Article by Dave Carpenter and data by Suzanna Hoppszallern

Two years before the scheduled launch of major changes in health care, the reforms already are beginning to alter the pace and direction of hospital construction. Trepidation about reduced reimbursement rates has put the big chill on many plans and reduced the scope of others, as shown by the annual construction survey by Health Facilities Management (HFM) and the American Society for Healthcare Engineering (ASHE).

Organizations are building fewer new or replacement hospitals, unwilling to proceed with projects in a slow economy and facing a year of uncertainty as they await decisions that will affect key aspects of reforms and even their constitutionality.

|

»Click here or on the image below for full construction survey, including charts (PDF). |

|

"The impact of reform is going to be huge," says Greg Weigle, P.E., FACHE, director of construction and design at the Medical University of South Carolina. His academic medical center is among those responding to the coming changes by renovating patient units instead of replacing them as had been planned originally. "Our margins define what we can afford to do and, from what I hear, they are going to shrink. That can't help but have an effect on construction."

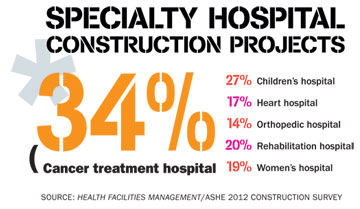

Accompanying the financial restraint is a shift in strategy prompted largely by the Patient Protection and Affordable Care Act for the surge in patients it is expected to bring after coverage expands in 2014 and its increased emphasis on patient safety and quality of care.

Hospitals and health networks appear to be scaling back on the patient-pleasing but costly "hospital-as-hotel" approach and focusing more on how to maximize value and improve medical outcomes, facing the prospect of future Medicare reimbursements being tied to performance. Organizations anticipate spending more on facility

renovations than new construction in 2012 for a second straight year, the survey indicates. They plan to build far more ambulatory or outpatient facilities than acute care hospitals in the next three years. Data centers and medical office buildings also are an increasing priority.

"Most everybody is struggling with margins right now," says George A. "Skip" Smith, CHFM, SASHE, vice president for facility management and clinical engineering at Catholic Health Initiatives in Hilliard, Ohio. "But there is this sense among systems that health care does need to change."

Capital budgets aren't taking a hit as they did after the financial crisis of 2008-09, by any means. Industry insiders expect roughly the same amount of spending on hospital construction in 2012 as in 2011, with specialty hospital projects and infrastructure upgrades helping to offset the drop in acute care hospitals.

But funds are limited and cash-conscious organizations are behaving differently. Respondents to the HFM/ASHE survey say they are less inclined to borrow money to pay for new facilities. They are giving projects more scrutiny based on return on investment (ROI). And those that have difficulty accessing credit are partnering with other hospitals.

"There's a dynamic tension right now about what we need to do and what we can afford to do," says Dale Woodin, CHFM, FASHE, ASHE's executive director.

Reform's impact

Evidence of a hold-down on new hospital construction because of reforms is clear from the results of the survey, which was conducted in October and November for HFM and ASHE by Perception Solutions Inc., Aurora, Ill.

Asked about the impact of reduced reimbursement rates on their hospitals' building plans, only 19 percent of the 531 ASHE members who responded say new hospital construction will proceed without changes. Another 13 percent say they will go ahead with modifications, and the rest either say plans are being reevaluated (26 percent), are less likely to proceed (19 percent) or will definitely not proceed (23 percent). Nearly three-fourths also say they will revise, review or possibly not go ahead with planned renovation projects, although fewer than 10 percent say they will suspend them.

Comments by survey respondents underscore the more tight-fisted approach toward construction spending because of reform: "A strong case must be made for any building projects," notes one anonymous respondent. "More focus on ROI and justification of all costs," says another.

Another respondent says Medicare reimbursement reductions as envisioned would have wiped out all of that hospital's profits from a year ago. Still another cites a $2 million interior renovation project that was ready to go to public bid, but has been tabled indefinitely: "All renovation projects will be placed on hold until the actual impacts of reduced reimbursements are known," the respondent says.

Hospitals budgeted less than half of what they did a year ago for new construction — just 16 percent of their capital budgets. Facility renovation got a bigger slice of the pie (21 percent), but is still down.

The caution is part of an outlook for overall hospital spending in 2012 that Zacks Investment Research Inc., Chicago, characterizes as "slightly somber." Hospital construction, in fact, is likely to be relatively flat for the next two years, according to Chip Cogswell, national health care director at New York-based Turner Construction Co.

The caution is part of an outlook for overall hospital spending in 2012 that Zacks Investment Research Inc., Chicago, characterizes as "slightly somber." Hospital construction, in fact, is likely to be relatively flat for the next two years, according to Chip Cogswell, national health care director at New York-based Turner Construction Co.

New construction approved now likely will be for lower-cost, community-based facilities than big on-campus projects, says Dan Cates, director of business development for health care at McCarthy Building Cos. in St. Louis. Physical plant infrastructure upgrades also are more likely to win approval. About 30 percent of respondents say infrastructure will account for a larger part of their capital budgets, significantly more than for new construction.

That can be explained by the fact that most hospitals have a deteriorating chiller, boiler or air handler that is beyond its useful life and long overdue to be replaced, especially with spending having been tight since the 2008 financial crisis, says York Chan, CHFM, administrator of facilities for Advocate Health Care in Oak Brook, Ill. "Infrastructure is very, very critical, and even if they held off on growth and expansion they can't hold off forever" on replacing such equipment, he says.

Financing changes

Organizations are relying less on bank loans and other debt to finance construction projects than at any time since the HFM/ASHE survey began in 2005. Just 17 percent are using debt, down from 20 percent a year ago, compared with 42 percent drawing on cash reserves.

"With the unknowns of reform and reimbursement, health care organizations are attempting to remain as debt-free as possible," says Ken Cates, principal of Northstar Management Co. in St. Louis. "The cost-conscious C-suite and boards of directors are taking the stance that many Americans have taken lately: Don't spend it unless you have it."

Use of tax-exempt bonds also is at its lowest in at least six years, accounting for just 21 percent of construction financing among survey respondents.

The volatility of financial markets, the unpredictability of cash reserves and tighter access to debt are what have caused organizations to become more conservative in their capital spending, says Fred Hessler, managing director of the health care group for Citigroup Global Markets Inc., New York. Not-for-profit hospital systems issued just $22 billion of tax-exempt debt through all but the final three weeks of 2011, he notes, a steep drop from $30 billion in 2010, $45 billion in 2009 and $60 billion in 2008.

The credit outlook should remain stable for health care organizations in 2012, Hessler says, with dramatic changes possible in 2014 depending on the final shape of reforms.

Smaller, more local

The survey shows that the shift in priorities from traditional hospitals to smaller, neighborhood or satellite facilities is accelerating.

Future projects most frequently cited by survey participants in response to reforms are emergency departments, by 17 percent; outpatient facilities in neighborhood settings, by 16 percent; medical office building expansions, 16 percent; and primary care clinics and urgent care centers in neighborhoods, both 14 percent.

Future projects most frequently cited by survey participants in response to reforms are emergency departments, by 17 percent; outpatient facilities in neighborhood settings, by 16 percent; medical office building expansions, 16 percent; and primary care clinics and urgent care centers in neighborhoods, both 14 percent.

The thinking is that the demand will increase for all of them in the decade ahead. Expanding and modernizing emergency departments will strengthen the first point of access to health care for many of the 32 million additional Americans who will have overage in coming years. Improving and adding neighborhood outpatient facilities also will facilitate access.

So will plans for expanding medical office buildings, which rose by nearly two-thirds from the 2010 survey. The sharp increase in medical office building expansions also reflects the surge of specialist physicians being employed by health care systems through practice acquisitions as organizations prepare for the era of accountable care, says Rich Galling, chief operating officer of Hammes Co., a health care consulting firm in Brookfield, Wis.

Nearly half (47 percent) of respondents say they have acute care hospital construction projects under way or planned within three years. But the vast majority involve renovations. Organizations plan fewer of those new hospitals in the next three years, in fact, than medical office buildings, outpatient surgical facilities or specialty treatment centers. Projects involving data centers and infrastructure upgrades also are rising sharply.

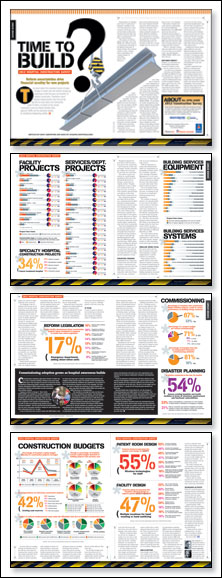

Numerous types of specialty hospitals are seeing significant upticks, including cancer treatment, planned by 34 percent of organizations in the next three years; children's, 27 percent; rehabilitation, 20 percent; and women's, 19 percent. Heart hospitals are next at 17 percent, although growth is flat from a year ago.

IT push

A push to invest in information technology is reflected in the services that hospitals have targeted for building projects. Imaging and tech-laden emergency departments, along with surgery, top the list of departments where construction or expansion is planned in the next three years. Interventional suites, combining surgery and imaging, also are a priority among projects currently under way.

That makes sense from a purely financial perspective. "These are the bread-and-butter sources of hospital revenue, so organizations cannot afford to allow these services to become outdated and non-competitive," says Kirk Hamilton, FAIA, FACHA, EDAC, professor of architecture and associate director of the Center for Health Systems & Design at Texas A&M University.

Organizations also are stepping up their investments in laboratories as science and technology play an increasingly stronger role in medicine. About 22 percent either have lab construction under way or planned. At the other end of the spectrum, bariatric surgery centers lagged all other services and departments in construction projects in progress and on the planning boards, as a one-time growth area fades.

Building automation is still the No. 1 building services system being replaced, both now and over the next two years, followed by security and patient monitoring/nurse call systems. Data infrastructure spending remains about the same after several years of heavy spending, but wired cable systems are still one of the top five priorities.

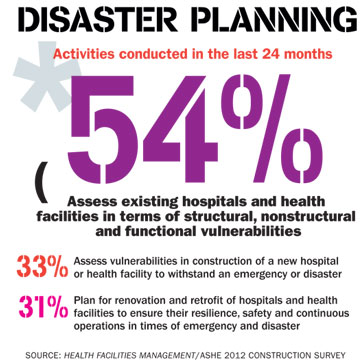

Patient safety features also are taking on more of an information technology emphasis. Wireless technologies for staff and in-room computers for patient charting were the top selected features being incorporated into patient room design for safety, with computerized provider order entry and bar coding for medication administration also registering highly.

Same-handed room design still has not gained widespread adoption, the survey indicates. Some observers suggest that may be due to the additional costs and space requirements as well as the absence of definitive research to show it reduces errors.

In-room sinks are trending strongly as hospitals strive to get infection rates down by ensuring that caregivers wash their hands frequently. Those efforts also show in the responses to another question, with "multiple locations for hand washing or hand sanitizing" the most-cited feature being incorporated into the hospital's physical design to improve patient safety and quality.

Acuity-adaptable or universal patient rooms are trending downward from previous years. That may be because clinical staff have had trouble accepting such rooms. It also could be a result of nursing staff not being as flexible or diverse in their skill sets, Ken Cates says.

For the third straight year, more than 60 percent of respondents say they have updated their master facilities plans within the last two years. But 10 percent still don't have one at all. That's a mistake, most experts agree.

"Without a long-term plan for the use of a campus or facility, it is very easy to sub-optimize the use of space for near-term needs," says Kip Edwards, vice president of development and construction for Banner Health in Phoenix.

In a big change from two years earlier, 60 percent say they budget and implement most facility infrastructure projects on an as-needed basis rather than according to a master facility plan or other planned replacement schedule. That is up from 22 percent in the 2009 survey.

Organizations have much more pressure today from competing capital needs and many are spending more of their capital budgets on information technology than they are on facilities, Galling notes.

BIM is better

Interestingly, about 37 percent, similar to last year but down substantially from two years ago, say they use building information modeling (BIM) in project management. The drop may be explained by the fact that hospitals at the moment are doing more smaller projects. BIM traditionally has been relied on for big projects carried out by large construction firms.

"It's a phenomenal tool, but can be expensive to use on small projects," says Galling. "And it's expensive to adapt to a renovation because as-built records are not always complete and accurate."

At a time when construction activity is relatively slow, more of the health care organizations that are building are getting their projects done swiftly and economically. The survey finds that 66 percent of recently completed projects are on or under budget and on or ahead of schedule — the highest percentage in the six years of the survey.

The weak economy and work-hungry contractors and suppliers have a lot to do with that, suggests Thomas Bickett, CHFM, system director for facility services at Legacy Health in Portland, Ore.

Projects also are being watched more closely because of financial concerns, according to numerous respondents.

Increased activity

While the overall hospital construction market is defined by spending restraint and smaller projects, there are some encouraging signs. No one seems to see the market going backward in 2012, and most see it as having bottomed out.

While the overall hospital construction market is defined by spending restraint and smaller projects, there are some encouraging signs. No one seems to see the market going backward in 2012, and most see it as having bottomed out.

Joseph Sprague, FAIA, FACHA, senior vice president and director of health facilities at HKS Architects in Dallas, sees increased activity and interest that should translate to many new construction projects once there's more clarity about how Medicare will change and whether the U.S. Supreme Court declares the Affordable Care Act unconstitutional.

"I think you'll see quite a building boom," he says, "once everything is known that's so uncertain now." But not in 2012.

Dave Carpenter is a Chicago-based freelance writer who frequently covers health care topics. Suzanna Hoppszallern is senior editor of data and research for Health Facilities Management's sister publication, Hospitals & Health Networks.

| Sidebar - Commissioning adoption grows as hospital awareness builds |

|

Commissioning is starting to gain some traction in health care as a way to maximize facilities' efficiency and control rising utility costs. Fully two-thirds (67 percent) of American Society for Healthcare Engineering (ASHE) members responding to the Health Facilities Management/ASHE Hospital Construction Survey conducted in October and November say they commission their facilities projects. Progress is evident to George A. "Skip" Smith, CHFM, SASHE, vice president for facility management and clinical engineering at Catholic Health Initiatives in Hilliard, Ohio, for one simple reason. When he raises the subject with others in the industry, he now finds more recognition of the benefits of commissioning — an audit to make sure building energy systems are performing as designed. "You don't get that deer-in-the-headlights look any more, and people wanting to change the topic because they don't understand what it is," he says. A lack of awareness was a primary reason why ASHE began a project about four years ago to compile commissioning guidelines and enlighten facility directors about the breadth of both commissioning and retrocommissioning. Guidelines were published in the summer of 2010 and workbooks prepared as part of the campaign. The initiative aims to educate key executives as well as facility managers, says Mark Kenneday, CHFM, FASHE, who headed the ASHE task force on commissioning. "The benefits far outweigh the costs, but they have not been well-defined and argued," says Kenneday, vice chancellor of campus operations at the University of Arkansas for Medical Sciences in Little Rock and ASHE president-elect. "It can't be just a one-and-done, 'Well, we checked everything and it looked good.'" ASHE's Executive Director Dale Woodin, CHFM, FASHE, hailed the 67 percent response as a positive step toward getting systems better coordinated and working together efficiently. Costs remain an issue, the survey indicated. Seventy-one percent of respondents say they put 5 percent or less of a project budget toward commissioning. And about one in five organizations save expenses by not hiring an independent, third-party commissioning authority. To pay for third-party commissioning, Jeff Cook, director of engineering at Reid Hospital in Richmond, Ind., says he would have to be able to quantify the value, and that's difficult to do. So he and his staff do what they can on their own. "We put it in the budget, but it's like gold bricks — usually the first thing that gets whacked out," Cook says. Advocate Health Care of Oak Brook, Ill., is in the process of retrocommissioning every HVAC system in its 12 hospitals. York Chan, CHFM, administrator of facilities, says simple matters such as a fan running above the designed speed, a blocked duct or a changed thermostat setting can inflate operating costs and monthly bills significantly over the long run. Despite the progress, Kenneday knows the commissioning push has a long way to go to achieve what's needed. He says executives still tend to think of costs as a project's initial costs rather than operating costs. "Every health facilities project should be commissioned to ensure you get full functionality and efficiency, but we're a long way from that." |