Pay has remained stable and even crept higher for Health Facilities Management readers through all the turbulence in the economy and health care over the past several years.

Pay has remained stable and even crept higher for Health Facilities Management readers through all the turbulence in the economy and health care over the past several years.

But all the uncertainty and industry cutbacks have taken a toll, knocking salaries off their previous growth rate. Now organizations are expected to trim further, clouding the outlook for managers and hospital workforces alike.

Those are some of the findings of a survey on management compensation in health care conducted for Health Facilities Management, the American Society for Healthcare Engineering (ASHE) and the Association for the Healthcare Environment (AHE).

By some key measures, the results show progress in the three-plus years since a similar poll was conducted.

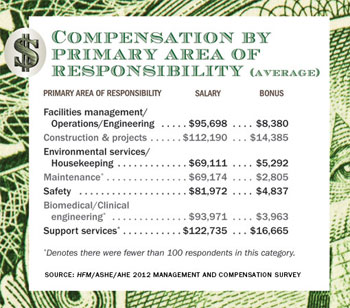

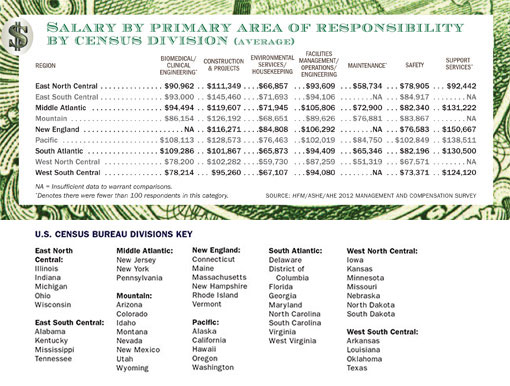

The average salary stretching across a variety of job categories encompassed by the survey has risen about 6 percent from early 2009 to $90,659. Two of the three largest areas of responsibility represented by respondents have seen salaries climb respectably: construction and project management up 7 percent to an average $112,190 and facilities management/operations/engineering up 4 percent to $95,698. The third, environmental services/housekeeping, inched up 2 percent to $69,111. Hospitals also are rewarding seniority, experience and certification, the survey results indicate.

|

| »Click here for a PDF of the above chart. |

Yet most of those gains are effectively treading water compared with inflation, which averaged 1.6 percent annually during the three-year period, according to Bureau of Labor Statistics data. That means prices are up roughly 5 percent since the previous survey was taken.

York Chan, CHFM, administrator of facilities for Advocate Health Care in Oak Brook, Ill., says it's clear from the results that his profession, among others, has not caught up from the economic downturn. There's no sign, he says, of a return to the days when automatic raises of up to 5 percent were standard — days that came to a grinding halt in the recession.

"Hospitals are scared to death about what's coming up with health care reform and restraints on reimbursement," says Chan, who is also a member of the ASHE board of directors. "Everybody's trying to get more efficient, so they can't be handing out 4 or 5 percent raises anymore. You get 2 percent if you're lucky."

The online survey was conducted in March and April by Perception Solutions Inc., Aurora, Ill., among health care organizations and members of ASHE and AHE. A total of 2,788 people responded, making for an overall margin of error of plus or minus 5 percent.

|

| »Click here for a PDF of above chart. |

Top 10 takeaways

A closer look at 10 key takeaways from the poll, provides insights into industry trends in pay and other areas:

1. The top tier of salaries is expanding. Nearly one in three managers, or 31 percent, commands an annual salary of more than $100,000, up from 25 percent in 2009. And those at the highest levels of responsibility are seeing salaries soar. Managers with 200 to 300 employees reporting to them saw pay jump 23 percent over the three years to an average $135,232; those with more than 300 reports enjoyed 16 percent salary hikes from 2009, to an average $166,877.

That's good news not only for the recipients, but also for health care business as a whole. Competitive salaries make it easier to recruit talent to an industry that historically has lagged in compensation.

"Institutions that appreciate the critical value of the role are paying more," says Jack Gosselin, FASHE, CHFM, a former hospital facilities manager who runs a Mystic, Conn.-based recruiting firm. "There is less undervalue in the field, and the best performers are getting the highest compensation."

Newcomers are being compensated significantly better, too. Among survey respondents, managers with less than three years' industry experience are now paid an average $73,665, up 9 percent in three years.

|

| »Click here for a PDF of the above charts. |

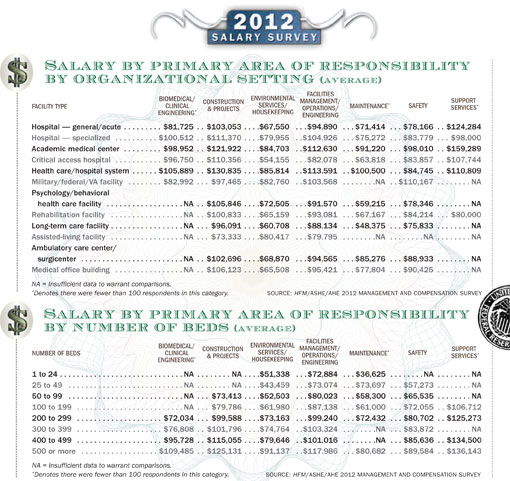

Where you work makes a critical difference, however. The average salary was up 10 percent or more for managers in health care or hospital systems, federal or Veterans Affairs facilities, and rehabilitation and assisted-living facilities. Those at hospitals, academic medical centers, long-term care facilities, ambulatory care centers and medical office buildings also saw salary increases, but in the single-digit percentages.

Faring among the worst recently are managers at small organizations. Those whose departments have annual operating budgets of less than $100,000 saw pay for their positions cut by 7 percent in the last three years, to just under $60,000.

2. Bonuses have grown. Bouncing back from the recession, cash bonuses have gotten slightly larger since 2009. Among survey respondents, 38 percent say they received bonuses averaging $10,108 in 2011. The median amount was $5,000. In the previous poll, the average was $7,719 and the median $4,500.

Within specific job descriptions, construction and project managers in 2011 received an average annual bonus of $14,385; facilities management/operations/engineering managers received $8,380; and environmental services/housekeeping managers got $5,292.

The percentage of those eligible for bonuses virtually was identical to those of three years earlier, when recipients also comprised slightly more than 38 percent of those surveyed.

Given the relatively large number of respondents who cited staff cutbacks, a hiring freeze or the elimination of annual staff increases at their organizations, ASHE Executive Director Dale Woodin, CHFM, FASHE, thinks the data are significant. "These seem to indicate that bonuses are being viewed as an effective way to incentivize high performance," he says.

3. Organizations plan to do more with less. Improvements to the economy notwithstanding, health care organizations remain in a defensive posture in the wake of the financial shock of 2008-09 despite all the reform-oriented items on their to-do lists.

Just over two-thirds of the managers who participated in the survey, or 67 percent, say their staff would decrease in the coming year. Three years earlier, only 16 percent forecast staff reductions and the majority expected staff to remain the same.

Departmental operating budgets for 2012 were reduced for 34 percent of respondents, with no change for another 25 percent. That left just 41 percent who increased them, down from 48 percent in 2009.

Michael Hatton, CHFM, system executive of engineering for Memorial Hermann Healthcare System in Houston, called those financial pullbacks "a concerning trend." "Reducing [full-time equivalents] continues to be a focus in health care," he says.

Chan attributes the staff reductions to all the uncertainty over the impact of health care reform in 2014 and coming reimbursement cuts. That's the reason, he says, why many respondents think "we're going to do more with less staffing."

|

| »Click here for a PDF of the above charts. |

4. Employee costs are rising and some key benefits are shrinking. The latest cost-cutting spilled over from operating budgets to affect individual employees in many cases. The majority of respondents noted tightened spending in areas from pension and retirement plan cutbacks to passing along higher costs for employee benefits.

One targeted area hits close to home for employees of health care organizations — health care insurance. Nearly a third say their organizations increased deductibles for their insurance plans, and a like amount (32 percent) say they boosted the percentage that employees contribute for premiums.

Eleven percent saw the company match in their 401(k) program either reduced (6 percent) or eliminated (5 percent).

Non-cash compensation took a hit nearly across the board, with declines since the 2009 survey in those receiving medical insurance (70 percent, down from 74 percent), employer-funded retirement plans (34 percent, down from 40 percent), dental insurance, long-term disability insurance and education reimbursement. With more austere plans for new hires, even the number of paid holidays is down.

5. The Northeast and California pay best. Consistent with the 2009 survey, the highest salaries are paid on the Atlantic and Pacific coasts. Four New England states (Massachusetts, Rhode Island, Connecticut, Vermont) plus New York, Delaware and Washington, D.C., were among the top 10 in salary, based on survey responses. California also remained near the top.

The higher salaries generally reflect a higher cost of living in those areas. For example, the median home price in the Northeast ($228,300) in March was $95,500 higher than in the Midwest and $81,800 more than in the South, with the West the second costliest region, according to data from the National Association of Realtors.

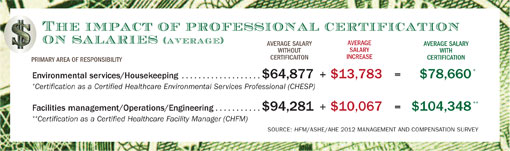

6. Certification pays off. Increasingly, certification matters on payday. Only about one of every three respondents had obtained the primary certification for their field: Certified Healthcare Facility Manager (CHFM), Certified Healthcare Environmental Services Professional (CHESP) or Certified Healthcare Constructor (CHC). It was required by fewer than 5 percent of organizations.

But those who have it are reaping dividends. In facilities management, the CHFM was worth an extra $10,000 in salary on average among poll participants last year ($104,348 for those with it, $94,281 for those without). For environmental services/housekeeping managers, having the CHESP designation meant an average of nearly $14,000 more in salary than their peers without it ($78,660 to $64,877).

"We are pleased to see the value of CHESP being translated into dollars, which can be a key motivation to become certified," says Patti Costello, executive director of AHE.

AHE president Kent Miller, director of environmental services at Jackson Hospital & Clinic in Montgomery, Ala., says the CHESP increase was great to see but not substantial enough. He thinks it should add on even more to salaries in a profession where pay lags other health care management jobs.

Achieving certification clearly improves earnings potential, and CHFM and CHC are becoming the expected standard in the industry, Woodin says. "But more than that, the growth of certification indicates a growing professionalism among the facilities management and construction management communities, with folks willing to have their knowledge and skill set validated through an exam."

Those initials provide an advantage in job-seeking, too. Hatton has been able to more quickly locate key team members by searching for various credentials. "Certification such as ASHE's CHFM readily denoted 'competence' of an applicant who can succeed in today's multitasking facility manager role," he says.

7. Education is increasingly valued. The survey showed that salary amounts are increasingly tied to education credentials.

Salaries declined from 2009 to 2012 for those without a college or advanced degree, dropping 5 percent to an average $64,938. Meanwhile, they rose 5 percent to $96,273 for those with a bachelor's degree and nearly 8 percent to $116,609 for those with a master's degree or MBA.

|

| »Click here for a PDF of the above chart. |

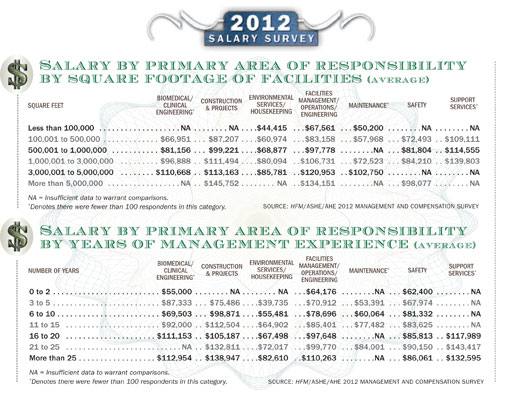

8. Pay accelerates with 25 years' experience. It takes more than two decades of experience before salaries grow at a significant pace, according to the survey results.

Average salaries among environmental services/housekeeping managers remain below $68,000 until reaching $72,017 for 21 to 25 years of management or supervisory experience, then average $82,610 after 25-plus years. Facilities managers, too, make a big jump after the 25-year mark, moving into six figures with an average $110,263.

Tenure alone doesn't explain the large increases in salary after the quarter-century mark, however. Costello says it's a combination of experience, education, certification and ongoing learning. "Remaining at the top of one's game by always having an eagerness to learn and grow is most worthy of salary increase consideration," she says.

9. The gender gap has widened. The gender gap for all job categories addressed by the survey remains significant, rising to a $20,314 difference between the average salaries for men ($93,805) and women ($73,491). That's a $2,700 larger difference than in the last survey. The higher-paying fields of facilities management and construction remain heavily male-dominated, and they accounted for about four-fifths of survey respondents. Still, health care leaders were at a loss to fully explain why the salary gap got bigger.

Gosselin says he has noticed more women in facilities management over the past decade, and he thinks the compensation there is equitable. The growing survey differential may be due to an increasing number of women in the lower-paying environmental services management roles.

10. The graying of management will soon leave a void. The proportion of managers older than 55 moved up significantly, to 40 percent from 35 percent in the 2009 survey. That heightens concerns about what will happen when a wave of retirements begins in the not-too-distant future.

Facilities management experts already were worried about what Chan calls a dire shortage of facility engineers. Now organizations need to firm up plans for the next generation of leadership in environmental services and construction as well as facilities management, while also working to attract more talent to their ranks. "We've been talking about the need for succession plans in the next five to 10 years," says Miller, "and this proves there's a great need for it."

Dave Carpenter is a Chicago-based freelance writer who frequently covers health care industry topics. Suzanna Hoppszallern is senior editor of data and research for Health Facilities Management's sister publication, Hospitals & Health Networks.

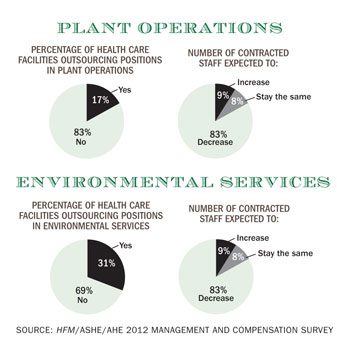

| Sidebar - Respondents expect contracted staff to decrease | ||

| Under relentless pressure to lower operational costs, hospitals are poised to further reduce their outsourcing. That was the consensus of an overwhelming majority of the American Society for Healthcare Engineering (ASHE) and Association for the Healthcare Environment (AHE) members surveyed. Five out of six (83 percent) of those polled say they expect the number of contracted staff in plant operations to decrease. A like percentage forecast a reduction of contracted staff in environmental services. Cutting back on outsourcing reflects organizations' intensive focus on costs in an era of declining reimbursement. Contractor costs tend to be substantially higher than staff costs, making it an obvious area to target.

They also make up a sizable chunk of most budgets, as 17 percent of those responding to the survey say their organizations outsource positions in plant operations and 31 percent do so in environmental services. Always cyclical, outsourcing has remained an important element of hospital plant operations and environmental services departments through the recession and now the recovery. Operation and maintenance of elevators, chillers, switchgear and other functions are commonly contracted out, as are plumbing, painting, housekeeping and many other services. The concern of many in the field, however, is the loss of expertise and experience in many areas when contracting is slashed in the interest of aiding the bottom line. That can only be compensated for by staff through a concerted effort that includes additional spending on training and tools. "Reducing the use of contractors puts greater pressure on in-house staff to remain current on the technologies used and effective operations, troubleshooting and repair of sophisticated equipment and systems," says Dale Woodin, CHFM, FASHE, the executive director of ASHE. "This takes a proactive approach to training and tools and time to work with systems." Organizations may find it hard to financially justify adding resources for that purpose at a time when they're in cutback mode, however. Already, 40 percent of respondents say their hospitals have eliminated staff positions for 2012 due to the economy or declining revenues or profitability. Building owners must beware of simply pursuing the lowest cost in maintenance, says Joe Stchur, director of facility operations at University of Michigan Hospitals. An outsourced vendor might be superior or inferior to an in-house product, he says: "You can always spend less by doing less. But if you want to have high reliability in hospitals, you want everything to work all the time." Besides helping the budget, returning outsourced functions to staff offers another advantage in that "you want the skills in-house" in facilities management and skilled trades, says Dana Swenson, senior vice president of facilities and chief facilities officer at UMass Memorial Health Care. The Worcester, Mass., system cut its one outsourced facilities management position recently to save money. Donald Wojtkowski, executive director of design and construction at SSM Health Care in St. Louis, says his organization is attempting to expand employees' skill sets to reduce purchased services. Patti Costello, executive director of AHE, says it's important to remember that the use of outsourcing has ebbed and flowed in recent decades, reflecting needs and the economy. Organizations may start out handling most functions in-house, then move to outsourcing increasingly through a number of companies before bringing more duties back in-house. |