Data by Suzanna Hoppszallern

About the HFM/ASHE 2010 Construction Survey

Health Facilities Management (HFM) and the American Society for Healthcare Engineering (ASHE) of the American Hospital Association surveyed a random sample of 4,111 hospital executives to learn about trends in hospital conÂstruction. The response rate was 13.9 percent, or 570 completed surveys.

Health Facilities Management (HFM) and the American Society for Healthcare Engineering (ASHE) of the American Hospital Association surveyed a random sample of 4,111 hospital executives to learn about trends in hospital conÂstruction. The response rate was 13.9 percent, or 570 completed surveys.

HFM thanks the sponsors of this survey—Brasfield & Gorrie, Phoenix Controls and Turner Construction—for underwriting this research.

PDF version

of GatefoldTo gain free access to the 2010 Hospital Building report addtional data tables not available in our magazine report

For larger images of the charts posted within this page, click here

Health care facility construction has a long history of remaining steady through economic slowdowns. Not this time, though.

A triple whammy of the recession, credit crisis and concerns about the impact of landmark health care legislation muffled the industry's nearly decade-long building boom in 2009, and no turnaround is imminent.

If the economy recovers strongly, experts say the best the hospital construction industry can hope for this year is a push on renovation rather than new buildings, and just matching last year's slowed pace. Projects that were halted or postponed, meanwhile, may have to wait until next year's budgets—caution is the byword for 2010.

Industry veterans such as York Chan, a board member of the American Society for Healthcare Engineering (ASHE), are witnessing a reaction to this downturn that never occurred during recessions in the '70s, '80s and '90s. "This is the first time I'm seeing hospitals suspend projects either on the books or under way, just to be conservative and see what the future is," says Chan, CHFM, director of facilities at Advocate Illinois Masonic Medical Center, Chicago.

The caution is reflected in many ways:

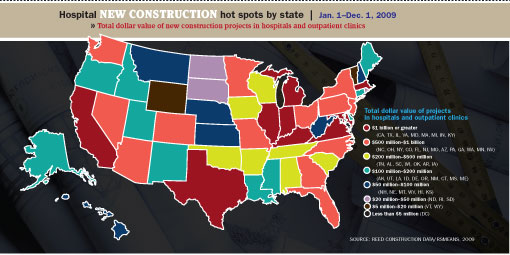

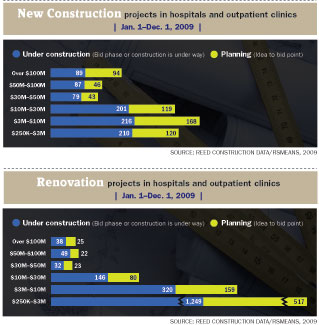

Less construction planned. A shrunken total of $33 billion in hospitals and clinics was in the planning pipeline at the start of the fourth quarter, according to RSMeans Business Solutions—down 26 percent from the average for 2007 and 2008 at the same point.

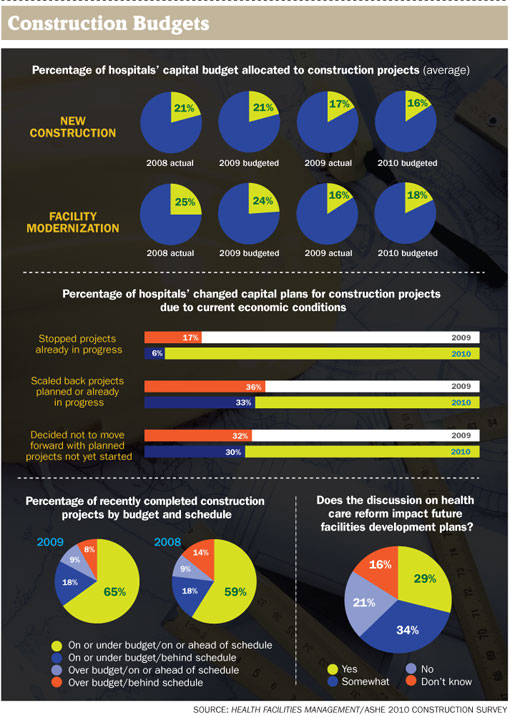

Projects suspended or scaled back. One of every six hospitals surveyed by Health Facilities Management (HFM) and ASHE in October and November stopped a construction project in progress in 2009 because of economic conditions. New bed towers, replacement hospitals, renovations and needed upgrades all were paused.

Another 36 percent of those responding to the annual construction survey said they scaled back projects planned or in progress, while 32 percent decided not to move forward with planned projects not yet started. The numbers of those altering construction plans for 2010 was only slightly lower.

Reduced budgets. Budgets for both new construction projects and facility modernization are down this year. Among those responding to the survey, an average of just 16 percent of fiscal 2010 capital budgets were allocated for new construction and 18 percent for modernization—down from 2009 targets of 21 percent and 24 percent, respectively.

Waiting on health care legislation. About 29 percent of survey respondents said the discussion on health care reform impacted their future facilities development plans, and another 34 percent said it had somewhat of an impact.

An improving economy and a revived stock market eased the pressure on hospitals in the closing months of 2009. Financing was again available through the bond market as credit issues faded. But hundreds of projects remained idled indefinitely and building designers' phones were hardly ringing off the hook with business for new projects. Even the most optimistic scenarios don't foresee a pickup in activity until the second half of 2010 at the earliest.

Worse than last year?

With so many holding back and the economy's staying power still in question, evidence points to 2010 being a worse year for hospital construction than 2009, according to some industry insiders. ASHE members are similarly wary; all but 26 percent of the survey respondents said this year would be about the same as last year for their building projects or worse.

"We're not out of the slowdown yet by any stretch of the imagination," says Robert Levine, who retired at year's end as senior vice president for health care at New York-based Turner Construction Co., a large builder of health care facilities. "And with health care reform, we may have headwinds coming out of it."

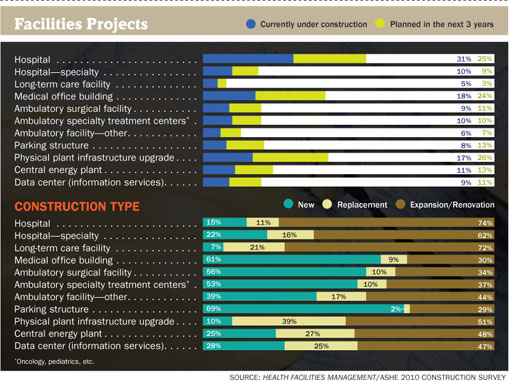

In short, it's too soon to expect a snapback in the market. However, it isn't as if a depression sidelined every construction crane. New technology, an aging population and the obsolescence of decades-old facilities all weigh in favor of continued development, and the pipeline is full of projects. In addition to the 31 percent of survey respondents that had hospital projects under construction, 25 percent said they planned them in the next three years.

There were 500 new construction projects for hospitals and clinics in the pipeline at the start of the fourth quarter of 2009, according to RSMeans Business Solutions. "It's still an absolutely enormous market," says Levine. "So it's tough to say it's going to be hard times."

But hospital organizations large and small are backing off on building rather than taking on more debt in uncertain times.

Advocate Health Care, which operates nine hospitals in the Chicago area, suspended all capital spending for 2009 and is just starting to release some dollars for 2010, according to Chan. Officials of 25-bed St. John's Lutheran Hospital in Libby, Mont., said they would likely postpone construction of a new $35 million hospital beyond 2010 due to lower profits during the downturn. "Right now is the time to build—it truly is," says a regretful Tony Rebo, manager of plant operations, citing the drop in building costs.

The Medical Center of South Arkansas, whose owner Community Health Systems has 120 hospitals in 29 states, is spending capital at its facility for such things as magnetic resonance imaging, cooling towers and infrastructure equipment—but that's about all, says Terry Martin, CHFM, SASHE, the center's director of engineering and ASHE's president. "We're waiting to see how the political realm's going to break out."

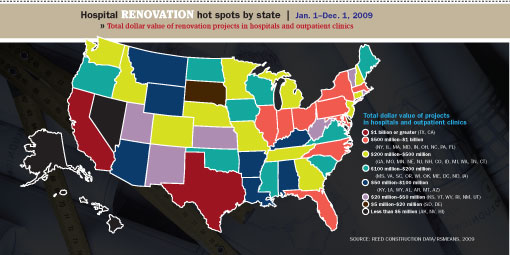

Renovation takes over?

The slump's impact on hospitals was cushioned in 2009 by a huge backlog of work. It may be felt more in 2010, however, as the cumulative effect of two straight down years weighs on bottom lines.

That's another reason why organizations are applying frugality to their facilitie—to ensure they avoid financial trouble. Besides putting projects on hold, it can mean repairs and renovation over new construction. And it signals that a return to the boom times of two years ago is unlikely any time soon.

"Many of us have retrenched," says Dana Swenson, senior vice president of facilities and chief facilities officer at UMass Memorial Health Care in Worcester, Mass. "I think we can do a lot better by just fixing up what we have—doing fit-ups and new equipment—and to not spend hundreds of millions on new construction but spend tens of millions on a spruce-up."

The vast majority (74 percent) of current or planned facilities projects cited by respondents to the HFM/ASHE survey are expansions or renovations, versus 16 percent new and about 11 percent replacements.

Another reflection of the trend toward cost control is that organizations appear to be relying more on cash on hand. More than 49 percent of poll respondents said they were financing construction projects from existing cash reserves, among other sources—up from 38 percent a year earlier.

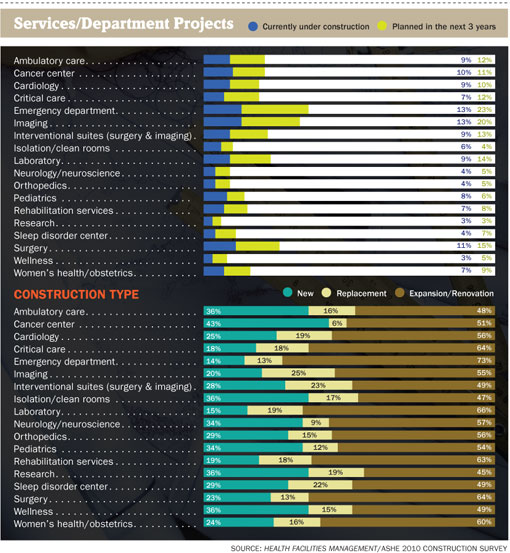

Among projects that are going ahead—either those in progress or planned in the next three years—cancer treatment hospitals were the most common new specialty hospital being built by surveyed organizations, followed by children's hospitals. Many of the additions or modernization projects are for emergency departments or imaging or surgery areas—important services that demand upkeep even during a financial crisis. Interventional suites combining surgery and imaging are among the most popular features being targeted for addition, replacement or expansion.

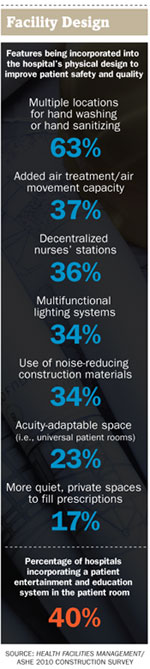

While safety features being incorporated into patient rooms didn't change much from the previous year's poll, a handful of comfort-oriented features showed higher use among respondents: patient bedside control (27 percent), wireless technologies (45 percent) and patient entertainment and education systems (40 percent).

EBD, green uncertainty

The slow but steady progress toward use of evidence-based design (EBD) concepts and green materials and construction methods could be experiencing a setback in the weak economy. Survey results are open to interpretation. While 51 percent of respondents said they were using evidence-based design in most or all construction projects, some facilities managers suggested that doesn't necessarily mean they play a large role in those projects.

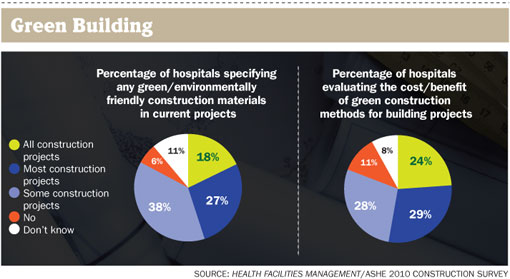

The extent of the commitment to green in tough times is equally uncertain. Forty-five percent said they are using environmentally friendly construction materials in most or all construction and renovation projects, and 53 percent are evaluating the cost and benefit of green construction methods for most or all projects. But a cautious, bottom-line-oriented approach may be slowing the embrace of green.

Dale Woodin, CHFM, FASHE, the executive director of ASHE, says there are still lingering concerns about whether certain approaches to green spending are always necessary when money's tight. The jury is still out on the long-term performance of some devices and systems intended to reduce the facilities' carbon footprint, he says, and concern remains that major retrofits may be needed when they don't perform as expected.

"Green and evidence-based design is often stuff that falls into the 'wishes and wants' category, and that can be what gets cut," says Woodin. "Basic savings and energy efficiency, that's ingrained into planning now. But rooftop gardens, waterless urinals, some of those things—there's a real discussion about whether they are really essential needs."

Evidence-based design is not being utilized as much as the market would like to say, according to Renee Jacobs, CHFM, vice president of facilities and construction at Saint Luke's Health System in Kansas City, Mo. Designers and planners, she says, need to do a better job studying facilities they designed to learn how they can be made more functional.

The financial meltdown seemed to leave more hospitals undecided on what to do about master facility plans, too. Just 43 percent of survey respondents had revisited their master facility plans within the past year, compared with an average of about 54 percent in the three previous annual HFM/ASHE surveys. And 27 percent hadn't updated them for more than two years, or since well before the crisis began.

Rethinking budgeting, planning

More hospitals (65 percent of respondents) were on or under budget and on or ahead of schedule than in previous years. That likely was more a reflection of less activity—more time to focus on fewer projects—than of getting a better handle on the construction cycle, according to Woodin.

More hospitals (65 percent of respondents) were on or under budget and on or ahead of schedule than in previous years. That likely was more a reflection of less activity—more time to focus on fewer projects—than of getting a better handle on the construction cycle, according to Woodin.

The chillier economic climate has prompted some organizations to rethink how capital budgets are developed, as a way to help control cost in the planning stages. Jayne Talmage, prinÂcipal of RSMeans Business Solutions, cites more interest in using cost engineering models and software to analyze downstream operational costs, particularly for energy and carbon reduction.

Another increasingly popular method of saving money by smoothing project logistics and facilitating communication with clients and subcontractors is building information modeling (BIM) software. Among those surveyed, 42 percent said they use it in hospital capital planning and 58 percent use it in project management.

In a recent trend analysis of projects bid in the last six months, analysts at Reed Construction Data, a leading advocate of BIM, found that hospital and clinic owners with total construction opportunity of $1 billion required that their projects be managed using BIM in specification documents.

One area where there may be more room for many to cut costs is in project delivery models, where 46 percent said they were still using the traditional design-bid-build model for their construction projects—up slightly from each of the previous three years. Guaranteed maximum price was the next most popular, used by 30 percent. Only 9 percent said they used integrated project delivery, where the shared-rewards approach provides strong motivation for all parties to save project costs and work collaboratively.

Those results show that the industry hasn't yet learned how to do integrated project delivery, according to Kip Edwards, system vice president for development and construction at Phoenix-based Banner Health, who expects it to ultimately become the dominant model. "Traditional design-bid-build naturally and financially puts everybody in a difficult arrangement. Integrated project delivery sort of does the opposite."

Wild card factor

The end of 2009 brought assurance of imminent changes to health care law but a wide range of possibilities for how it will affect hospitals. The uncertainty left hospitals somewhat tied in knots with their plans for 2010 and beyond.

Near-universal health care coverage for all Americans promises to bring in millions more for medical treatment. But some are concerned about the prospect of lower reimbursements, and others say a healthier population could lessen demand for new facilities over the long term.

Whatever happens, numerous factors make an extended slump highly unlikely in the years ahead.

"There's no question that we've got a still-growing population of older adults," says Jill Hoggard Green, R.N., chief operating officer for PeaceHealth's Oregon region in Springfield, Ore. "Many of us have to update our infrastructures. And making rooms sensitive to patient needs and advancing technology remains a priority."

Prospects brightened around mid-fall when facilities experts say project planning started to move cautiously forward again. A rebounding stock market, improving economy and less restrictive bond market all were encouraging signs.

That won't be enough to jump-start all stalled projects, especially with many organizations having deferred big capital spending until 2011 budgets. But signs of revival at the end of what began as a calamitous year were enough for Martin to declare it a successful year for hospitals under the circumstances.

"We had a shot over the bow and we tightened our belts and we held our costs down, whether it was utilities or construction," he says. "We've lost a lot of jobs, there have been a lot of cuts. But we survived."

Dave Carpenter is a Chicago-based freelance writer who frequently covers health care industry topics. Suzanna Hoppszallern is senior editor of data and

research for Health Facilities Management's sister publication, Hospitals & Health Networks.

| Sidebar - About the HFM/ASHE 2010 Construction Survey |

|

Health Facilities Management (HFM) and the American Society for Healthcare Engineering (ASHE) of the American Hospital Association surveyed a random sample of 4,111 hospital executives to learn about trends in hospital construction. The response rate was 13.9 percent, or 570 completed surveys. HFM thanks the sponsors of this survey—Brasfield & Gorrie, Phoenix Controls and Turner Construction— for underwriting this research. |

| Sidebar - The bright side of the downturn |

|

On the bright side, the Great Recession has provided a rare opportunity for some health care organizations to save millions of dollars on material and labor costs. Certainly not all could take advantage of the savings during the economic slump. Many projects across the country were halted in place or had their target dates pushed back. But those with the confidence and financial reserves to proceed with construction projects in dark times realized unexpected gains. At the University of Arkansas for Medical Sciences, the status of a 300,000-square-foot expansion of the Winthrop P. Rockefeller Cancer Institute appeared to be in jeopardy in the wake of the 2008 financial market meltdown, just a year after groundbreaking. The organization's investments had plummeted and cash flow declined. But the Little Rock-based organization decided it could reduce project costs without scaling back, since subcontractor pricing was so favorable. "Certainly the first, knee-jerk reaction was to pull back," says Mark Kenneday, CHFM, SASHE, vice chancellor for campus operations. "But what we discussed was this is a terrific opportunity to find value in market pricing for our projects." Nearly all the project's subcontracts were renewed at improved terms, resulting in significant savings. "We were in a strong position to take on a dip in the economy," Kenneday says. Cascade Medical Center in Leavenworth, Wash., was in a similar position, enabling it to start a $10.5 million renovation and modernization project as planned last August. It had already funded the project prior to the downturn. "We found the slower construction environment to be favorable to us in terms of 'hungrier' contractors, resulting in more competitive bids," says Facilities Director Greg Horton. Officials at Rockingham Memorial Hospital in Harrisonburg, Va., did not let a drop in investment returns dissuade them from continuing to build a $300 million replacement hospital and medical clinics. The hospital had its cash and financing well in hand before the economic slump and felt an obligation as a community hospital to improve. "We are proceeding with optimism that the needs of our community will grow even if our economy does not," explains Paul Ketron, FACHE, director of plant operations. Phoenix Children's Hospital experienced both pluses and minuses from the recession. It went full speed ahead with a new $580 million facility that it obtained bond money for before the crash while putting a clinic and medical office building on hold due to the economy. Even that setback, though, ultimately turned positive when it rebid the project with five contractors and found the price had dropped to $6.5 million from $9.1 million a year earlier. "Those of us that stuck it out or were lucky enough to get a project funded or under way like we did hit the market at the right time," says Dave Cottle, executive director of planning, design and construction. "Folks who didn't get funded or financed had to stop projects. That's unfortunate because it's just going to take double the amount of money to start them up again." |