It may be the least talked about result of health care reform, but the supply chain will undergo a serious transformation. Materials managers, logistics professionals, group purchasing organizations and manufacturers all will be more accountable for their roles in reducing costs and supporting more efficient, safer and higher-quality care. Many experts believe this trend will continue into 2011 and beyond regardless of whether Republicans make good on their promises to repeal or otherwise derail the reform bill.

"The way in which health-care purchasing decisions are evaluated and even how health care is going to be delivered in the United States is evolving, and supply chain has a major role in this transformation. And like it or not, comparative effectiveness and value-based purchasing are part of the new equation," says Ray Moore, CMRP, MBA, system contract manager at PeaceHealth, Bellevue, Wash.

Evidence-based supply chain

Moore, who also serves as board president for the Association for Healthcare Resource & Materials Management, argues that materials managers and their colleagues now are expected to employ "evidence-based supply chain" practices in the same way that physicians are expected to follow the tenets of evidence-based medicine.

Moore, who also serves as board president for the Association for Healthcare Resource & Materials Management, argues that materials managers and their colleagues now are expected to employ "evidence-based supply chain" practices in the same way that physicians are expected to follow the tenets of evidence-based medicine.

"Supply chain is increasingly being looked to as more than just the folks who reduce cost for products and services. More and more [they're looked at] as a strategic patient-care function, from streamlining care-related logistical processes to related data management and utilization-opportunities analyses," Moore says.

Group purchasing organizations, which historically have been recognized primarily for the cost savings they can leverage on behalf of hospitals, see the shift as well.

Mike Alkire, president of Premier Purchasing Partners, an alliance of more than 2,400 nonprofit hospitals and 70,000 nonacute sites, says members are looking far beyond the dollars and cents of supply costs. They're closely examining population-based care delivery models and clinical integration across the spectrum of care.

From a supply chain perspective, Alkire says members are paying closer attention to drug and implant utilization, particularly in the nonacute setting.

"We've enhanced our focus on the nonacute setting. As reform continues to evolve and move toward more of a population-based setting, more and more care will be delivered outside the four walls of the hospital," Alkire explains.

Cost-cutting initiatives

Like some other GPOs, Premier is focusing on delivering new tools that will help its members deal with the many changes reform will bring.

"Our board has asked us to focus on diagnostic tools to help the membership understand and anticipate the impact of health care reform," Alkire says.

"Our board has asked us to focus on diagnostic tools to help the membership understand and anticipate the impact of health care reform," Alkire says.

Some of the tools Premier is delivering focus on such issues as reducing unnecessary readmissions and reducing health care-associated infections (HAIs). Through reform, hospitals will face additional reductions in Medicare payment for these types of harm.

Randy Walter, executive vice president of enterprise solutions and marketing at Amerinet, says while he also sees a clinical shift in focus among many supply chain leaders, this change is being brought about because of the need to drive down costs further.

"A lot of hospitals feel as though they are going to have to start operating at almost Medicare-reimbursement costs or less across the board. And if they can do that, they have a fighting chance to survive. So that's driving a lot of initiatives on the commodities side as well as the implant side and physician preference items," Walter says.

Nik Fincher, vice president of purchased services and capital for VHA, says the reform bill will lead more hospitals to tap into GPOs for their consultant's knowledge and the GPO members' expertise on more sophisticated ways to reduce costs.

"Our largest customers are coming to us and saying, 'Can you tap your sources of data and help us benchmark [costs] and then see if there are opportunities to help us create programs that take advantage of these opportunities?'" Fincher says.

GPOs measure up

Survey data published in July by our sister magazine, Hospitals & Health Networks, underscore just how much hospitals rely on their GPOs to help them cut costs and the extent to which GPOs deliver value. Among the findings: Seven of 10 respondents reported GPO-attributed savings of 5 percent or more on their supply purchases, while one in four reported GPO savings of more than 11 percent.

The survey data also reinforced that hospitals work with their GPOs on issues far beyond simply reducing supply costs. For instance, more than 80 percent of respondents said safety and quality programs offered by GPOs are an important factor in their selection of a GPO. Meanwhile, more than two of three respondents (68 percent) said the ability of a GPO to help them benchmark clinical improvements was an important factor in GPO selection. Meanwhile, more than half (53 percent) considered consulting services on such physician preference items as implantable orthopedic, spinal and cardiac devices an important factor in their selection of a GPO.

Similarly, respondents generally expressed high satisfaction rates for their GPOs in such areas as pricing/savings (89 percent satisfied or very satisfied), contract data management (86 percent satisfied or very satisfied) and customer service/rapid-response time (78 percent satisfied or very satisfied).

Still, hospitals need to develop even tighter relationships with their GPOs going forward as various parts of the reform bill take effect over the next five years, experts suggest. Many hospitals clearly see this period as a major challenge.

Concerns on the horizon

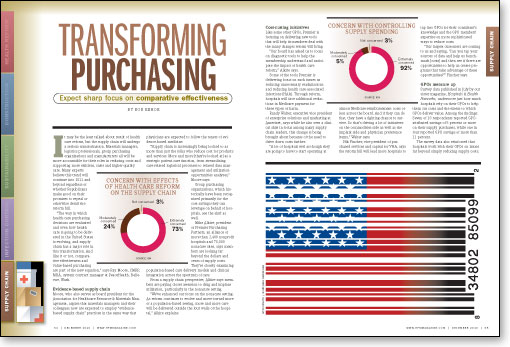

A survey conducted earlier this year for the Integrated Delivery Network (IDN) Summit and Expo found that nearly three of four (73 percent) of the 200 senior health care supply chain professionals polled were extremely concerned about the potential effects of reform. The respondents typically represent IDNs and health systems with more than 500 beds. Just under half the respondents felt the reform bill will have a net-negative effect on the health care supply chain.

Much of the concern about the impact of the bill centers around reduced payments to hospitals, which could well cause materials managers to have to leverage still lower prices for supplies to make up for some of the difference. One of the most significant cuts hospitals face is a $150 billion-plus cut over 10 years in Medicare payments. Also, nearly all providers will be subject to pay for performance under Medicare and Medicaid, under which a portion of payment is withheld and providers can earn back full reimbursement by showing high levels of improvement in scores on measures of clinical quality and patient satisfaction.

Among the areas of the reform bill about which IDN Summit respondents described themselves as extremely concerned are:

- the long-term impact of commercial payer contract strategies (62 percent);

- payment reductions for preventable readmissions (55 percent);

- payment reductions for HAIs (54 percent);

- pay for performance under Medicare and Medicaid (53 percent).

Respondents apparently didn't miss a small section tucked more than 700 pages deep in the bill that calls for a 2.3 percent excise tax on the sale of medical devices by the manufacturer or importer. Nearly two-thirds of the respondents (63 percent) are extremely concerned about the prospects of that tax being passed on to hospitals in the form of higher prices for medical devices. Premier's Alkire shares that concern.

"We're very keen on making sure that hospitals don't pick up that [excise tax cost]," Alkire says. "What our nation's hospitals cannot afford is another $100 billion [in costs] on top of cuts projected under reform. My board and my CEO shareholder committees have been very direct with me about working to ensure that members don't have to foot that bill as well."

Price forecasts

Outside of these major concerns, hospitals shouldn't have too much to worry about in the form of significantly higher supply prices in 2011, particularly since most GPO contracts already have specified pricing for next year. However, the GPOs with whom we spoke for this story noted concerns about some rising commodity prices for raw goods frequently used in medical supplies and hospital construction.

Cotton prices, for example, more than doubled during the 12 months prior to October 2010. Metals prices for copper, aluminum and nickel also have risen, though far less dramatically.

VHA's Fincher says with hospital construction rebounding considerably in some markets in 2010 and with the forecast for 2011 generally looking stronger than 2010, construction materials prices may rise further.

"With Obama financing the rebuilding of America's infrastructure through the stimulus package, some of the prices of materials that are being used in health care facilities such as concrete, steel and copper, are up across the board," Fincher says. "We haven't seen any huge escalation in prices, but we see less willingness among vendors or suppliers to do the deep discounting they were in 2009."

Fincher also notes that among hospitals that have resumed building, there seems to be more emphasis on sustainability and energy efficiency in building design.

Bob Kehoe is the associate publisher of Health Facilities Management.