2023 Hospital Construction Survey results

Image from Getty Images

Sustainability has been a focus of many health care facilities departments for more than a decade, but the growing awareness around climate change’s impact has taken this focus to an entirely new level. For many health systems, that previously unreached level is the C-suite.

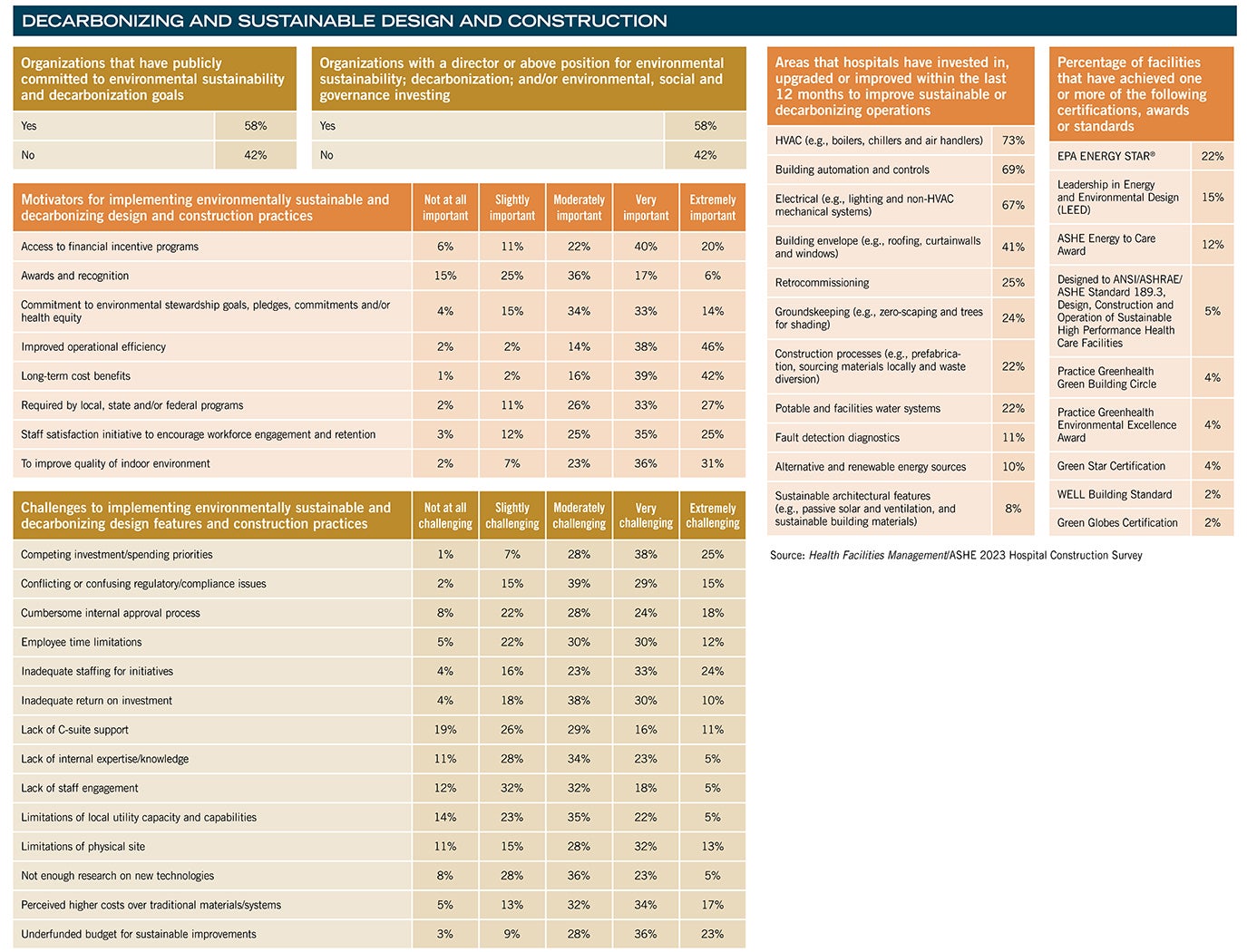

More than half (58%) of the 200 facilities professionals from across the country who participated in the 2023 Hospital Construction Survey conducted by the American Society for Health Care Engineering’s (ASHE’s) Health Facilities Management (HFM) magazine report that their organization has publicly committed to environmental sustainability and decarbonization goals. These goals are directly impacting facility design and construction projects and processes by driving a shift in how these projects are approached.

“For many years, this [work] has been in the facilities department with a focus on simply trying to save energy. Now, it’s being elevated, and it’s being looked at very carefully,” says Kara Brooks, MS, LEED AP BD+C, senior associate director of sustainability at ASHE.

This heightened focus means that a broader range of sustainability and decarbonization strategies are being implemented at health care facilities of all types and sizes. However, survey respondents indicate that the journey to zero carbon emissions is not without its challenges.

Funding options

Although 58% of Hospital Construction Survey respondents report having leadership in place to guide sustainability or broader environmental, social and governance-related investments, leadership support is not necessarily translating to funding for these projects.

While the professionals surveyed by HFM reported having capital budgets for new construction and renovations close to levels last seen in 2017, these projects are spread across a wide range of initiatives. In fact, 60% of survey respondents cited underfunded budgets to support sustainable improvements as “very” or “extremely” challenging.

Competing investments and spending priorities are a significant roadblock to movement and cited as “extremely” or “very” challenging by 64% of survey respondents when it comes to securing funding for environmentally sustainable and decarbonizing design and construction practices.

Health systems that have prioritized sustainability for some time now have been able to put strategies in place to fund these projects without competing with patient care projects. This can provide a roadmap for other facilities.

“Over the last few years, we’ve been able to designate ‘green funds’ for projects,” says Gordon Howie, MSPM, CHFM, CHC, regional director of facilities and construction services at Mayo Clinic Health System – Eau Claire in Wisconsin and 2023 ASHE president. “Based on priority and other metrics, there’s money that we can get to do these projects that doesn’t compete against patient care or other infrastructure projects.”

Of course, the C-suite isn’t the only new player focusing on decarbonization. Climate change is driving action from local municipalities up to the Biden administration, and that, too, is translating into dollars.

One anonymous Hospital Construction Survey respondent explained that state-supported grants were being used to upgrade their steam plant in 2023 with more efficient condensing hot water boilers. “We’re currently evaluating [whether to install] variable-frequency drives throughout and, potentially, a 1.5-megawatt cogeneration project,” the respondent added.

Another survey respondent shared receiving a grant to replace their facility’s 1940s-era generators with new, more efficient diesel generators in addition to adding a hydrogen fuel cell to support uninterrupted operation.

Power and plants

The issue of how to sustainably support uninterrupted power faces some unique challenges from the very regulators that seek to drive decarbonization efforts. Emergency backup power is one such example. While there’s a push to go all-electric to better support the switch to alternative power sources, including solar and wind power, code-required emergency backup systems are typically powered by traditional fuel. Regulations in many areas make the process of switching to alternative options, such as hydrogen fuel cells, fairly arduous.

“The big challenge is navigating current regulations that are over a decade old,” says Chad Beebe, AIA, CHFM, CFPS, CBO, FASHE, deputy executive director at ASHE, pointing to the Centers for Medicare & Medicaid Services’ use of the 2012 editions of the National Fire Protection Association’s NFPA 101®, Life Safety Code®, and NFPA 99, Health Care Facilities Code. This continues to limit the ability of certain technology upgrades for facilities that rely on Medicare and Medicaid reimbursement.

“Implementing some of this is difficult enough with coordinating around new technology, but then you have to coordinate with what the authority having jurisdiction may or may not understand about the technology and the complexities they may add to the process,” Beebe says.

In fact, 45% of survey respondents cited conflicting or confusing regulatory and compliance issues as “very” or “extremely” challenging when implementing sustainability projects.

Despite this challenge, surveyed facilities professionals recounted several recent investments into alternative power sources, including a microgrid to support one survey respondent’s campus, several geothermal systems, parking structure solar arrays to support site lighting, and one all-electric hospital supported by the addition of a 69-kilovolt electrical station on the hospital campus. The switch to all-electric is key for not only supporting the transition to alternative power sources, but also navigating the increasing number of natural gas bans being implemented across the country.

Systems and controls

Increased investments in electrical systems are reflected in the survey, which found that electrical switchgear and transformers is the number two investment survey respondents are making in building services equipment.

Jonathan Flannery, MHSA, CHFM, FASHE, FACHE, senior associate director of advocacy at ASHE, cautions that facilities with an urgent need here should make a move now. “Electrical transformers have gone up in cost by as much as 500%, and you could have to wait two years to get one,” he says.

The focus on power upgrades is also reflected in the types of building projects facilities professionals report focusing on today. While acute care hospitals remain at the top of the list for upcoming construction projects (34% of survey respondents report planning a new or expanded hospital in the next three years), this is directly followed by work on physical plant infrastructure upgrades (18%) and central energy plants (17%) planned in the next three years.

“I think the pandemic identified some of the weaknesses of our infrastructure when it comes to providing air and filtration needs,” Beebe says of this investment focus.

Indeed, the leading investment when it comes to building services equipment remains air-handling units (AHUs) and ventilation solutions (54%). Some of this investment, too, may be a lingering reaction to energy-intensive ramp-ups of air circulation during the COVID-19 pandemic. But as health care facilities professionals evaluate their AHU options today, there’s a push to implement more efficient solutions to support future needs.

“There’s technology out there that we can take advantage of, like enthalpy wheels and desiccant dehumidification and using filter media instead of mechanical systems, to really improve efficiency while not jeopardizing air quality,” Howie says.

Health care facilities professionals are also upgrading systems that can regulate air movement — and everything else. The building technology being installed or upgraded by many Hospital Construction Survey respondents is building automation systems, with 51% of survey respondents having a project either in the works or recently completed.

“Those technologies have continuously progressed, and today there are technologies that can integrate different versions of legacy building automation systems,” says Caleb Haynes, PE, vice president of business development for Bernhard TME, an engineering firm. “A building automation system is the heart of your building, and initiatives such as retrocommissioning have stronger payback when you have a fully upgraded building automation system.”

Hospital Construction Survey respondents appear to agree. “Our controls and building automation system replacement and upgrade has allowed us to save costs and reduce energy consumption through occupancy setbacks and HVAC scheduling,” said one respondent.

Another survey respondent stated, “Air-handling unit upgrades, with building automation system upgrades, are saving us money and giving us better control of the environment.”

While these controls systems may seem ubiquitous today, Haynes notes, “We’ve seen so many of our clients still have pneumatic systems that are 30 or 40 years old in some of their facilities that they still need to upgrade.”

One survey respondent noted that as recently as 2017 they had changed out pneumatic HVAC controls to direct digital controls, while others mentioned tackling controls upgrades today.

Still more health care facilities professionals are taking the next step and ensuring that those systems are working properly through the retrocommissioning process. Within the last 12 months, a quarter of survey respondents have taken this step to ensure building systems are operating as designed.

“Ongoing retrocommissioning is a good practice,” Haynes comments. “There are always tweaks that need to be made in system programming to achieve optimal performance. The worst thing that can happen is for programming to be overwritten and we go back to the static operation of that system for a long period, which leads to a degradation in the savings performance.”

Safety and security

Health systems are also making changes to several systems to support patient and staff safety. The most common technology projects following building automation that are in the works or recently completed include fire alarm and protection system upgrades or replacements (34%) and temperature and humidity monitoring equipment (33%). These investment priorities reflect an ongoing compliance focus, Haynes explains.

About this survey

SPONSORED BY

The American Society for Health Care Engineering’s Health Facilities Management (HFM) magazine surveyed a random sample of 4,396 hospital and health system executives to learn about trends in hospital construction. The response rate was 4.7%. HFM thanks the sponsors of this survey: Gordian Inc., Greenville, S.C., and W.W. Grainger, Lake Forest, Ill.

“There is a recent heightened focus on clinical outcomes from temperature and humidity that, in conjunction with regulatory pressures, have raised the priority for these system upgrades,” Haynes says.

Health systems are also implementing additional physical security measures. The third-largest investment in technology is in security systems, a clear reflection of the disturbing increase in violent incidents.

“We are making investments in access control and cameras throughout the enterprise,” Howie says, as one case in point. “In particular, several regions in the Midwest have upgraded card access software for integration across sites and expanded card access to all data and information technology rooms. This improves security features and allows automated granting or denial of access. Monitoring of access broadly is another nice benefit.”

Regarding cameras, Howie notes that today’s smart technology options can help identify possible issues more quickly, making it a worthwhile upgrade. Mayo is also among those systems investing in passive weapons detection systems to ensure security of patients, staff and visitors. “These investments allow better overall security without adding a lot of staff,” Howie says.

Other priorities

The pandemic also highlighted the need for significant investment in behavioral health services, and that, too, is reflected in construction planning. Thirty-seven percent of survey respondents currently working on a specialty hospital project are building a behavioral health hospital.

These projects include a 45,600-square-foot facility one Southeast region respondent said is being constructed to offer a full spectrum of evidence-based crisis stabilization treatments for behavioral health needs. The 46-bed facility includes a 30-bed adult crisis stabilization unit and 16-bed children and adolescents’ unit for ages 5-14.

Construction for children’s hospitals is also highlighted in this year’s survey. When it comes to specialty hospital projects, 26% of survey respondents have plans for children’s hospital construction, moving this up significantly to fall just below behavioral health as a construction priority. As with behavioral health, the pandemic highlighted gaps in pediatric care, and now an influx of grants is translating into progress on these projects.

On a broader scale, the Hospital Construction Survey also revealed that the medical office building (MOB) sector remains hot. MOB construction closely follows acute care hospitals in terms of the level of projects underway. Eleven percent of survey respondents have an MOB in the works, and 16% are planning construction within the next three years. However, budgets for off-site facilities are increasing at a slower rate than in years’ past. In 2023, 39% of survey respondents are seeing their budgets grow for off-site facility construction, compared to 51% in 2022 and 41% in 2020.

Budgets for hospital new construction, on the other hand, remain stable (45%) or are on the rise, with 38% of survey respondents reporting an increase to their budget. It’s a change in pace from the levels seen in recent years. Even prior to the COVID-19 pandemic, in early 2020, only 28% of facilities professionals were seeing an increase in their budget for new hospital construction. These budgets may be born out of necessity, as inflation and supply chain issues continue to drive construction costs higher. More than a quarter (26%) of survey respondents report that their projects are over budget and behind schedule — up from 20% last year and the highest level in over a decade.

Undeniable change

Despite clear hurdles, there’s an undeniable momentum today toward creating an altogether healthier health care environment. From sustainability initiatives to the embrace of technology to the emphasis on patient and staff safety, health systems are pushing the needle on how design and construction can support their mission.

“All of this coming together is really opening everybody’s eyes as to what is possible and how it impacts the bottom line,” Beebe says. The decarbonization movement, he says, is a clear case in point of how priorities have shifted.

“A decade ago, I think the notion was that hospitals are open all the time and so we couldn’t be sustainable,” Beebe says. “As we’ve learned more, looked closer and asked questions, we have finally learned some tricks on how to create a more sustainable environment and the economic value of this, too.”

This article was written by Megan Headley, a freelance writer and regular HFM contributor based in Fredericksburg, Va. The data is by Jamie Morgan, editor of HFM.