A year that saw contentious passage of comprehensive health care reform, a sluggish economy triggered by a severe financial crisis and rancorous congressional elections followed by threats of repealing the reform package was bound to bring uncertainty to health care planning, design and construction.

Perhaps that's why many health construction industry players seem undaunted by 2010's relatively flat performance.

Though hardly inspiring, this level of activity was certainly welcome after the battering health care construction took in 2009. Moreover, most forecasters expect building activity to start moving forward again next year as the push for efficiency and advanced technology drives new capital spending plans.

The numbers

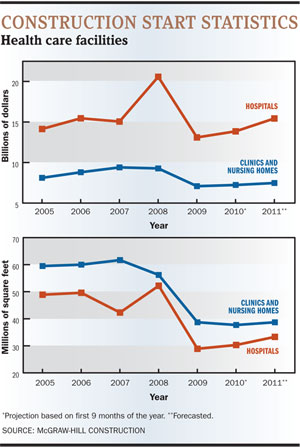

The depth of 2009's health care construction crash is apparent in the raw square footage numbers.

The depth of 2009's health care construction crash is apparent in the raw square footage numbers.

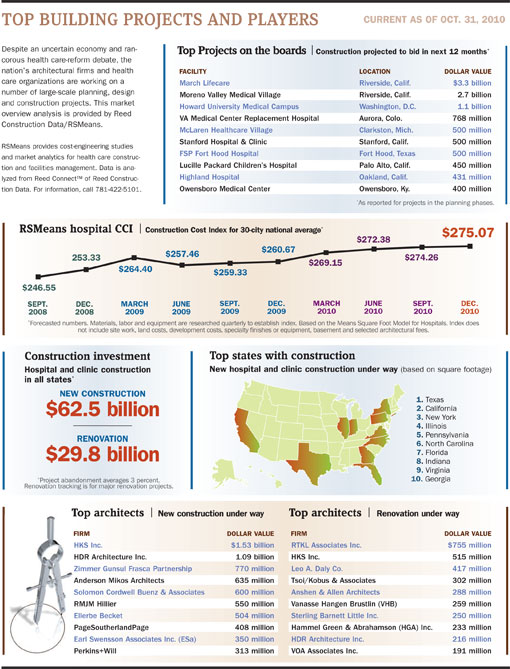

"Following the near-record high in 2008, health care facilities plunged 38 percent in 2009 to 68 million square feet, the worst one-year decline in at least 50 years," Robert Murray, vice president of economic affairs for McGraw-Hill Construction writes in the firm's Construction Outlook 2011 report. "Neither sector in the health care building category performed well last year: Clinics/nursing homes fell 31 percent and hospitals tumbled by 45 percent."

Plagued by a weak economy and tight credit stemming from the late-2008 financial crisis, many hospital construction professionals spent the better part of 2009 disengaging from stalled projects and "burning off" work put in the pipeline before the downturn. A number of them also pursued a rush of Department of Veterans Affairs (VA) and Department of Defense (DoD) projects that were sent out to bid.

"The VA is in the midst of one of their largest capital expansion programs since World War II and the DoD has several large projects underway," says Kevin Haynes, consultant at FMI Corp., Raleigh, N.C. "Clearly, a lot of activity has swung over to the public sector side," adds Russ Wenzel, senior vice president, McCarthy Building Companies Inc., St. Louis.

While initial fears of a banking meltdown eased, they were replaced by the uncertainty of a heated health care reform debate, which continued on through this year. Eventually, as reform passed and the debate over it moved to background noise, industry professionals settled into a "new normal" based slightly above or below 2009's construction totals.

"I think we all kind of came to grips with what the impact was in 2009," sums up Wenzel. "And it's more or less stayed at that level."

Improved conditions

For its part, McGraw-Hill estimates health care construction for 2010 to stay at 68 million square feet, with a 5 percent increase for hospitals combined with a 3 percent decrease for clinics and nursing homes.

"While the steepness of the 2009 downturn was unsettling, a sense of stability has returned to the category in 2010," McGraw-Hill's Murray writes in Construction Outlook 2011. "Improved conditions have allowed many established projects to resume, and low interest rates have made financing these developments more attractive from a fiscal standpoint. Additionally, the passage of health care reform alleviated the uncertainty that had been undermining investment."

Indeed, most experts agree that hospitals with healthy balance sheets and adequate reserves are able to find money. "Clients are continuing to go to the market and get financing," says Richard Galling, president and COO of health care consulting and development firm Hammes Company, Brookfield, Wis. "I think they would tell you the underwriters are probably more stringent today, but not ridiculously so."

And many hospitals that have re-bid their construction projects have been pleasantly surprised by the drop in construction prices, according to Galling.

"We had a couple of projects that were put on hold at the beginning of the financial crisis when they were in design phase," he says. "Then, the clients had those projects competitively re-bid when they were restarted, and the prices were about 15 percent lower than their original estimates before the financial crisis."

The ability to get capital still appears to be a two-tiered system, however.

"The very small projects where a hospital would be going to a small regional lender are more problematic," says Jim Haughey, chief economist for Reed Construction Data, Norcross, Ga., "because a lot of small regional lenders are still in deep financial trouble."

Galling speculates that the industry's uptick in merger-and-acquisition activity is at least partly attributable to smaller hospitals having trouble finding capital, not only for construction projects but also for information technology (IT) upgrades.

In fact, Michael Kuntz, senior vice president in charge of New York-based Turner Construction Co.'s health care group, believes the drive for IT may be contributing to some growth in renovation projects. "A smaller regional hospital has to go ahead and make that [IT] investment or run the risk of becoming a potential acquisition target," he says.

Kuntz estimates that 30 to 35 percent of Turner's health care renovation work is driven by changing technology, and expects that to increase to half of its renovation work within a couple of years.

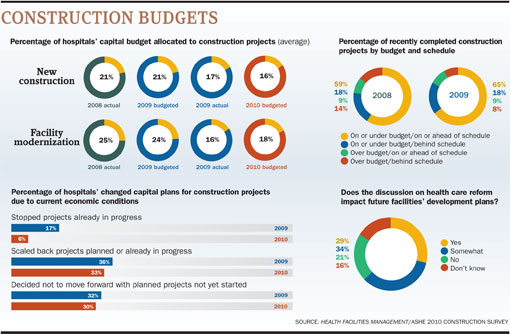

The interest in IT is a two-edged sword, however. Some say that IT and other efficiency initiatives are competing with construction projects in capital budgets.

"Aside from financing problems, our health care customers have seen heavy capital demands from implementing electronic medical records and strategic provider networks," Wenzel explains. "And they have had to deal with these needs as well."

Reform drivers

Health reform also appears to be an influence on IT-related construction projects, though the size of its role is a matter of conjecture. While some industry players believe it's coincidental to technology trends that already are underway, others believe it's key.

"A huge component of the health care reform bill is information technology," says Kuntz, whose company is a strategic partner in the Center for Connected Medicine (http://connectedmed.com). "And hospitals will struggle to remain competitive if they don't have robust IT systems."

Ultimately, Kuntz believes the reform-driven emergence of electronic health records and the advent of telemedicine are ushering in an IT wave that will dominate the industry within 5 to 7 years. "The hospitals we build today are certainly digital but there's another quantum leap yet to happen," he explains.

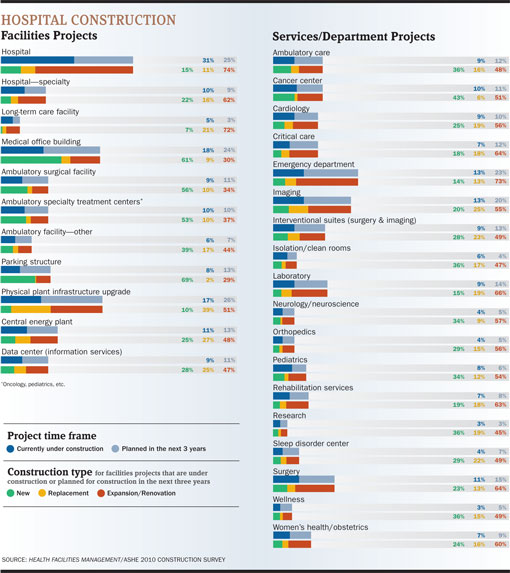

In addition to driving technology, health care reform and the general move toward greater efficiency also are leading many hospitals to look at outpatient construction.

"I think there's been a general trend toward ambulatory facilities," Murray says. "By increasing the number of insured, it stands to reason that health care reform would encourage hospitals to look at smaller-scale facilities."

"We're seeing a tremendous amount of interest in ambulatory," Galling agrees. "That's largely due to anticipation that we're going to be moving toward accountable care organizations and bundled payments. Many of the clients we're working with are focused on how that will occur and recognize that ambulatory is going to be a huge part of it."

Wenzel adds that the lower cost of constructing these types of facilities also may be contributing to their popularity.

"I think there's maybe a little pent-up demand by some health care systems that have very local strategies," he theorizes. "And ambulatory facilities are obviously more affordable per square foot, so the systems are able to act on them for strategic advantage."

Opinion is mixed on how threats to repeal reform would affect the health care market in the coming year.

Opinion is mixed on how threats to repeal reform would affect the health care market in the coming year.

Many say it will have little effect, since reform measures are merely pursuing efficiency goals that the health care industry needs to address. "I think many believe that the industry is going to end up here anyway," Galling says. "And, when you really look at it, it is a good method for containing costs."

However, a few say the repeal talk is adding another level of uncertainty to an already tenuous financial situation. "I don't think anybody knows exactly what's going to happen from a revenue standpoint," says Jay Bowman Sr., consultant and principal at FMI. "So there's sort of a hedging of bets right now."

Moving forward

While the health care construction market is fraught with uncertainty as it moves forward, most industry forecasters are cautiously optimistic.

McGraw-Hill, for instance, expects hospital square footage to grow another 10 percent next year, with clinics and nursing homes rebounding 3 percent. A more circumspect Kuntz predicts a slightly better 2011 for all health care categories, though not by much. "If you called it even, that would be a safe bet."

After noting several large-scale hospital projects currently underway, McGraw-Hill's Murray writes, "Supportive demographics also underlie the stronger gain for 2011, as the aging population and continued federal support of Medicaid bolsters the ranks of the insured."

Indeed, as Kuntz contends, demographics and advancing technology often have provided buffers for an industry particularly vulnerable to political winds. "The demands of the aging population and the number of obsolete facilities are creating a lot of demand for new construction," he says. "If there's any market to be bullish on, it's health care."

But, no matter how reassuring these buffers, the winds of uncertainty are not expected to let up any time soon. "The biggest problem right now is the lack of any clarity out there," Bowman concludes. "When nobody knows where it's going, wallets clamp down."

Mike Hrickiewicz is editor of Health Facilities Management magazine.