Hospitals planning capital projects have about one year left to take advantage of a recently approved law giving community banks—and their hometown hospitals—new options for low-cost credit. The new lending option involves the 12 Federal Home Loan Banks (FHLBs). As a system of regional banking cooperatives, the FHLBs make direct loans not to individuals but to their member banks, like the Morton (Ill.) Community Bank.

Hospitals planning capital projects have about one year left to take advantage of a recently approved law giving community banks—and their hometown hospitals—new options for low-cost credit. The new lending option involves the 12 Federal Home Loan Banks (FHLBs). As a system of regional banking cooperatives, the FHLBs make direct loans not to individuals but to their member banks, like the Morton (Ill.) Community Bank.

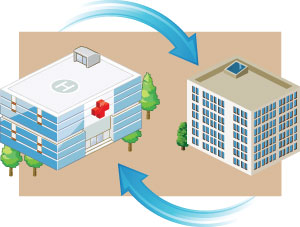

Investment bank Lancaster Pollard recently served as bond underwriter for a deal between Morton and FHLB-Chicago to lend $5.5 million to Hopedale (Ill.) Medical Complex for its 25-bed critical-access hospital. Hopedale's executives were told by their large national lender last spring that their letter of credit would not be renewed. In the past, a hospital Hopedale's size would be out of options, especially after the credit crisis. But in the Housing and Economic Recovery Act of 2008, Congress gave the home-loan banks the authority to provide credit enhancements to tax-exempt projects that qualify as "community investments"—including hospitals.

This makes it possible for Morton to use the FHLB's bond rating to guarantee a loan to Hopedale, to refinance its debt and borrow $1 million to design and plan a $20 million expansion, Mark Rossi, Hopedale's chief operating officer, told Health Facilities Management's sister publication Hospitals & Health Networks.

Rossi says Hopedale is moving forward with its expansion plans and intends to use the same process to finance it.