Much of the heavy fog of uncertainty for hospital construction has lifted in 2013 following an election that locked in sweeping health care reforms. But the industry is still operating at reduced speed as it prepares to navigate all the changes ahead.

Health care organizations are investing less in megaprojects involving traditional hospitals and more in upgrades or additions designed to help them thrive under the Affordable Care Act (ACA), with its emphasis on accountability, affordability and patient access. That means a greater focus on infrastructure and technology, hospital-physician integration and outpatient facilities.

A still-sketchy economic outlook continues to hold many back, too. Industry activity in 2012 was flat or slightly down overall, based on results of an annual survey by Health Facilities Management and the American Society for Healthcare Engineering as well as comments by industry experts.

As a result, 2013 shapes up to be similar to last year constructionwise, says Dan Cates, director of business development for health care at St. Louis-based McCarthy Building Cos.

"I think it's going to be a slow comeback this year and probably in 2014, too," he says. "Larger projects are fewer and farther between. Hospitals are still trying to figure out how everything's going to work with the demographics and reimbursements changing so, outside of the occasional large project, we see health care organizations primarily focusing on smaller infrastructure and outpatient facility projects."

"I think it's going to be a slow comeback this year and probably in 2014, too," he says. "Larger projects are fewer and farther between. Hospitals are still trying to figure out how everything's going to work with the demographics and reimbursements changing so, outside of the occasional large project, we see health care organizations primarily focusing on smaller infrastructure and outpatient facility projects."

In the face of so many competing needs and new requirements, though, observers say a major or protracted hold-down in building activity is unlikely.

"What's going on now is maybe a leveling, a pause," says Steve Higgs, senior vice president with health care facility advisory firm KLMK Group in Peachtree City, Ga. "But there's lots of pent-up demand, and we have more certainty now. We will soon know how the effects of Obamacare play into volume."

Changing plans

Most organizations contemplating building new hospitals were either reevaluating plans or said they would not proceed at the time of the survey. Asked to assess the impact of reduced reimbursement rates under the ACA, only 17 percent of those respondents said they definitely would proceed as planned. Twenty-nine percent said they would not go ahead, 20 percent were less likely to proceed, 25 percent were reevaluating and 9 percent said they would proceed but with modifications.

That hesitancy to commit to new facilities almost certainly was greater before the November elections, when the future of health care coverage and reimbursement still hung in the balance. The online poll involving 612 hospitals was conducted in October and November for HFM and ASHE by Perception Solutions Inc., Aurora, Ill. Leaders knew that if Mitt Romney and the Republicans won, there would have been major moves to scale back or repeal reforms and competitive bidding on premiums, among other potential changes.

Pervasive uncertainty about both the election outcome and the economy stifled health care building activity throughout 2012, in fact. The industry experienced a considerable loss of momentum, leading to steep construction declines for both hospitals and clinics, according to Robert Murray, vice president of economic affairs for McGraw-Hill Construction.

Total construction starts were on pace to plunge 16 percent for the year to 63 million square feet, down from 109 million square feet in 2008. The dollar value of starts was on track to fall 12 percent to $20 billion. In 2012, only 15 projects valued at $100 million or more had broken ground by fall, Murray wrote in McGraw-Hill's Outlook 2013.

Hospital renovation and expansion projects have not been shelved as much as new facilities. Only about a third of respondents (33 percent) to the HFM/ASHE survey either said they would not proceed with those combined projects or were less likely to. And for hospital renovations without expansion as well as for infrastructure upgrades, respondents were more positive. A slight majority said they will proceed either as planned or with modifications.

ASHE president Mark Kenneday, CHFM, FASHE, says organizations are continuing to put off bigger projects until the economy improves. "You can replace, remodel or refurbish and optimize your existing resources" in this tight-budget environment in the meantime, says Kenneday, vice chancellor of campus operations at the University of Arkansas for Medical Sciences in Little Rock. "In good times you might be looking at an $8 million to $10 million project; now it might be a $1 million to $2 million project."

Favoring renovations over replacement or expansion isn't just a matter of spending fewer dollars. Hospitals that need to renovate because of increased technology, code compliance or the need for a better electrical/mechanical infrastructure simply can't put those construction programs off indefinitely, notes Ken Cates, principal of Northstar Management Co., St. Louis, which acts as project manager for hospital construction projects.

'Planning paralysis'

The election "cleared up about half the muddy water" for hospitals, Kenneday reckons, in terms of what the future will bring. He senses the pre-election slowdown has eased, although projects remain smaller than before. "I see a shift to more work but of lower dollar value," he says.

The election "cleared up about half the muddy water" for hospitals, Kenneday reckons, in terms of what the future will bring. He senses the pre-election slowdown has eased, although projects remain smaller than before. "I see a shift to more work but of lower dollar value," he says.

But the prospect of sharply lower reimbursement and other impending changes is causing "planning/decision paralysis" for many, according to Kip Edwards, vice president for development and construction at Phoenix-based Banner Health. "Hospital systems are in a quandary right now," he says. "They must continue to operate and function in today's health care world, which means they need to address condition and capacity issues, but realize that as accountable care begins to impact the market, the need for inpatient beds will reduce." That has a lot of systems pulling back on their capital plans, Edwards says.

Hospitals are still trying to get a handle on the impact of the ACA. Only 34 percent of those who participated in the survey said there have been discussions with senior leadership about potential changes needed to existing facilities or campus design as a result of it. Similarly, there were no statistically significant changes from a year ago in responses to a question about what future facility development plans are being considered in response to health care reform.

Comments by survey respondents reflect the pressure on organizations that need to change their approach to patient care because of reforms,but have limited resources.

"Less reimbursement means cuts in every conceivable area and capital projects driven for economy with minimal regard to patient niceties," noted one anonymous respondent. "Construction projects have been put on hold and master plan expenditures suspended until the effects of the law are known," said another.

Staying flexible

Adjusting the scope and size of new or reconfigured spaces was cited as a priority by numerous organizations — for the purposes of flexibility, affordability and meeting future needs. Many others mentioned putting a greater emphasis on energy conservation and cost-reduction in lieu of construction.

St. Joseph Regional Health Center in Bryan, Texas, is among the energy-focused, aiming to slash utility costs by 20 percent over two years through an audit and follow-up measures. "Due to declining payment levels from multiple payers, including Medicare and Medicaid, we are seeking to reduce operating expenses in any way that we can," says Steven Crichton, vice president for support services.

Memorial Health System in Colorado Springs, Colo., is investing in infrastructure projects with anticipated future savings in maintenance, energy and even cleaning costs. The uncertainty of future reimbursement rates is a growing factor in such capital cost decisions, says Norman Wolfe, senior project manager for planning design and construction.

Adapting to industry changes, Brattleboro (Vt.) Memorial Hospital has tabled plans to build a new wing in favor of renovating rooms, expanding its emergency department and allocating more resources to outpatient services. "The spike in inpatient utilization that was predicted with the aging of the baby boom generation has not occurred," says Rob Prohaska, director of plant services. "So rather than spending on expansion of inpatient beds, we are doing the responsible thing."

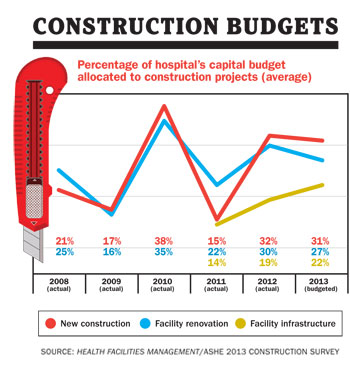

Despite the deferral of so many capital expansion plans, there's still no sign of a true building bust. In fact, the percentage of hospital capital budgets allocated to construction projects in 2013 (31 percent) is up sharply over similar budgeted numbers a year ago (16 percent), according to the survey — representing a bigger slice of a smaller capital spending pie.

Given all the ambiguity about the future and concerns of a building slowdown, the survey results actually reflect a surprising steadiness in industry activity, says Kirk Hamilton, FAIA, FACHA, EDAC, professor of architecture and associate director of the Center for Health Systems & Design at Texas A&M University, College Station.

The weakness in health care construction that was evident last year is expected to be short-lived, according to Murray, because of the need to replace dated facilities and the increased demand for services from an aging population. While the near-term outlook remains clouded, he says, "it will brighten as the economy improves and a clearer picture emerges about the future of Medicare, Medicaid and overall health care reform."

The weakness in health care construction that was evident last year is expected to be short-lived, according to Murray, because of the need to replace dated facilities and the increased demand for services from an aging population. While the near-term outlook remains clouded, he says, "it will brighten as the economy improves and a clearer picture emerges about the future of Medicare, Medicaid and overall health care reform."

Infrastructure and outpatient

About a fifth of the hospitals surveyed had acute care hospital projects under construction and another fifth said they planned them within the next three years. But just 30 percent of those were building new or replacement hospitals, the vast majority being expansion or renovation projects.

In addition to renovations, the results reflect the push for physical plant infrastructure upgrades — under way or planned by 37 percent — medical office buildings (32 percent) and ambulatory centers and other outpatient facilities.

Data centers also have begun sprouting as hospitals speed the transition to electronic health records to meet meaningful use guidelines. The number of respondents with such centers under construction jumped to 6 percent from less than 1 percent in the 2011 survey, with more planned.

A largely overlooked factor behind the strong emphasis on renovation and infrastructure is the ability to align those projects with depreciation expense, says Dana Swenson, P.E., senior vice president and chief facilities officer at UMass Memorial Health Care, Worcester, Mass. "As health care organizations retrench, a capital baseline predicated on the depreciation expense is established and the funds are directed to maintaining the plant, property and equipment — renovation and infrastructure," he explains.

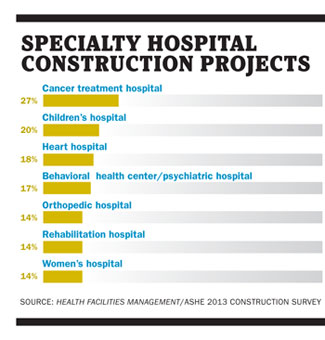

Cancer treatment (27 percent) and children's hospitals (20 percent) again were the top two specialty hospitals either being built or planned within three years, though both figures were down markedly from a year earlier. Heart hospitals remained steady (18 percent), and behavioral health centers and psychiatric hospitals emerged as a growth area, registering 17 percent in their first appearance in the survey.

Emergency departments and imaging were the most frequent targets for additions or modernization projects of any department, followed by surgery centers and interventional suites. But again, both areas slowed slightly as organizations eased off on project spending.

Ambulatory care projects accounted for the most new facilities. That's a consequence of reform and hospitals' desire to support their market position in a fast-changing industry, according to Rich Galling, president and chief operating officer of Hammes Co., a health care consulting firm in Brookfield, Wis. "They want to maintain their inpatient facilities properly, but with a finite amount of resources they're being more conservative and making sure they allocate money to their employed physician network and ambulatory facilities," he says.

Green still growing?

Green still growing?

The breakdown of those specifying green or environmentally friendly materials in construction and renovation projects remained virtually identical to the previous two years: 43 percent use it for some projects, 25 percent for most projects and 17 percent for all projects. That might indicate that interest in green has leveled off.

It has in the Midwest, at least, according to Cates of Northstar. "To many [hospital] owners, the bottom-line budget does not support these initiatives when competing for other important needs such as patient safety," he says.

But others maintain that the interest level is higher than before, even if it's not translating to more projects lately. Joseph Sprague, FAIA, FACHA, senior vice president and director of health facilities at HKS Architects Inc. in Dallas, says more hospitals are coming to understand that green can bring a handsome return on investment while also serving as an attractive tool for marketing and projecting a positive image.

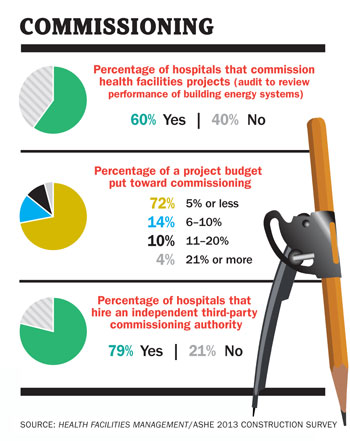

The use of commissioning for health facilities projects was down slightly. About 60 percent said they commission their projects versus 67 percent a year earlier. That could reflect a one-year anomaly, a result of tighter capital budgets or the fact that many outpatient medical office buildings are smaller and require less complex commissioning, industry observers suggested.

Among other survey results:

• Organizations relied slightly more (20 percent) on bank loans or other debt to finance construction projects than in 2011, taking advantage of record-low borrowing rates. That is notable, observes Hamilton, at a time when the credit crunch and uncertainty are still prominent.

• An impressive 68 percent of recently completed construction projects were finished on or under budget and on or ahead of schedule — the highest in the seven years of the survey.

• About 41 percent of respondents had updated their master facilities plans within the last year, down from 42 percent a year ago, but up from 39 percent two years ago. Only 24 percent said most infrastructure projects are budgeted and implemented on a planned replacement schedule as part of a master plan, down from 26 percent. Kenneday called the results "almost alarming" and a huge opportunity for facilities to improve.

• Disaster planning activities were down somewhat from the 2011 survey. An uptick seems likely this year, however, in the wake of Superstorm Sandy and possible new federal requirements, says Chad Beebe, AIA, SASHE, CHFM, CFPS, CBO, director of codes and standards at ASHE.

Looking for work

Overall, even in the face of growing needs for new or upgraded facilities, a return to a hectic building pace does not appear to be in store for the immediate future. While health care facility planning and construction is picking up in several areas internationally — China, India, Australia and the Middle East among them — the U.S. market remains relatively quiet.

Philip Stephens, MHA, CHFM, FASHE, director of facilities management services for the Carolinas HealthCare System in Charlotte, N.C., says all the architects, engineering firms and contractors with whom he talks are looking for work. He doesn't expect business to stay slow indefinitely for hospital building work, however.

"Construction is down, and when it's going to come back I don't know," says Stephens, the 2014 ASHE president-elect "But there's always going to be a call for it. We seem to be continuously ramping up our standards."

Dave Carpenter is a Chicago-based freelance writer who frequently covers health care topics. Suzanna Hoppszallern is senior editor of data and research for Health Facilities Management's sister publication, Hospitals & Health Networks.

| Sidebar - Hospitals being patient, persistent about designing rooms for safety |

| Hospitals didn't need the Patient Protection and Affordable Care Act to spur them into designing safer patient rooms. They've been preparing for that aspect of health reform for years. So, despite an apparent decline in the number of safety features incorporated into patient room design last year, industry experts say the issue remains as much a priority for organizations as ever. "I'm not sure why the numbers are down, but we shouldn't be fooled by that," says Chad Beebe, AIA, SASHE, CHFM, CFPS, CBO, director of codes and standards for the American Society for Healthcare Engineering (ASHE). "If anything, awareness of patient safety and quality is on the rise." The annual Health Facilities Management/ASHE hospital construction survey data showed a modest dip in safety features from a year earlier. The top five features incorporated for safety remained the same: in-room computers for patient charting, wireless technologies for staff (which fell a spot from most common feature cited in the 2011 survey), in-room sink, computerized provider order entry and patient lifts for transfer. Other popular in-room safety features included, in order of frequency, are specialty lighting, bar coding for medication administration, added air treatment or air movement capacity and a medication dispensing station — the latter two newly added to the survey as hospitals experiment with more solutions. The added incentive for hospitals is that they now have more of a financial stake in care outcomes. Medicare and Medicaid won't reimburse hospitals and health systems when patients are readmitted for preventable conditions. More features mean more expense, which could explain the temporary drop during a year of uncertainty about whether reform measures would stand. But, ultimately, organizations will do what they can to stop health care-associated infections from spreading through air ventilation or water systems, says Philip Stephens, MHA, CHFM, FASHE, director of facilities management services for the Carolinas HealthCare System in Charlotte, N.C. "We're talking a lot more about patient safety in construction projects than we used to," Stephens says of the industry. "We've learned a lot about how to design heating, ventilating and air conditioning systems." Health care organizations have, indeed, made progress toward completing installations, nudged by additional requirements, says Ken Cates, principal of St. Louis-based Northstar Management Co. Sinks in patient rooms now are required in new construction and renovations. Wireless technology and computers for charting are fast becoming the norm as access to patient information becomes increasingly important. Patient lifts still are being evaluated for their benefit to both patient and caregiver safety. A new push on patient room safety is coming as well. Patient safety and infection control will be top priorities in the 2014 edition of the Guidelines for Design and Construction of Health Care Facilities, says Joseph Sprague, FAIA, FACHA, senior vice president and director of health facilities at HKS Architects Inc. in Dallas and president of the Facility Guidelines Institute, which will publish the update this year. One proposal being considered is to incorporate a Patient and Caregiver Safety Risk Assessment requirement so that all health facility projects are designed to facilitate the safe delivery of care. — Dave Carpenter |