Facility costs rise heading into 2026

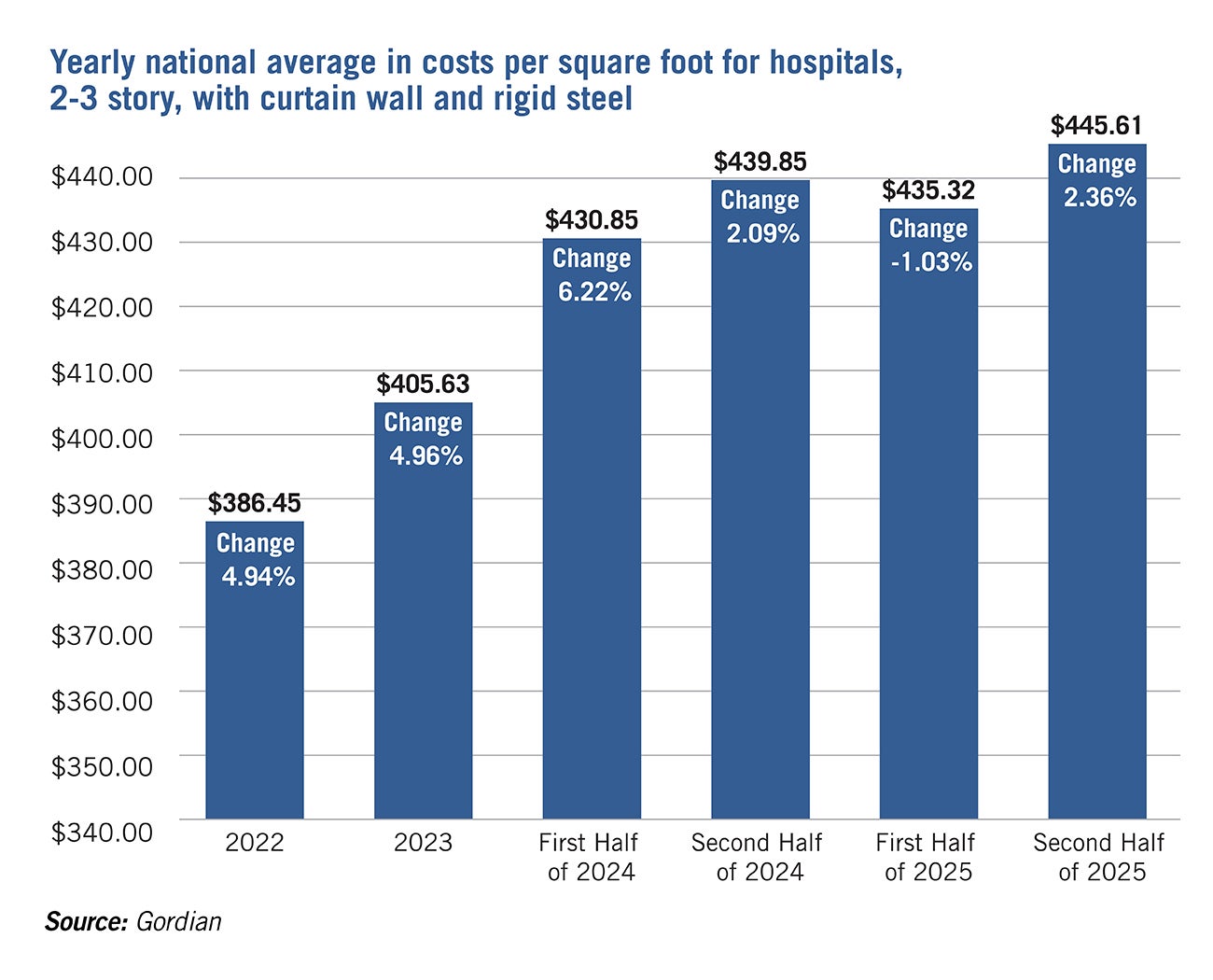

Despite economic uncertainty in 2025, year-end costs were only slightly higher than the previous year. Hospital costs rose 2.2% to 2.4% since July 2025, bringing the year-over-year change to an increase of 1.3% to 2%, which was a slower pace than in 2022 and 2023.

Based on square foot estimating data from international construction data and services firm Gordian, these increases can be seen consistently around the country.

While costs were increasing in most of the health care building models, the standard medical office building models were not experiencing the same magnitude of increases. One key driver: plumbing material costs rose 8% to 9% in the last six months of 2025. Plumbing accounts for up to 23.7% of material costs in other models but only 7% in medical offices.

Other changes include cost decreases in finishes across all building models after earlier increases, making them a smaller share of total costs. Concrete material costs also fell, while openings rose in every model. Overall, materials saw mixed shifts, but it’s notable that installation costs did not decline.

Gordian is expecting cost trends to continue upward in 2026, though the extent is uncertain. Previously, steel and conductive metal costs were expected to rise, but that hadn’t occurred to the extent that was anticipated. Costs are influenced by demand, and leading indicators of construction activity like the American Institute of Architects Architectural Billings Index showed softening demand.

The index decreased even more in the institutional sector, potentially signaling slower health care construction growth. However, recent interest rate cuts could reverse that trend.

Adam Raimond is a program manager at Gordian, provider of data-driven solutions for all phases of the building life cycle. He can be reached at adam.raimond@gordian.com.