2014 Hospital Construction Survey

Since the Affordable Care Act (ACA) came into law, hospitals and health systems primarily have been focused on how to respond to the quality, clinical and economic issues associated with the legislation. Many moved quickly to expand physician alignment efforts, assess potential alliances through mergers and acquisitions to round out service lines, and address other big-picture business strategies.

Since the Affordable Care Act (ACA) came into law, hospitals and health systems primarily have been focused on how to respond to the quality, clinical and economic issues associated with the legislation. Many moved quickly to expand physician alignment efforts, assess potential alliances through mergers and acquisitions to round out service lines, and address other big-picture business strategies.

Meanwhile, important bricks-and-mortar questions have bubbled beneath the surface that organizations will need to answer, such as:

• Will our existing facilities enable us to effectively manage the transition from volume-based care to value-based care?

• As we work to reduce costs by moving care delivery to the clinically most cost-appropriate setting, do we have sufficient outpatient facilities to meet the needs of our population and in convenient locations?

• As our inpatient population shifts to more chronically ill patients and complex cases, will we need to reconfigure our acute care facilities?

For the first time since the ACA went into effect, most hospitals and health systems have begun addressing these and other questions. That's one key finding from the 2014 Hospital Construction Survey conducted by Health Facilities Management and the American Society for Healthcare Engineering (ASHE).

A time of change

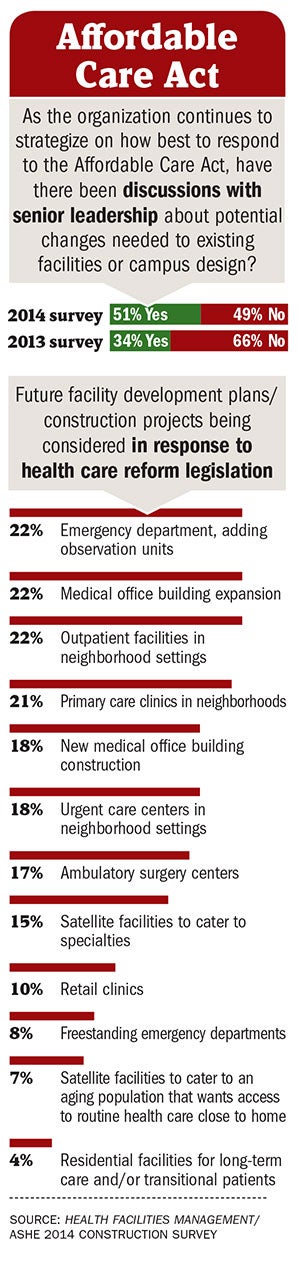

More than half of respondents — 51 percent — said they are considering the ACA in senior leadership discussions about potential changes needed to existing facilities or campus design. That's up from 34 percent of respondents the prior year who said that the ACA was playing a role in senior-level construction planning discussions.

It's a marked change from years past when construction focused on building inpatient beds and increasing other acute care facilities to enhance curb appeal and gain market share.

"Today you can't talk about construction without talking about health reform," says Dale Woodin, CHFM, FASHE, executive director of ASHE. "The fact that more than half are including the ACA in construction planning shows they are thinking about this proactively. This has huge implications on facility planning."

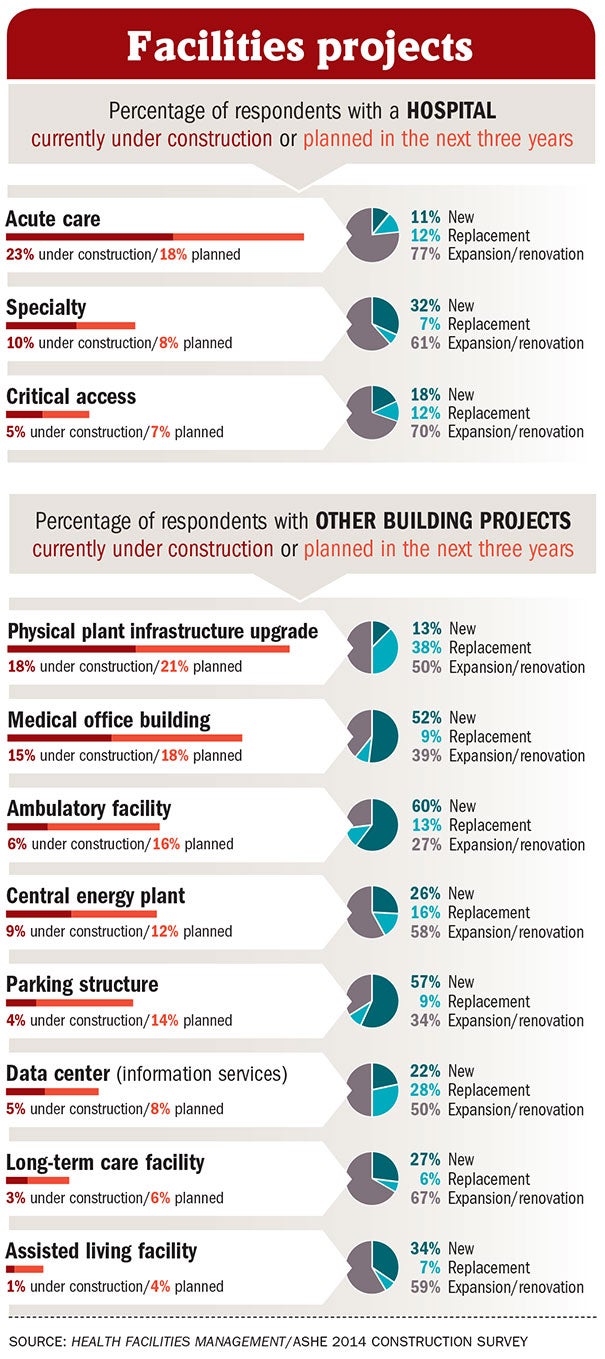

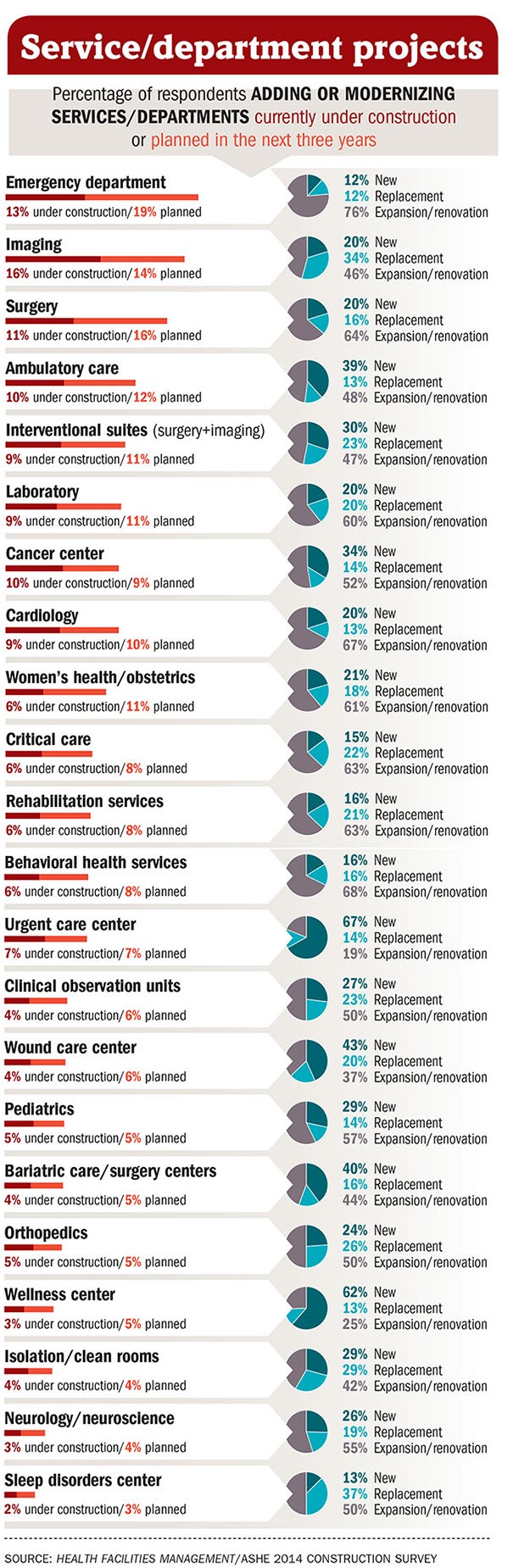

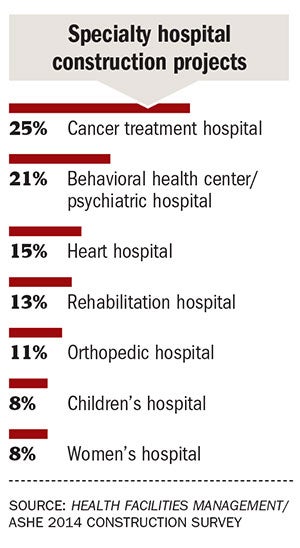

The online survey, completed by nearly 500 hospital and health system executives nationwide in October and November 2013, shows a bigger focus on ambulatory care settings, urgent care and emergency department patient flow. One-fifth of respondents said they have an ambulatory care construction project under way or planned in the next three years. And one-third said they are or will in the next three years construct new, replacement or renovations of emergency departments.

"The shift to outpatient is really coming to fruition," says Andrew Quirk, senior vice president and national director at Skanska USA Building. "Hospitals are expanding their brands into their communities. It's coming to fruition because of the Affordable Care Act, but it also has been in the works for the past five to eight years."

Moving care delivery

System executives said the survey results line up with their strategic plans. "Our No. 1 priority is pushing care into our communities," says Kip Edwards, vice president of development and construction at Banner Health in Phoenix. "The medical office expansion is logical as more physicians become hospital employees."

In terms of what future facility development plans are being considered in response to the ACA, 22 percent said medical office building expansion, up from 16 percent in 2012; 18 percent said new medical office building construction, up from 15 percent in 2012. Some 22 percent said outpatient facilities in neighborhood settings, up from 15 percent the prior year; and 21 percent said primary care clinics in neighborhoods, up from 16 percent in 2012. And 17 percent of respondents said ambulatory surgery centers are being considered, up from 11 percent in 2012 and 2011.

"Hospitals are investing in outpatient care instead of inpatient care — I think that's interesting," says D. Kirk Hamilton, FAIA, FACHA, professor of architecture at Texas A&M University in College Station. "This is the first time I can remember seeing so little in high-tech investment in the hospital. I think the shift in focus is a big story."

Comments from survey participants illustrate these trends:

• A Midwestern hospital system is "purchasing physician practices and moving them around the community … and we are considering building medical office buildings at two facilities to house surgical and physician practices to get them near hospitals."

• A large Texas health system is "building more outpatient clinics to reduce emergency care wait times and ease overcrowding."

• A hospital in the Southeast is "modifying existing space to improve emergency department patient flow and volume."

• And a Great Plains hospital is "looking at new service delivery models changing to a greater percentage of business based on outpatient care."

Uncertainty lifted

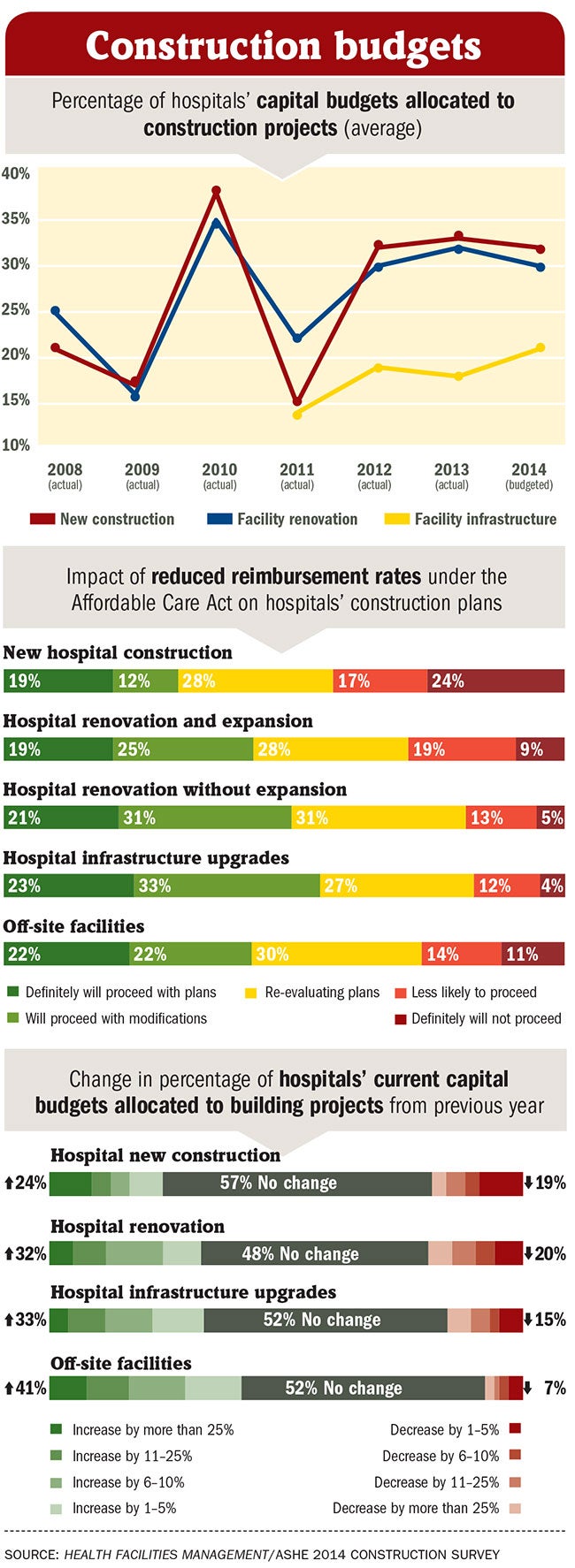

The shadow of uncertainty that fell over hospital construction during the recession and ACA legal challenges largely has passed. Plans appear to be crystalizing and projects are moving forward, according to survey results. But many of these projects have been modified or scaled back. For instance, some 21 percent of hospital renovation projects are going forward as planned, but 31 percent are moving forward with modifications.

There is more hesitancy around new hospital construction — 19 percent of respondents said they will definitely proceed with plans, but 24 percent said they definitely won't. And approximately 41 percent of respondents said they are less likely or not likely to proceed with plans because of the ACA.

"That is down from a period of positive plans to change revenue streams or gain a competitive advantage," Hamilton says. "This sounds surprisingly nonaggressive and noncompetitive."

The survey results indicate that the medical arms race of years past is no longer the main focus.

A full 62 percent of respondents said their infrastructure projects are budgeted and implemented "as needed due to aging, equipment malfunctions, regulatory compliance and as budget allows."

"Before the recession, hospitals were building brand new facilities, but then that came to a grinding halt," says Woodin. "Now people are saying, let's make sure that our infrastructure serves our needs. They are facing a brutal reality that their existing facilities will need to continue to provide services for many years to come."

Although there is a change in focus to outpatient care, hospitals will need expensive technology to compete, says Philip Stephens, MHA, CHFM, FASHE, a senior specialist at Carolinas HealthCare System in Charlotte, N.C., and ASHE president for 2014. "I'm not sure you are going to see all the bells and whistles go away," Stephens says. "We will continue to see aesthetic upgrades in the market. But I do think that people will have to change strategies and culture and the way they do business, or they will get left in the dust."

Hospitals are having to get creative and do more with less, agrees Joseph Sprague, FAIA, FACHA, FHFI, principal and senior vice president at HKS, an architectural firm in Dallas. "Under population health management, systems will manage money through provider networks," Sprague says, adding that he sees a keen focus on improving patient satisfaction as part of construction projects today. Medicare's value-based purchasing program reimburses hospitals in part on patient satisfaction scores. "Patient satisfaction is an important side to reimbursement today," he adds. "So there is a focus on the built environment to support better patient outcomes, like infection control and acoustics to reduce noise in the hospital."

Observing a trend

Federal regulations aside from the ACA also are driving construction trends — namely, the "two-midnight rule." This new regulation was included in the 2014 Medicare inpatient prospective payment system final rule and released in October 2013. The two-midnight rule means that hospital stays lasting less than two midnights must be classified and billed as outpatient services. Hospitals are still working on the best way to approach this new rule, but Edwards of Banner Health says adding observation units makes sense. Under the rule, hospitals won't be able to keep patients under extended observation for inpatient reimbursement, so cases will have to be more effectively managed.

"The reimbursement under this rule will be awful, so we are trying to figure out the right patients to keep in observation," Edwards says. "It's hitting us hard financially."

In response to the rule, hospitals are consolidating their observation-status patients into single units instead of scattering them around the hospital. Some research shows that hospitals that have dedicated observation units have shorter patient lengths of stay. Some 22 percent of respondents to the annual construction survey said they have plans under consideration that include adding observation units, in response to health reform. This is up from 15 percent of respondents the prior year.

With the accelerating change of pace in health care reform, it's surprising that 34 percent of respondents updated their facility master plan more than two years ago. Just 19 percent updated their plan within the past six months, down from 23 percent in 2012.

But the recession forced many hospitals to scrap their master plans entirely and that work hasn't picked up again, Skanska's Quirk says. "Clients said, 'There's so much upheaval and turmoil, we aren't going to spend the money to draw them up,'" he says. One client hospital began the process of resurrecting and revising its facility master plan recently, but then it saw a drop in patient census and halted the process, he says.

Preparing for disasters

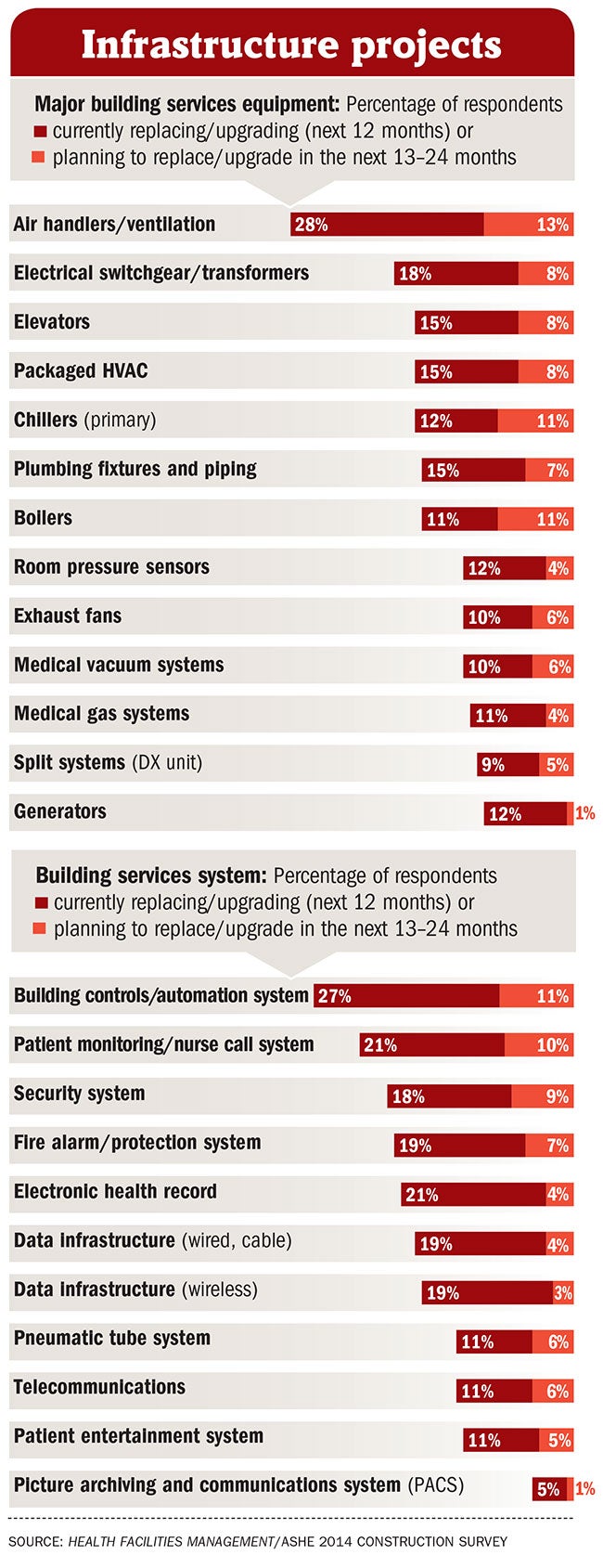

Hospitals are responding to events on the ground — whether the ACA, new payer reimbursement schemes or natural disasters. Twelve percent of respondents said they are currently replacing or upgrading their generators in their inpatient facilities. Another 1 percent said they plan to replace or upgrade generators in the next one to two years.

That focus on emergency preparedness is a direct response to Hurricane Sandy and other recent natural disasters, says Quirk. "There's a heightened interest in this in the Northeast and Mid-Atlantic after Hurricane Sandy," he adds. "There's also an interest in energy as a topic. Clients are starting to ask more questions about making facilities more efficient. ROI is everyone's focus and becoming 25 percent more efficient can save millions of dollars on your budget. It's an untapped area."

Indeed, commissioning — an audit to review performance of building energy systems — rose to 65 percent of respondents in 2013 after having dipped to 60 percent in 2012. And 84 percent of respondents said they hire an independent third-party commissioning authority.

Sprague says he was surprised that nearly 35 percent of respondents don't perform commissioning. "I thought that was remarkable," he says. "You can have the best intent in design and construction, but if things don't operate in the quarters they were designed for, that's a missed opportunity."

Stephens of Carolinas HealthCare agrees. "Commissioning is an absolute necessity to make sure you get what you paid for," he says. "Thirty years ago, it was a slower pace and you could look at and review things before moving to the next phase. That's not true anymore."

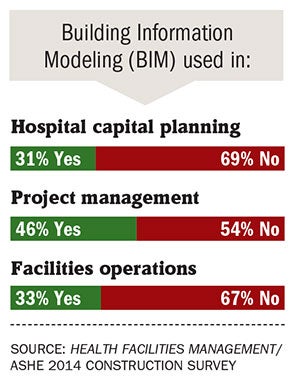

Similarly, those interviewed for this story say building information modeling (BIM) is important in a number of areas. Thirty-three percent of respondents are using BIM in facilities operations. Quirk says this is encouraging. "I think BIM's most powerful use is on the facility management side. "There's a lot of opportunity there."

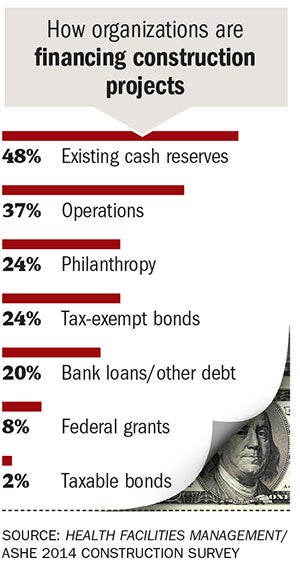

Hospitals seem to have the cash on hand to fund projects. Nearly half of respondents said they use existing cash reserves for financing, while 37 percent said they use operations dollars, and 20 percent use bank loans or other debt. Woodin says this reinforces the air of caution around hospitals today. "Hospitals are reluctant to take on a bigger debt load," he says. "They are still trying to understand this new financial model, so taking on more debt often doesn't make sense."

Many hospitals have no problem funding new construction, Quirk says. "Everyone is saying [that] paying for the projects isn't the issue," he says. "It's waiting for the ACA to resolve itself on the reimbursement side."

Rebecca Vesely is a freelance health care writer based in California. Suzanna Hoppszallern is a senior editor of data and research for Health Facilities Management's sister publication, Hospitals & Health Networks.

Green responses stall as some practices become routine

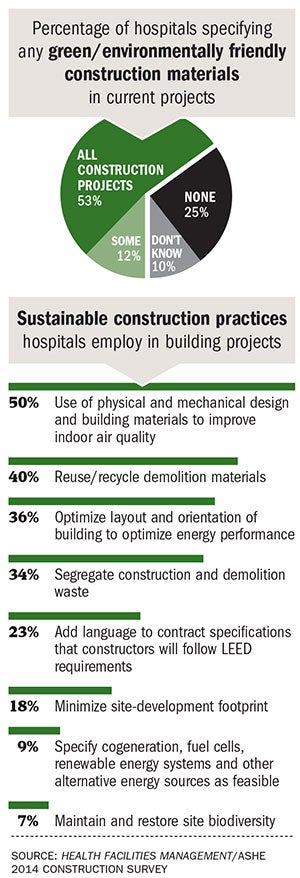

Some 65 percent of hospitals and health systems are specifying green or environmentally friendly materials in all or some of their current construction or renovation projects, according to the 2014 Hospital Construction Survey.

But executives from a quarter of hospitals and health systems responding to the survey said they aren't specifying green materials in their projects, and another 10 percent said they didn't know if they specify green materials or not.

These results suggest that some hospitals don't see the value of green construction and design, says Joseph Sprague, FAIA, FACHA, FHFI, principal and senior vice president at HKS in Dallas.

"Part of the problem with sustainability is a lot of hospitals don't believe there is an ROI," Sprague says. "I think there is misconception that there is no return on their investment. But there are lots of kudos for being friendly to the environment. That is a point that is overlooked."

Robin Guenther, FAIA, LEED AP BD+C, and principal at architectural firm Perkins+Will, New York City, says the results could be interpreted in another way. "Some categories of green materials have become so ubiquitous that you almost can't distinguish them from standard practice," Guenther says. "Like low-VOC paints or formaldehyde-free insulation — these are now industry standard. Some people might not even consider it a green material."

Still, hospitals are leaving money on the table by not incorporating green and energy-efficient features into their design plans, notes Laura Brannen, senior sustainability consultant at Mazzetti in San Francisco.

"In design, the typically overlooked areas still tend to include a fully functional waste management or minimization dock and/or utility rooms with adequate space for recycling and reprocessing," Brannen says.

The most common features being incorporated today are high-efficiency building controls (65 percent); high-efficiency HVAC (66 percent); and low-flow water fixtures (50 percent), according to the survey.

The numbers on use of low-flow water fixtures surprised Guenther — she considers that adoption rate of slightly more than half of respondents quite low. "I thought almost everyone installs water-efficient fixtures in their projects," she says. "That should be standard practice. The next step in water conservation is using harvested rainwater and municipal reclaimed water."

Likewise, sustainability experts say that low-emission glass for windows — 32 percent of respondents said they incorporated this into their design — is another feature that should be status quo in hospitals.

LEED certification also was not very popular among survey respondents. Just 23 percent of hospitals and health systems said they add language to contract specifications that requires constructors to follow LEED requirements. Other recent surveys have indicated waning interest in LEED certification in design.

"There is some noise in the marketplace that hospitals are bypassing LEED," says Guenther, adding that her firm is continuing to certify health care projects using LEED. "I don't see that in our practice. I think third-party certification is important to achieving a green building."

Even if hospitals are constructing buildings using green materials, LEED certification ensures that they don't backslide during the value-engineering and construction process, Guenther says. "LEED requirements can be inconvenient," she says. "During construction, when a product is delivered that is not the green one you specified, there is huge momentum to install it in the building instead of sending the truck back for the green product. Third-party certification ensures that the green product gets into the building."

It is "very surprising, unacceptable even" that only 34 percent of respondents said they segregate and recycle construction and demolition waste, Brannen says. "We can be doing better as there is a tremendous amount of reusable and recyclable material generated during this process," she says. "If the hospital construction team, not the contractors, managed the waste contracts, they would be more accountable for the waste generated during construction, and this figure might improve."

About the HFM/ASHE 2014 Construction Survey

Health Facilities Management (HFM) and the American Society for Healthcare Engineering of the American Hospital Association surveyed a random sample of 3,714 hospital and health system executives to learn about trends in hospital construction. The response rate was 13 percent.

HFM thanks the sponsors of this survey: Armstrong Flooring, Grainger, Robins & Morton, Sherwin-Williams and TeleHealth.