In the vast and mountainous Western states, patients sometimes can drive more than 100 miles to receive care that could be more easily and economically delivered closer to home.

It's a problem Phoenix-based Banner Health knows well. And, with post-Affordable Care Act (ACA) reimbursements expected to decline, it's one that can't be ignored.

Since May 2012, the health system has brought online seven freestanding health centers providing primary care in Arizona and Colorado to join its roster of hospital-based facilities, says Dan Dupaix, P.E., LEED AP, mechanical engineer for Banner's development and construction group.

At the same time, Banner has added a series of leased health care spaces, usually in existing office parks, he adds.

While the pace of construction is impressive, these new buildings would be little more than isolated clinics if not for the facilities, biomedical and information technology (IT) infrastructure that streams data from these outposts into Banner's Mesa, Ariz., corporate office, which houses the organization's data center as well as its 24/7 facilities monitoring operation.

"I just can't emphasize enough the importance of having that remote facilities monitoring capability," Dupaix says, "because you want to be operating as efficiently as possible and that means seeing what's going on in a facility without having to send someone out there."

Changes on campus

As Banner and similar health systems across the country attempt to satisfy patient preferences and economic imperatives with planning activities aimed at delivering community- and even home-based primary care, they also are primed to handle a much more acute patient population within their hospital walls.

"I believe patients who will be utilizing hospitals in the future will be much more critical in terms of health care needs as lower-acuity care moves from the central hospital into more freestanding facilities," agrees Todd Wilkening, CHFM, CHST, director of facilities at Ridgeview Medical Center in Waconia, Minn., which operates 13 off-site facilities.

This increased hospital intensity will require changes in the hospital's mechanical-electrical-plumbing (MEP) and technology infrastructure that will lower operational costs on the one hand while improving the hospital's ability to reach out to the system's other facilities on the other.

"As we look at the portfolio of expenditures in a health care campus, the three primary components are staff salaries, supplies and utilities and the last one is clearly where we come in," says Greg Quinn, P.E., LEED AP, principal at Affiliated Engineers Inc., Madison, Wis. "I think the focus on operations has tightened considerably and the awareness of where dollars are spent per British thermal units of energy and gallons of water has grown, particularly as the ACA has moved institutions to pay much closer attention to what they previously viewed as sunk costs."

For instance, Quinn says, hospital executives are now receptive to longer payback periods. "There's a willingness to spend additional infrastructure dollars that see a measurable impact on the bottom line even if it takes a longer period of time," he says. "Whereas, five years ago they were looking for paybacks in the five- to six-year range, they are now accepting paybacks closer to 10 years."

The effort toward controlling readmissions also has benefited MEP spending as it relates to patient safety issues, Quinn adds, especially in areas like emergency power, water quality, building controls and HVAC systems.

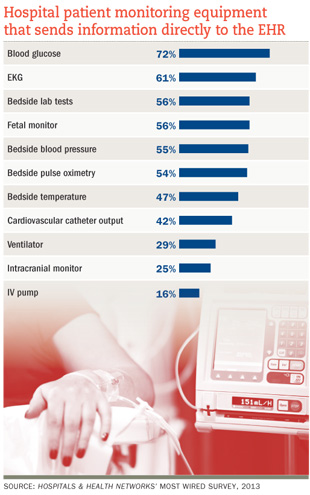

Not surprisingly, a big focus of hospital technology infrastructure planning has been on collecting, processing, analyzing and disseminating ever-increasing amounts of data from throughout the health care system as well as from individual pieces of medical equipment within the hospital.

Although Health Facilities Management's annual Hospital Construction Survey has found health care data center and data infrastructure projects proceeding at a double-digit clip over the past several years, the new generation of wireless mobile health devices has put a premium on additional technology capacity, says Ted Hood, senior vice president and COO at GBA, a health care technology consulting firm based in Franklin, Tenn.

"The wireless systems in a lot of existing facilities are just not adequate," he explains. "When you're looking at the growth of wireless medical equipment and bring-your-own-device policies, you're starting to burden those networks, and upgrades are going to have to happen."

Of course, these new data demands will require more processing capabilities, with experts predicting a combination of on-site data centers as well as cloud-based solutions.

"It appears that hospitals will keep their critical systems at the main hub, but they may put other programs out on the cloud that are, perhaps, not business-sensitive or critical to patient safety or documentation," says Wilkening.

Ultimately, though, Hood believes that larger data capacity must be combined with better technology planning to be truly effective.

"Many times, facilities buy technologies and struggle with configuring them properly to where they will actually support the facility and not hinder it," he says. "So, as all these medical devices — telehealth technologies, smartphones and electronic health records (EHRs) — are coming together, they have to be configured correctly to support operations."

Moving outside

While the growth of technology plays an important role in enabling many previously hospital-based services to move to more remote locations, the key driver is undoubtedly cost savings, with patient convenience being another plus, says Mike Pedersen, health care market sector leader for Mortenson Construction in Minneapolis.

"Patients are saying, 'I want the most optimal value I can get' and that means quality care at a convenient location at a reduced cost," he says. "So, every hospital is trying to adapt to provide the best care, make it convenient and make it seem as if the cost matches the care that's given, and that's driving a lot of these outpatient facilities."

The search for patient convenience and economic performance is also expanding the variety of services offered in these facilities which, in turn, is challenging MEP design and operations professionals, says Clay Seckman, P.E., executive vice president, Smith Seckman Reid Inc., Nashville, Tenn.

"An outpatient facility used to be a clinic or a doctor's office that might have an exam room or two and maybe an X-ray machine, but when you say outpatient or ambulatory facility these days, you don't know if it may be ambulatory surgery or diagnostic imaging or emergency care," he says. "One of the biggest challenges for us is designing a mechanical and electrical system that's robust enough to handle that kind of demanding load and performance on a very tight budget, because the hospital is trying to build a facility where it can provide services at a lower cost and the budget per square foot is much less than you'll see in a hospital."

While some tradeoffs, such as a lighter load on the emergency power system, bottled medical gas vs. a central system and lower-capacity HVAC equipment, can help trim costs in some instances, other costs are the inevitable result of the increasingly demanding off-site environment, Seckman says.

One way to boost funding, says Gerry McCusker, Banner Health's director of facilities services, design and construction, is to convince executives to move away from a first-cost mindset. "You have to look at the total cost of ownership over the life of the asset," he says. "Some folks have the tendency to waive off maintenance costs but, over a lot of years or if there's an interruption of business, it becomes quite significant."

A systemwide master planning process helps to pinpoint opportunities for off-site infrastructure investments, particularly as they relate to technology, adds Mo Deljoo, P.E., president of Noveen Consulting, Louisville, Ky. "If you have a master plan in place that looks at how you need to incorporate technology to gain efficiencies over your whole portfolio, you can implement some of those projects when you receive funding for related capital projects," he says.

As Banner Health's and Ridgeview Medical Center's experiences demonstrate, technology also can play a key role in reducing operating costs and improving patient safety at off-site facilities by allowing remote monitoring of HVAC, security, life safety and even power metering and lighting control.

"All of our remote building automation and IT systems tie back to the central hub so we have a 24/7 pulse on all of our properties, whether it's HVAC or pharmaceutical refrigerators, medical gases or other critical alarm points," says Ridgeview's Wilkening, who adds that monitoring allows Ridgeview to send staff to affected facilities before problems become severe, and also enables the hospital to benchmark its remote facilities against each other to detect any variations.

Of course, medical technology infrastructure also is a major concern when transferring information from remote facilities to a central data center and other elements within the health care system.

"A lot of organizations are trying to figure out the best way to communicate back to the primary hospital as they move out into the communities," says GBA's Hood. "Being able to access the network and the medical records, and scheduling among multiple systems, multiple buildings and multiple clinics becomes more challenging because they're used to dealing with it only at the hospital."

Among the most frequent applications on these systems, according to Mortenson's Pedersen, is transmitting EHRs as well as increased use of video for conferencing and telehealth. Other experts mentioned diagnostic imaging applications as another area of growth.

However, Hood advises against simply adding to the infrastructure without careful planning, saying that the biggest pipeline in the world won't help a system that is not properly configured.

In fact, he adds, the criticality of these remote systems calls for a new recognition of the importance of satellite facilities and their technology infrastructures in the organization's overall mission.

"There are some health care organizations with hospitals and clinics that are so intertwined they're reliant on access to medical information, scheduling, communication and telehealth," he says. "So, if they lose their connectivity or they lose their power, it is really going to hinder the organization and its business plan."

Ultimately, Hood foresees physician call centers and other online clinical consulting initiatives originating from both hospitals and satellite facilities that will be accessible by patients in their homes.

Taking it home

Indeed, while off-site satellite facility construction and operations are attracting the majority of attention these days, much research is under way on lowering costs and improving satisfaction through technology-enabled, home-based care.

Yan Chow, M.D., director of the Innovation & Advanced Technology Group for Kaiser Permanente, Oakland, Calif., says his organization has more than 170 telehealth pilot projects under way, which roughly split up into video conferencing, "store and forward" of photos and video via email, remote patient monitoring and a self-service paradigm based on patient empowerment through technology and social networks.

While many of these projects are aimed at physician-to-physician communication, advances in technology are encouraging more interest in home-based care.

"There's a trend of large, expensive stationary equipment in hospitals and labs becoming much smaller and cheaper to the point where use in the home becomes feasible," says Chow. "Many of these new technologies are connected to home hubs, personal computers or smartphones that allow people to send in their blood pressure, glucose or other personal data as well as communicate with their care team while at home, work or traveling."

Monitoring chronic conditions is chief among these applications, although Chow also mentioned that acute problems, such as a child's earache in the middle of the night, can potentially be managed.

"I'm seeing a lot more of these devices [with] cell chips built into them so they communicate directly over the cell network, which is a lot easier for elderly patients or others who might have difficulty setting up an Internet connection," he says. "I'm also noticing that a lot of these devices are starting to collaborate to cut down on false alarms so, for instance, if a patient's heart rate drops off but his other vital signs are normal, you know it's a problem with the sensor rather than an emergency situation."

Characterizing the current state-of-the-art in home monitoring as "the Wild West" in terms of interoperability with EHRs, Chow believes technology infrastructures will need to support a variety of wireless and wired devices coming over phone lines, cell networks and data lines.

"I think the underlying systems will need to have ubiquitous real-time information sharing and that means you'll have routing of communication to the right displays, to the right people and to the right offices," he says, urging facilities to build flexibility into their technology infrastructure planning.

Beyond the campus

The expansion of patient care from the hospital to off-site facilities and the home is fraught with literally thousands of MEP and technology infrastructure decisions unique to each project.

One key to making the right choices, experts say, is for health facilities professionals to recognize the significance of the changes under way and move beyond a campus-based outlook.

"We as an industry used to think of these facilities as 'just a clinic across town' or 'just an outpatient imaging center,'" says Seckman. "But, as they become a more important part of the care network, having a patient in a clinic across town is going to be almost as important as having one in your emergency department on your main campus."

Mike Hrickiewicz is editor of Health Facilities Management.