cost-conscious measures since the recession began, the poll shows. But patient-focused services, starting with improved technology capabilities, now are seen as a must for competitive and other reasons. "Technology in the room, and the capability to bring in customized technology for things like PlayStation, are the norm now," says Mark Kenneday, CHFM, SASHE, vice chancellor for campus operations at the University of Arkansas for Medical Sciences in Little Rock, Ark. His organization made patient focus a priority in a recently completed bed tower, adding a wireless network with guest access in all new rooms and making them 260 to 300 square feet — large enough to allow a family member to stay and work. Wireless technologies, this time for hospital staff, also topped the list of features most often incorporated for safety purposes for the fifth consecutive year of the survey. Next were computerized provider order entry, in-room sinks, patient lifts and bar coding for medication administration. Fletcher Allen Health Care in Burlington, Vt., is planning to install terminals in patient rooms in its eventual patient-bed replacement building in keeping with its shift to electronic health records, while still retaining the option for nursing staff to bring in mobile terminals. "Part of the reason for going both those ways is there's a lot of individual preference among clinicians," says David Keelty, CHFM, director of facilities planning and development. Clinical staff at most hospitals have resisted going wireless, but the switch is inevitable, says Howard Allums, vice president and general manager for the national health care group at Turner Construction Co. "It eliminates not only a lot of costs from hard-wire systems but also provides Internet access to most patients," he says. Room size may have peaked as organizations focus more on cost-effective room design, according to Joseph Sprague, senior vice president and director of health facilities at HKS Architects in Dallas. "Every hospital is trying to get as much either reduced cost or increased efficiency out of their design, because they're being asked to do more with less," he says. As for features being incorporated into hospitals' overall physical design to improve patient safety and quality, multiple locations for hand washing or hand sanitizing topped survey respondents' list for the third straight year. Next were decentralized nurses' stations and added air treatment or air movement capacity. |