Survey explores facility outsourcing practices

American Society for Health Care Engineering (ASHE) members have consistently requested tools that would allow them to benchmark and justify staffing levels for their organizations. Given this need, ASHE has launched a line of benchmarking research starting with focus groups and workshops with members and chapter collaborators.

Collaborators often mentioned the unique relationship that outsourcing plays in staffing needs and operational excellence. However, before we can fully understand the unique impact outsourcing has on operational excellence and staffing performance, we must first gain a baseline understanding of outsourcing in health facilities.

Research in this article was drawn from a special section of the recent ASHE/Health Facilities Management (HFM) Salary Survey, which appeared in the November/December issue of HFM. Respondents reported information on their organization’s overall outsourcing percentages as compared to their in-house percentages and the roles/areas that they outsourced. These data will be combined with other research to inform an upcoming in-depth report on staffing models and benchmarking.

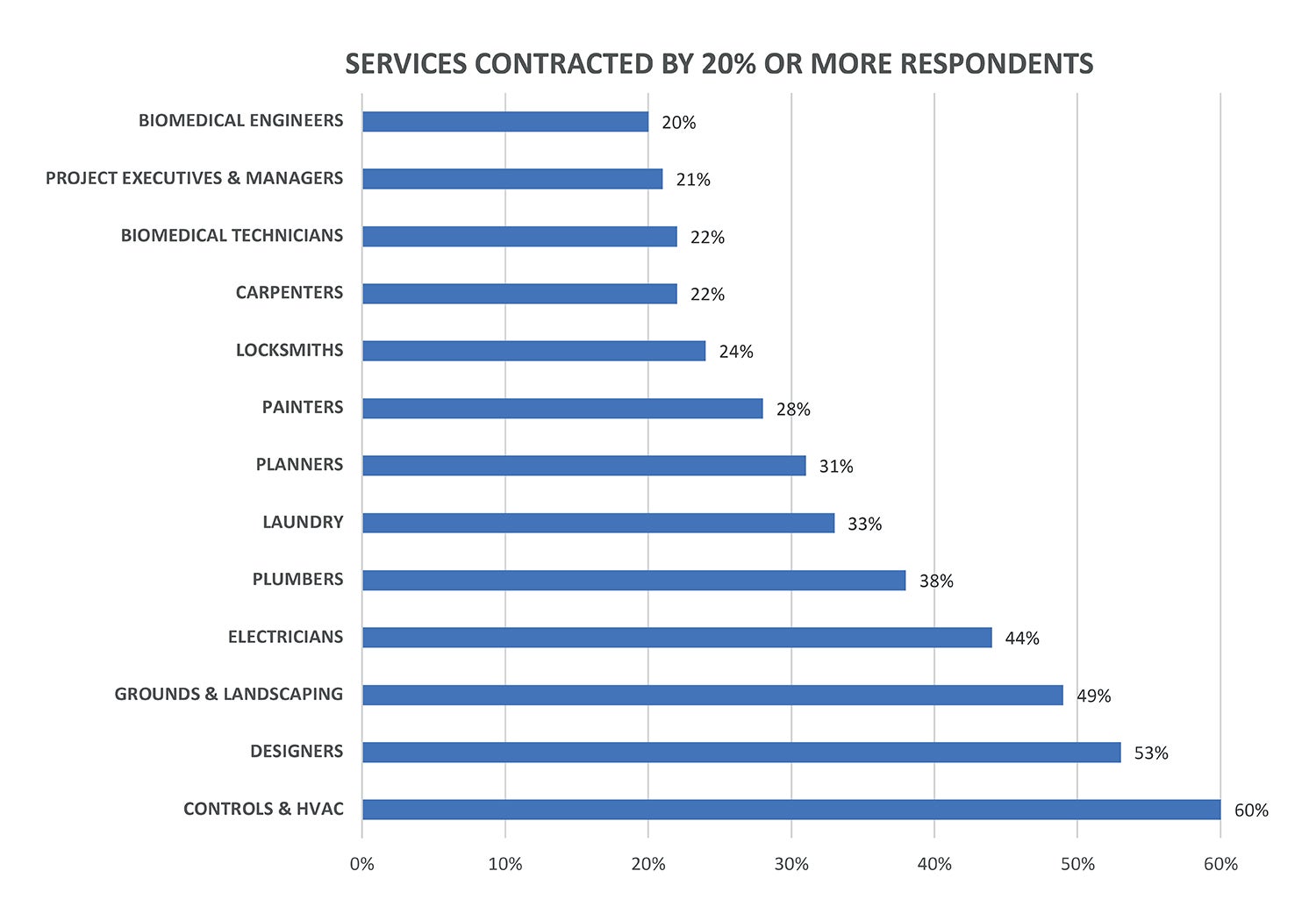

Overall, approximately 25% of all facilities management activities were outsourced. The most often outsourced roles included controls and HVAC (60%), design (53%), grounds and landscaping (49%), electricians (44%) and plumbers (38%). Roles least likely to be outsourced were infection control (2%), safety (3%), administration (4%) and generalists/zone technicians (6%). No regional differences in overall outsourcing were noted. However, Montana (44%) and Maine (40%) reported the most outsourcing, and Wyoming (13%) and West Virginia (14%) reported the least outsourcing.

Interestingly, hospital size, as measured by number of beds, showed a significant U-shaped pattern, where organizations with the largest number of beds (more than 500 beds) reported the most outsourcing (42%), followed by organizations with the smallest number of beds (1 to 24 beds) at 31%. These outsourcing percentages were both significantly higher than the average of the other six bed categories in between them (25 to 500 beds), which had 24%.

An opposite pattern was noted when exploring the differences as related to gross square footage. Specifically, significant differences in outsourcing were only noted at the lowest gross square footage category, where those reporting square footage between 100,000 and 500,000 reported the most outsourcing (31% versus an overall average of 23%). However, the number of hospitals within an organization was not significantly related to outsourcing percentage, except for the cases in which respondents reported not having hospitals within their organizations (e.g., organizations that did not have inpatient services).

In these cases, those working in non-inpatient settings were significantly more likely to report outsourcing (32% for respondents with 0 hospitals versus an overall average of 24%). Finally, respondents reporting 24-hour operations also trended toward higher outsourcing percentages (27% versus 24%); however, the difference was not significant.

Do these patterns make sense to you? Can you think of any other factors that might explain them? How do you think outsourcing might directly impact staffing in relation to this? Be a part of this conversation by providing your feedback and helping to select the next step in the research process. A short survey that allows readers to select another research question to be covered in this column can be accessed at ashe.org/outsourcing_hfm.

Lisa Walt, Ph.D., senior research strategist, American Society for Health Care Engineering.