2022 Hospital Construction Survey

When a hospital is forced to do an emergency repair, it creates a domino effect that can disrupt operations across the board.

If a boiler malfunctions, a hospital could lose heat and hot water, forcing the evacuation of patients to other facilities. If an operating room air handler fails, the hospital may temporarily have to cancel surgeries. The malfunction of an HVAC system could lead to a potentially life-threatening health care-associated infection for a patient or staff member.

And the ripple effects — losing revenue, disrupting staff schedules, reprioritizing capital budgets, etc. — go on from there.

While each of these incidents are costly, stressful, time-consuming and potentially dangerous, they are preventable with routine maintenance.

Nevertheless, emergency repairs are not rare, according to the 2022 Hospital Construction Survey conducted by the American Society for Health Care Engineering’s (ASHE’s) Health Facilities Management magazine, which included responses from 381 facilities professionals at hospitals across the country.

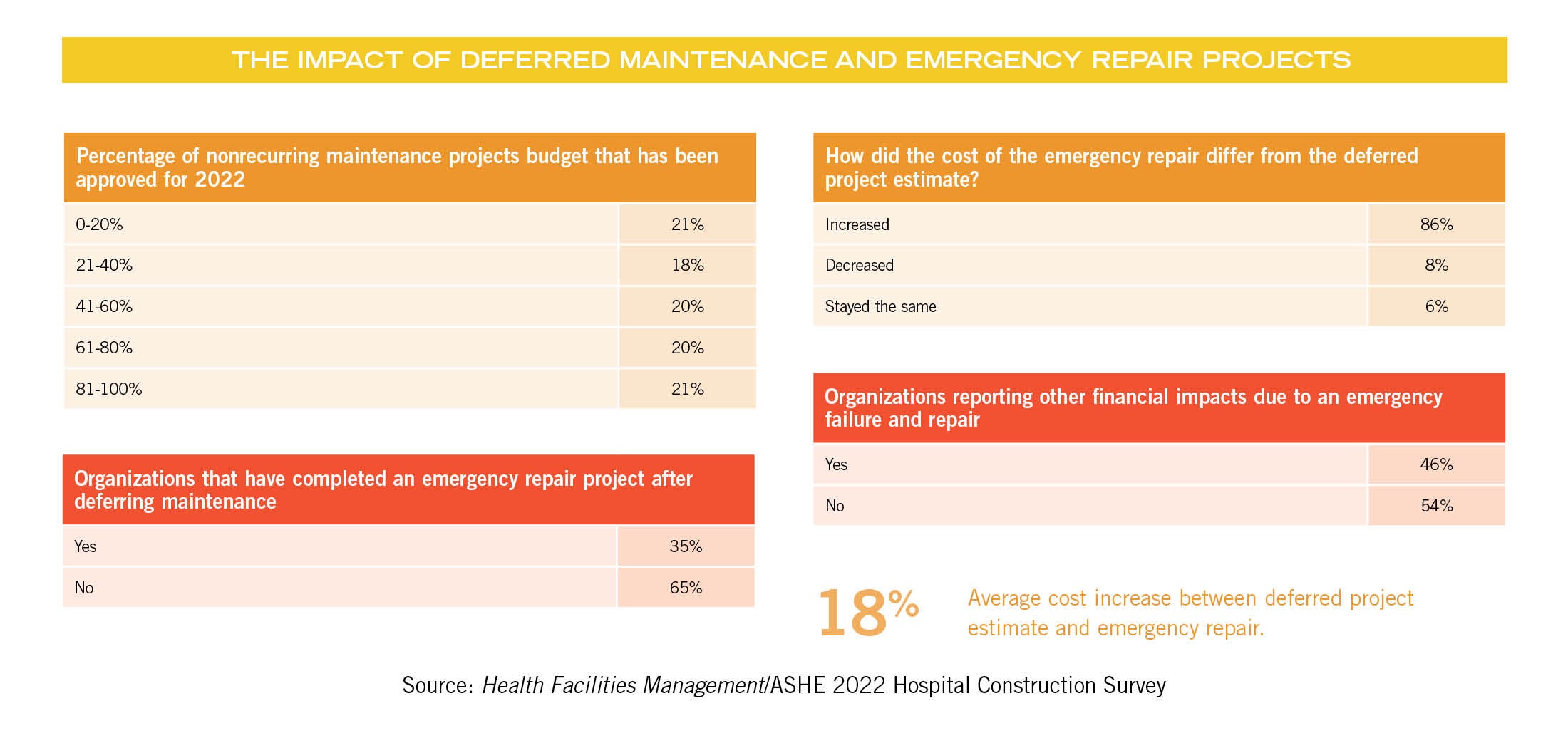

In the last three years, roughly 35% of hospitals surveyed said they have performed an emergency repair on a piece of equipment after deferring maintenance on said equipment.

And hospitals paid the price. When the projects were done under emergency conditions, 86% said the cost was higher by an average of nearly 18%.

So, while investing in maintenance has the potential to save hospitals millions each year, cash-strapped hospitals often are more focused on funding revenue-generating items like new patient services and state-of-the-art technology than paying for upkeep and repair on items that might — or might not — break down anytime soon.

But hospitals can no longer afford to put off critical maintenance, says Chad E. Beebe, AIA, CHFM, CFPS, CBO, FASHE, deputy executive director of ASHE. He points to recent research by Facility Health Inc. (FHI) showing that the total amount needed to address deferred hospital maintenance today is projected to be $243 billion across the nation.

“With the amount of deferred maintenance continuing to grow, we eventually will hit a breaking point in health care,” Beebe says. “When this happens, hospitals will need to undergo major renovations or possibly even need replacement. We can hope that the breaking point is a slow, manageable situation, but for some facilities it may be catastrophic — that is, major loss of systems that could shut down the entire hospital.”

Costs of deferring

In the survey, respondents cited many of the same emergency repairs stemming from deferred maintenance, including faulty boilers, chillers, HVAC systems (including air handlers, coils, etc.) water pipes, roofing and nurse call systems.

One respondent reported the failure of a main oxygen tank. “This required the repair of valves that should have been replaced years ago. This was just the repair. We are waiting for the replacement.”

Other comments include: “Water pipes burst and flooded the outpatient pharmacy,” “Upgraded HVAC for long-term care facility,” and “Chilled water coil and tube rupture could not be repaired, forcing an emergency replacement.”

More than 46% incurred additional expenses related to the emergency repair, including renting substitute equipment; revenue loss from cancelling MRIs, CT scans and surgeries; overtime costs for staff; flood damage; and temporary relocation of services.

To move the needle on funding maintenance projects, experts say change must occur in two areas. Facilities managers must push harder to get maintenance costs included in hospital budgets, and maintenance staff must be included in every phase of design and construction for new projects and renovations.

Traditionally a lower priority, deferred maintenance funding may not even be included as a line item in some hospital budgets, Beebe says. Facilities managers need to make a case clearly and consistently for funding nonrecurring maintenance with hospital administrators, including a breakdown of costs associated with emergency repairs. If need be, they should keep asking.

“What happens is that facility managers ask for funding, they don’t get it and then they give up,” Beebe says. “You need to protect yourself as a facility manager. Make sure hospital administrators keep hearing why this funding is necessary.”

In the 2022 survey, budgets for nonrecurring maintenance are roughly on par with expectations, says Jonathan Flannery, MHSA, CHFM, FASHE, FACHE, senior associate director of advocacy for ASHE. While very few hospitals got their entire nonrecurring maintenance requests approved, nearly one-third of respondents are getting more than 70% of their budgets approved.

“There is never enough time, money or staff to get every project funded,” Flannery says. “Considering the impact of COVID-19 on health care, getting 70% of a budget approved is about what we expect. Unfortunately, that still means a lot of preventive maintenance isn’t getting funded.”

Getting maintenance input

About the 2022 Hospital Construction Survey

SPONSORED BY

The American Society for Health Care Engineering’s Health Facilities Management (HFM) magazine surveyed a random sample of 4,962 hospital and health system executives to learn about trends in hospital construction. The response rate was 7.6%. HFM thanks the sponsors of this survey: Gordian Inc., Greenville, S.C., and W.W. Grainger, Lake Forest, Ill.

Early in his career Flannery says he learned a valuable lesson about the importance of including the input of maintenance staff on design/construction or renovation projects and their role in preventing emergency repairs.

As a general engineer/projects manager, Flannery made the decision to install epoxy flooring in the hydrotherapy rooms as a solution to stop water leaking from the floor into the ceiling spaces below. He soon realized that option wasn’t working.

“We stopped the leaks, but there were other issues with epoxy flooring that were not effective for our purposes,” Flannery says.

When he was promoted to supervisor of maintenance and operations at the same facility, he asked maintenance staff for input on a new flooring solution. Ultimately, the team removed the epoxy flooring and repaired the original ceramic tile flooring — a costly but effective solution.

“If I had involved the maintenance staff during the design process from the beginning, we would have followed their recommendation and could have saved significant time and effort,” Flannery says. “Since then, I made sure maintenance staff was included in every design/construction project.”

According to the survey, hospitals are already moving heavily in that direction. A resounding 92% of hospitals say they include maintenance staff in the design and construction process, primarily in the construction, design development and occupancy/punch list stages.

While that is good news, Joseph Sprague, FAIA, FACHA, FHFI, principal and senior vice president at HKS, Dallas, says there is still work to do.

“That number should be 100%,” Sprague says. “Defining operational and maintenance issues that might not seem to be a priority sets the stage for any successful plan of action in terms of changing the old system to a new system.”

Maintenance staff who work with hospital systems, processes and products every day understand the facility’s needs in ways a designer or architect might not recognize, says ASHE President Shadie (Shay) R. Rankhorn Jr., SASHE, CHFM, CHC, senior director of facilities management at Quorum Health, Brentwood, Tenn.

“The maintenance team already knows the building(s) and can help identify existing issues and avert potential new problems due to existing condition limitations,” Rankhorn says. “They are an additional set of eyes to catch things others may have missed. They can see impacts to daily operations that benefit or hurt the overall productivity of the team or impact customer experience in a way the designer may not have anticipated.”

Beebe says involving staff as early as possible — including in concept and schematic phases — equips the team with necessary information going into the project. For example, if the design team chooses a new technology for heating and cooling, it might require special tools or skills to operate or maintain. Or certification might be required. The maintenance staff can add that valuable input from the beginning.

“Other team members might not see the types of connections that maintenance staff are aware of, so it’s important to involve them as early as possible,” Beebe says.

Positive general trends

Overall, the survey offered some positive takeaways for hospitals, including increases in commissioning and certification, and a steady increase in budgets for design/construction projects. And as COVID-19 continues to impact the economy, hospital funding decisions are being driven at least in part by the pandemic.

“COVID-19 has been and still affects everything moving into the future in terms of hospital funding,” Sprague says. “Preparation for the next pandemic will facilitate appropriate response.”

In terms of budget increases, many hospitals are playing catch-up and resuming active construction projects that shut down when COVID-19 started.

Simultaneously, hospitals facing labor shortages, supply chain disruptions, rising prices and increased demand may be forced to increase budgets, says Adam Ashouri, senior project manager at Meyer-Najem Construction Co., Indianapolis, and a member of the ASHE Young Professionals Committee. And they are facing competition for supplies and labor.

“If a hospital system wants to build a $100 million patient tower and another company is building a massive warehouse three miles down the road, they will both compete for labor and supplies,” Ashouri says. “Hospitals should understand the market forces at work in their area and ensure that the risks associated with the forces are mitigated. Sometimes, this may mean bigger budgets to compete.”

To survive in a volatile market, more contractors are securing early procurement packages for materials like steel, roofing and major equipment, locking in prices at the time of purchase before they escalate, he says.

“And more owners are allowing contractors to bill for stored materials, which insulates them from market risk associated with price escalations outside of the contractor’s control and, in many cases, can help secure more competitive pricing,” Ashouri says. “In many cases, it can be a benefit to engage a construction manager early in a project to help navigate industry trends and manage the owner’s schedule and budget risk.”

Hospitals continue to invest in acute care facilities in terms of new, replacement and expansion/renovation projects. Hospitals with acute care projects underway or in the planning stages increased from 16% in 2021 to 23% in 2022.

The survey also shows a sizeable increase in hospitals building or planning physical plant infrastructure projects, which increased from 11% in 2021 to 16% in 2022. Beebe says this also has a COVID-19 connection.

“Hospitals investing in physical plant infrastructure are preparing for the future in terms of surge capacity,” Beebe says. “They want to be ready to handle future pandemics or other emergency needs with a high influx of patients.”

Hospitals are allotting more funding for emergency departments (EDs), ambulatory care and security systems, and many are focusing on flexibility and adaptability to maximize physical space. Some are examining the feasibility of having one central entrance versus multiple entrances to aid in directing patients to the right areas while limiting exposure points.

“COVID-19 revealed just how vulnerable a hospital’s infrastructure can be,” Rankhorn says. “Operationally, there is an ongoing focus on how to improve throughput. Hospitals are reviewing practices and necessary design changes in patient care and other areas of the hospital.”

Hospitals also continue to invest in behavioral health care centers, with 42% of respondents planning a specialty hospital saying they have one underway or planned for the next three years. This focus isn’t likely to change soon, Sprague says.

“Behavioral problems will continue to be a priority,” Sprague says. “Recently, issues have developed from pandemic burnout felt by both patients and staff at hospitals.”

Hospitals also are investing in cancer, pediatric hospitals and cardiac projects now and in the next three years.

The aging population is driving consistent investment in rehabilitation projects and a rise in orthopedic construction projects, which jumped from 14% in 2021 to 21% in 2022 among those working on a specialty hospital project, which is in line with what Ashouri is seeing in the field.

“We are seeing a big shift toward geriatric care in response to the aging population,” Ashouri says. “That is an area where we are expecting a future surge in the industry.”

Hospitals may be moving away from building microhospitals, which were a rising trend in recent years. In 2022, not one hospital in the survey reported an active microhospital project, while 3% are planning one in the next three years.

“Many hospitals have realized that microhospitals weren’t the answer they were looking for,” says Beebe, citing strict regulatory requirements and reimbursement issues as factors in the drop.

COVID-19 also is driving increasing investments in equipment such as air handlers, packaged HVAC systems, exhaust fans and temperature/humidity controls that are necessary for controlling airborne infections. These investments also tie in with hospital goals for energy efficiency.

More than 30% of hospitals plan to replace or upgrade their building controls/automation systems now or in the next year.

“The surge in building automation is a direct reflection of COVID-19,” Flannery says. “All hospitals are focused on optimizing those systems to contribute to a safer work environment and stay up to code.”

The survey also shows an increase from 2021 to 2022 in purchases of automated transport systems, or robots used for transporting materials, which cuts down on the person-to-person contact that may spread germs.

Critical for the future

As COVID-19 continues for the foreseeable future, more hospitals are seeking higher safety and training credentials from the general contractors working for them. Hospitals requiring two ASHE certification credentials jumped substantially in just one year.

Nearly 37% of hospitals now require contractors to have ASHE Certified Healthcare Constructor credentials, up from 20% in 2021. Roughly doubling 2021 numbers, 10% of hospitals now require contractors to achieve Certified Health Care Physical Environment Worker Certification, commonly known as the ASHE Worker Certification.

“The pandemic really shed light on the need for all contractors to be fully prepared,” Beebe says. “By requiring workers to earn these certifications, hospitals can reduce risks by ensuring people working in their facilities understand important patient safety concepts.”

More hospitals are also commissioning — conducting an audit to review energy performance, safety and sustainability, among other factors — the survey shows. The number of hospitals that are commissioning jumped from 74% in 2021 to 80% in 2022.

Commissioning, which is integral to sustainability and energy conservation, also ties closely to reliability-centered maintenance, a strategy and process designed to promote the reliability of equipment, systems and structures.

“ASHE has worked hard to increase participation in both credentialing and commissioning,” Beebe says. “Both of these initiatives are critical to the future of health care, so ASHE is very happy to see these numbers continue to increase.”

Beth Burmahl is a Carbon Cliff, Ill.-based contributor to Health Facilities Management and Jamie Morgan is editor.