Strategies for successful energy investments

Most hospital energy buyers choose a fully fixed rate for energy because budget stability is perceived as vitally important. This has the advantage of protecting the budget against price increases within the budget cycle. But, in exchange for short-term risk avoidance, the hospital pays a fee. Moreover, the timing of the purchase, as well as the quality of the supplier that provides the product, have a significant impact on the fixed rate. That, plus the fact that this method precludes being able to access lower prices available in changing markets, ensures that it is usually the most expensive way to buy energy over the long term.

With natural gas, which is traded on a national public exchange, hospital facilities professionals have become comfortable buying fuel in segments over time, rather than setting the budget based on a single rate on a single day. In making natural gas decisions, the facility staff may engage the hospital chief financial officer in market timing decisions or bring in outside advisers to provide forecasting and other professional services.

However, with electricity, the complexity of the products and lack of market transparency have caused most hospitals to lock the entire budget at a single fixed rate and walk away from market management. This is unfortunate because electricity spending is typically four times the value of natural gas spending and, therefore, deserves much closer attention and management.

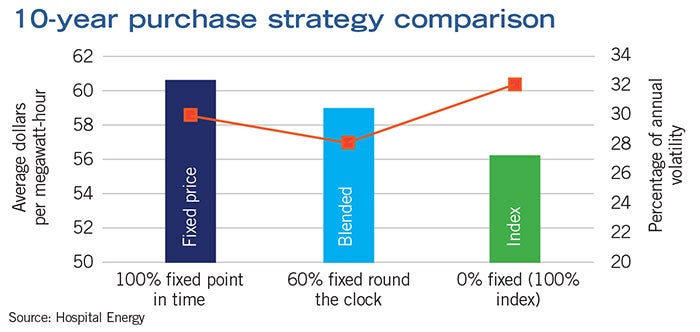

Over the past 10 years, a buyer who bought energy at the hourly market index rate would have saved significant money compared with buyers who bought using fixed pricing — any fixed pricing. However, health care organizations tend to fear this method because it can involve market swings of 100 percent or more over a single year, and they are unwilling to tolerate such uncertainty.

If a hospital’s energy committee decides to go with a fully indexed product, it should develop an investment strategy for each slice of its energy-procurement pie. It will need to monitor market trends, lock in buys at appropriate points and manage the potential for severe market shocks.

A market management approach offers a balance of low cost and price stability, combining the savings from market index pricing with the predictability of fixed pricing. This approach consists of contracting for different layers of energy buys at different fixed prices at different points in time, with a portion of the load left unfixed, to float at market index rates. This approach also provides the flexibility to lock pricing layers at various times, allowing for opportunistic purchases when market conditions are favorable. Using this approach, the buyer assesses potential savings opportunities and balances this with the probabilistic risk of the market moving higher.

The foundation for market management is the energy block. A block is a portion of the hospital’s energy load that is priced at a fixed rate. These fixed-price block contracts mimic wholesale forwards or swaps except they are for much smaller volumes than normally traded in the wholesale market.

Suppliers typically will price these forward block products based on the wholesale price of the same contracts. The portion of the hospital’s load that is not fixed by the block floats at the clearing price set in the wholesale market for the region in which the hospital is located.

This index and block structure allows for a layered approach and allows the hospital to fix portions of its physical energy demand over time. For example, one layer might be purchased upon closing of the initial supply contract, with more layers added on a monthly or quarterly basis, often relating to physical settlement months or years in the future.

Layers can be added up until the month when the energy is to be consumed. The benefit to the customer is building a portfolio of fixed prices, akin to dollar-cost averaging in a supply chain contract. Over the past 10 years, this active market-management approach has resulted in lower overall costs and less budget volatility than fixing the full price and volume on a single date.

As the electricity market has matured, some leading energy advisers now are able to offer their clients access to forward market-price curves and provide advice on managing future budget risk. The use of statistical probability modeling and other analytical methods to manage market risk also has introduced a new level of service for larger retail commercial buyers. While not as widespread as the traditional fixed-rate product, this new level of market-management service is changing how hospitals buy electricity and natural gas.

In addition to the energy commodity, the retail energy purchase includes other charges such as capacity, transmission, ancillaries and distribution-line losses in the case of electricity. For gas purchases, non-energy costs include transportation, lost gas charges and energy-conversion factors. In general, these additional cost components are charged based on tariffs that are set by either state or federal regulators, so the end user likely will have little control over them. Still, understanding the trend of these costs helps to put budgets into perspective.

Mark Mininberg is president of Hospital Energy, Elmhurst, Ill., and co-author of the ASHE monograph, “Energy Procurement: A Strategic Sourcing How-To Guide.” He can be contacted at mark@hospitalenergy.com.